If you're in the market for a new mattress, you may be wondering about the financing options available at Mattress Firm. One question that often comes up is whether or not Mattress Firm runs credit checks on their customers. The answer is not a simple yes or no, so let's dive into the details.Does Mattress Firm Run Credit Checks?

The short answer is yes, Mattress Firm does check credit for some of their financing options. However, it's important to note that not all financing options require a credit check. This will ultimately depend on the specific financing plan you choose and your credit history.Does Mattress Firm Check Credit?

So why does Mattress Firm run credit checks for some financing options? The answer is simple: they want to ensure that their customers are financially responsible and able to make their monthly payments on time. This is a standard practice for most retailers who offer financing options.Mattress Firm Credit Check

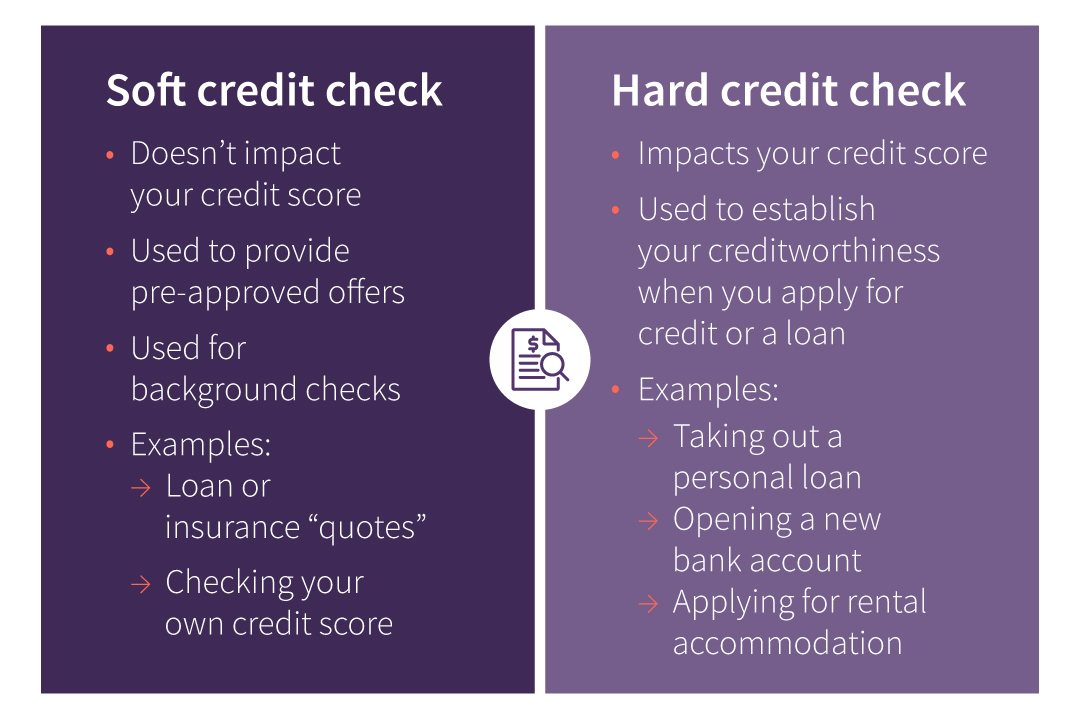

As mentioned earlier, not all financing options at Mattress Firm require a credit check. For example, if you choose to pay for your mattress in full at the time of purchase, there will be no need for a credit check. Additionally, some financing plans may only require a soft credit check, which does not impact your credit score.Does Mattress Firm Do Credit Checks?

If you do choose a financing plan that requires a credit check, it's important to know that Mattress Firm does have certain credit score requirements. This means that if your credit score does not meet their minimum standards, you may not be approved for financing.Does Mattress Firm Require Credit Check?

