If you're in need of a special mattress due to a medical condition, you may be wondering if your medical insurance will cover the cost. The answer is, it depends. While some medical insurance plans do cover special mattresses, others may have limitations or exclusions. In this article, we will explore the ins and outs of medical insurance coverage for special mattresses.Does Medical Insurance Cover Special Mattresses?

Medical insurance plans typically cover mattresses that are deemed medically necessary for a specific condition. This may include mattresses for pressure relief, pain management, or to accommodate a medical device such as a CPAP machine. However, not all types of special mattresses may be covered. It's important to check with your insurance provider to see what types of mattresses are covered under your plan.What Types of Mattresses Does Medical Insurance Cover?

Adjustable beds, which can be beneficial for individuals with certain medical conditions, may also be covered by medical insurance. These beds can provide relief for conditions such as sleep apnea, acid reflux, and chronic pain. However, it's important to note that not all adjustable beds may be covered. Your insurance plan may have specific criteria or limitations for coverage, so it's best to check with your provider.Are Adjustable Beds Covered by Medical Insurance?

If you believe that a special mattress would benefit your medical condition, the first step is to consult with your doctor. Your doctor can provide documentation and a recommendation for a specific type of mattress that may be beneficial for your condition. This documentation will be necessary when submitting a claim to your insurance provider. It's also important to check with your insurance provider beforehand to see if they have any specific requirements for coverage.How to Get a Special Mattress Covered by Medical Insurance?

The requirements for medical insurance coverage of special mattresses may vary depending on your insurance plan. However, some common requirements may include a prescription from a doctor, documentation of medical necessity, and prior authorization from your insurance provider. It's important to carefully review your insurance plan and speak with your insurance provider to ensure that you meet all necessary requirements for coverage.What Are the Requirements for Medical Insurance Coverage of Special Mattresses?

If you have already purchased a special mattress and it meets the criteria for coverage under your insurance plan, you may be able to get reimbursed for the cost. You will need to submit a claim to your insurance provider and provide all necessary documentation, such as a receipt and a prescription from your doctor. It's important to note that reimbursement may not cover the full cost of the mattress, and you may be responsible for a portion of the cost.Can You Get Reimbursed for a Special Mattress Through Medical Insurance?

While some insurance plans may cover special mattresses, there may be limitations or exclusions to coverage. For example, your plan may only cover certain types of mattresses or have a maximum coverage amount. It's important to carefully review your insurance plan and speak with your provider to understand any limitations or exclusions that may apply.What Are the Limitations of Medical Insurance Coverage for Special Mattresses?

The best way to find out if your medical insurance covers special mattresses is to contact your insurance provider directly. They can provide you with information about your specific plan and any limitations or exclusions that may apply. You can also review your insurance plan documents or speak with your HR department if you have insurance through your employer.How to Find Out if Your Medical Insurance Covers Special Mattresses?

If your medical insurance does not cover special mattresses or if the cost is not fully covered, there are alternative options you can explore. Some mattress companies may offer financing or payment plans to help make the cost more manageable. You can also look into charitable organizations or crowdfunding platforms that may provide assistance for medical expenses.What Are the Alternatives to Using Medical Insurance for Special Mattresses?

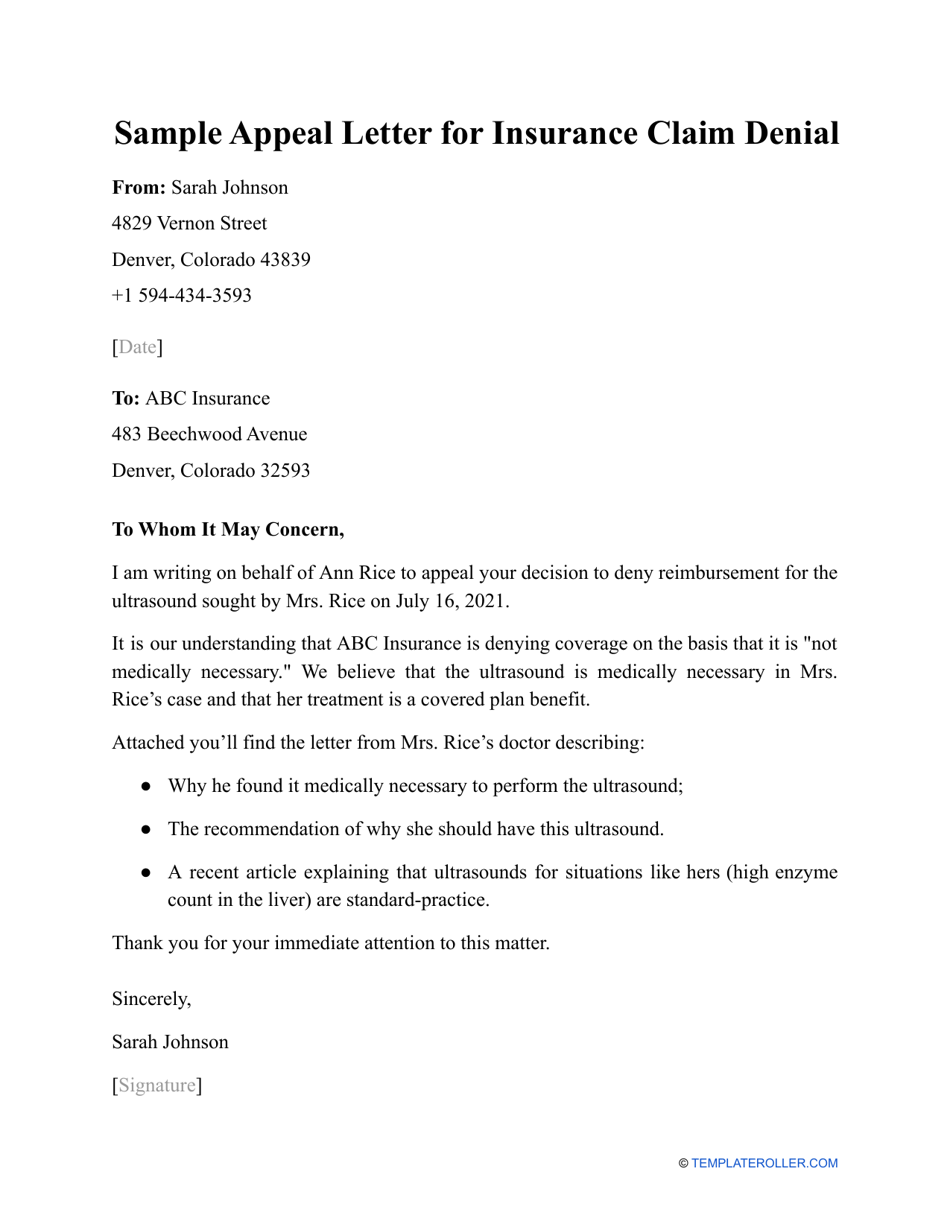

If your insurance provider denies coverage for a special mattress, you have the right to appeal their decision. The first step is to review your insurance plan to understand the appeals process and any deadlines that may apply. You will need to provide additional documentation or information to support your appeal, such as a letter from your doctor. If your appeal is still denied, you can contact your state's insurance department for further assistance.How to Appeal a Denial of Medical Insurance Coverage for a Special Mattress?

Does Medical Insurance Cover Special Mattresses?

The Importance of a Good Mattress for Your Health

When it comes to creating a healthy and comfortable living space, one of the most important elements to consider is your mattress. A good mattress is essential for getting a good night's sleep and ensuring your overall well-being. But for some individuals who suffer from certain medical conditions, a standard mattress may not provide the necessary support and comfort they need. This is where special mattresses come into play.

Special mattresses

are designed to cater to specific medical needs such as chronic back pain, arthritis, and fibromyalgia. These mattresses are made with materials and features that offer extra support, pressure relief, and temperature regulation, all of which can greatly benefit those with medical conditions. However, one of the main concerns for those looking to invest in a special mattress is whether or not their medical insurance will cover the cost.

When it comes to creating a healthy and comfortable living space, one of the most important elements to consider is your mattress. A good mattress is essential for getting a good night's sleep and ensuring your overall well-being. But for some individuals who suffer from certain medical conditions, a standard mattress may not provide the necessary support and comfort they need. This is where special mattresses come into play.

Special mattresses

are designed to cater to specific medical needs such as chronic back pain, arthritis, and fibromyalgia. These mattresses are made with materials and features that offer extra support, pressure relief, and temperature regulation, all of which can greatly benefit those with medical conditions. However, one of the main concerns for those looking to invest in a special mattress is whether or not their medical insurance will cover the cost.