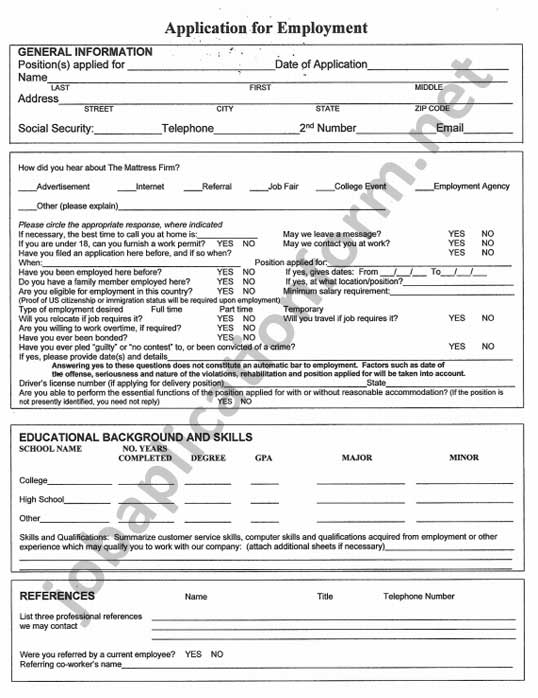

When applying for financing at Mattress Firm, it's important to understand that the credit check is just one factor that they consider. They also take into account your income, employment status, and other financial factors. So even if your credit score is not ideal, you may still be approved for financing.Mattress Firm Financing Credit Check

If you're worried about your credit score and the possibility of being denied financing, don't fret. Mattress Firm offers a variety of financing options to suit different credit profiles. This includes options for customers with less-than-perfect credit.Does Mattress Firm Offer Financing?

If you are approved for financing, congratulations! This means that Mattress Firm has confidence in your ability to make your monthly payments on time. However, it's important to remember that financing is a commitment and you should only take on what you can afford.Mattress Firm Credit Approval