Understanding Your Medical Insurance Coverage

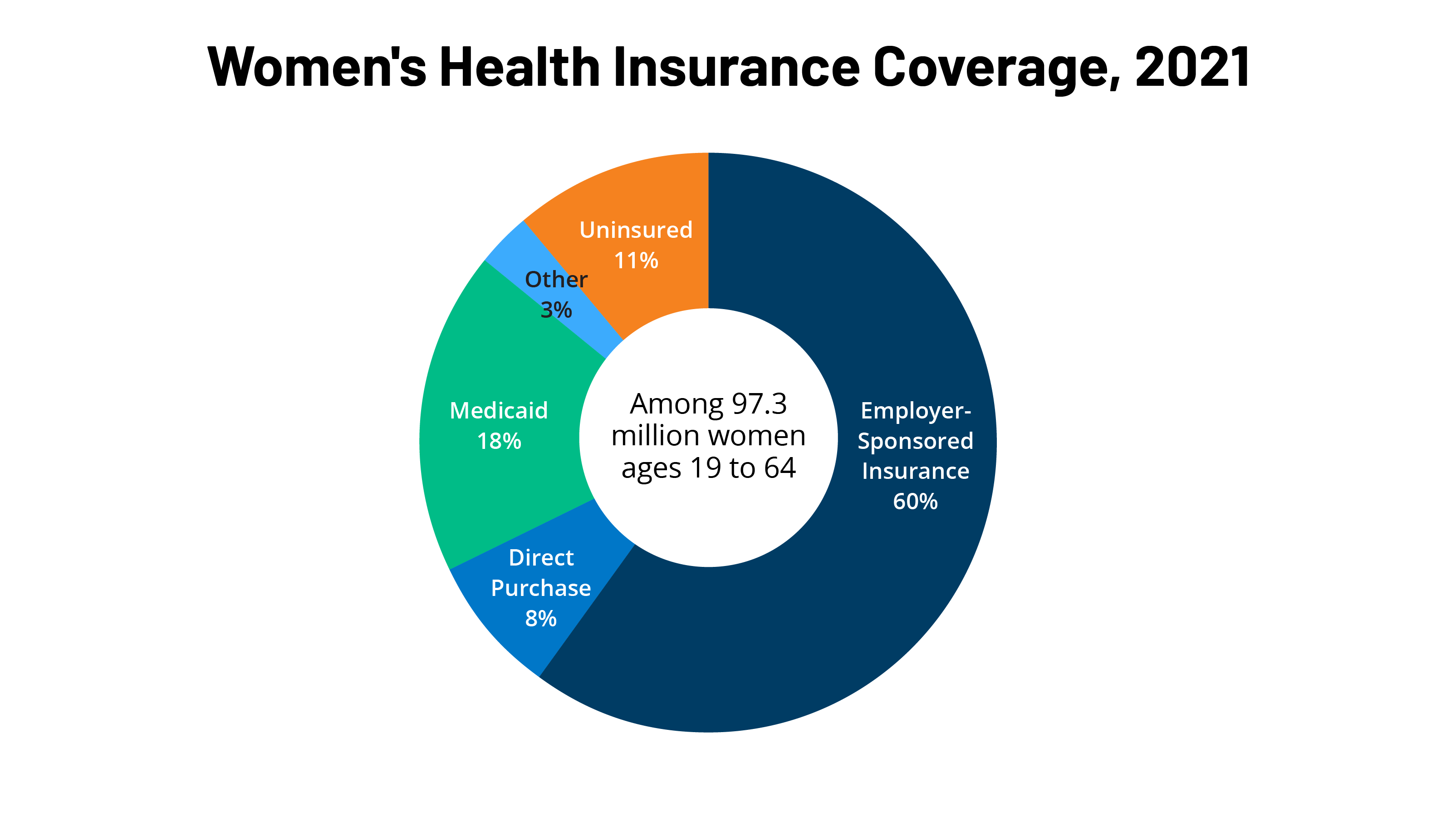

The first step in determining if your medical insurance will cover a special mattress is to understand your coverage. Some

medical insurance plans

may include coverage for durable medical equipment, which can include specialized mattresses. However, it is important to note that coverage may vary depending on the type of plan you have and the specific medical condition you are seeking treatment for.

Another factor to consider is whether or not the special mattress is deemed medically necessary by your doctor. In order for your insurance to cover the cost, the mattress must be prescribed by a healthcare professional and deemed necessary for the treatment of your medical condition. This means that simply wanting a more comfortable mattress may not be enough to justify coverage.

The first step in determining if your medical insurance will cover a special mattress is to understand your coverage. Some

medical insurance plans

may include coverage for durable medical equipment, which can include specialized mattresses. However, it is important to note that coverage may vary depending on the type of plan you have and the specific medical condition you are seeking treatment for.

Another factor to consider is whether or not the special mattress is deemed medically necessary by your doctor. In order for your insurance to cover the cost, the mattress must be prescribed by a healthcare professional and deemed necessary for the treatment of your medical condition. This means that simply wanting a more comfortable mattress may not be enough to justify coverage.

Alternative Options for Coverage

If your medical insurance does not cover the cost of a special mattress, there may be other options available to help with the cost. Some mattress manufacturers offer financing plans or payment options to make the purchase more manageable. Additionally, there are non-profit organizations and charities that provide assistance for medical equipment, including specialized mattresses.

If your medical insurance does not cover the cost of a special mattress, there may be other options available to help with the cost. Some mattress manufacturers offer financing plans or payment options to make the purchase more manageable. Additionally, there are non-profit organizations and charities that provide assistance for medical equipment, including specialized mattresses.

The Bottom Line

While medical insurance coverage for special mattresses may not be guaranteed, it is worth exploring your options and discussing with your healthcare provider. A good night's sleep is crucial for your overall health and well-being, and investing in a special mattress may just be the solution for your medical needs. Consider reaching out to your insurance provider and exploring alternative options to help make your purchase more affordable.

While medical insurance coverage for special mattresses may not be guaranteed, it is worth exploring your options and discussing with your healthcare provider. A good night's sleep is crucial for your overall health and well-being, and investing in a special mattress may just be the solution for your medical needs. Consider reaching out to your insurance provider and exploring alternative options to help make your purchase more affordable.