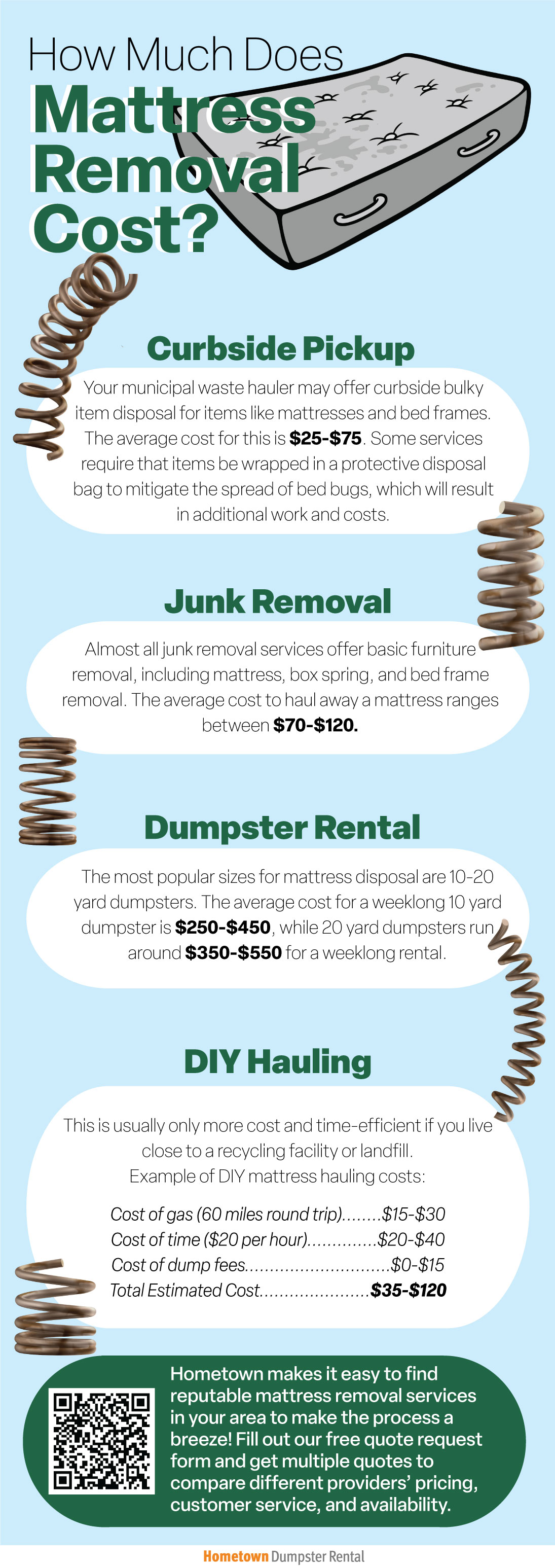

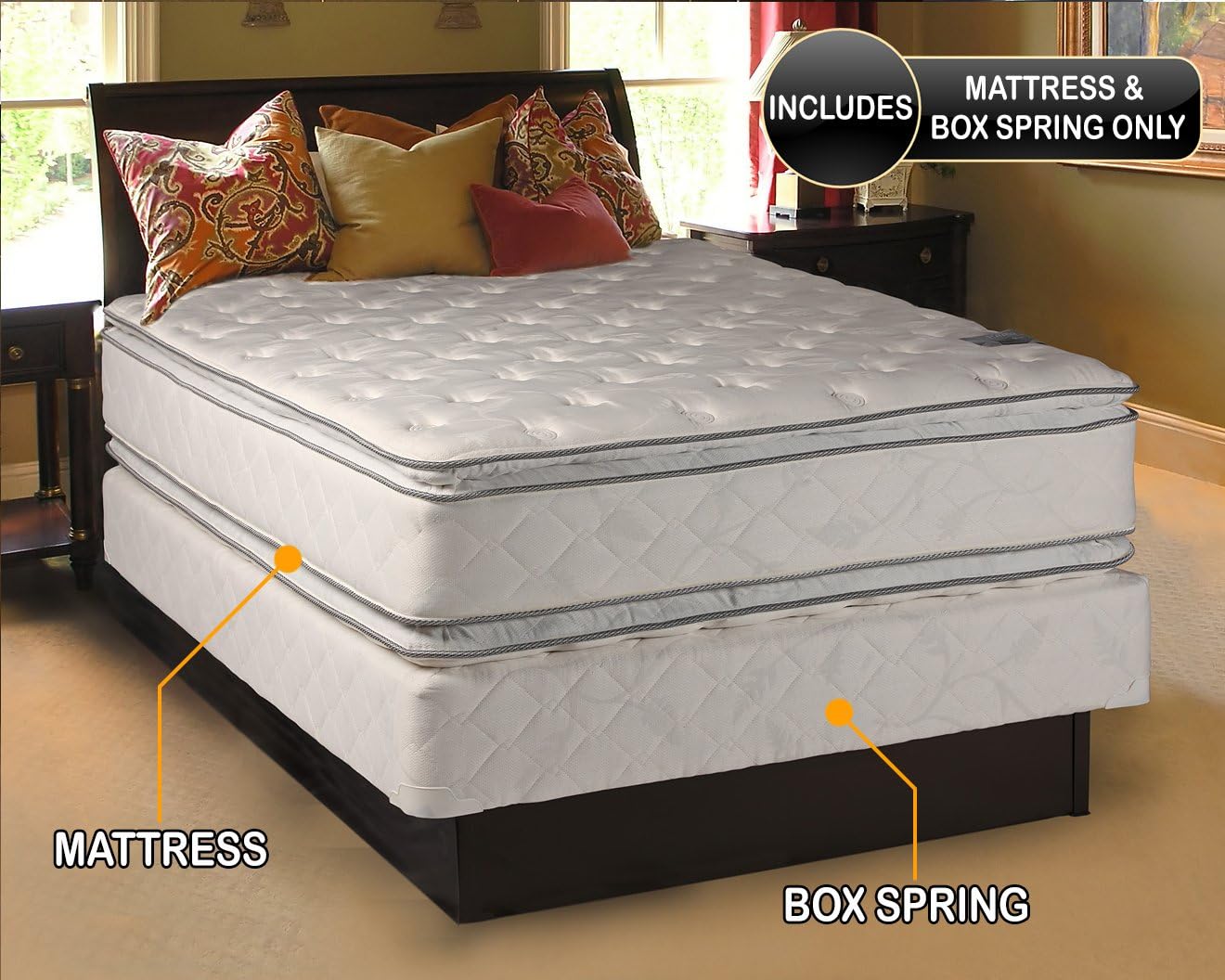

In addition to traditional financing plans, Mattress Firm also offers other credit options such as layaway and lease-to-own programs. These options may not require a credit check and can be a great alternative for those who are looking to finance a mattress.Does Mattress Firm Have Credit Options?

As mentioned earlier, Mattress Firm does have credit score requirements for their financing options. While these requirements may vary, it's generally recommended to have a credit score of at least 660 to be considered for financing. However, there are always exceptions, so it's worth discussing your options with a representative at Mattress Firm.Mattress Firm Credit Score Requirements

Does Mattress Firm Run Credit Checks?

When it comes to purchasing a new mattress, many people turn to Mattress Firm for their wide selection and competitive prices. However, for those who may have poor credit or are trying to build their credit , the question arises: does Mattress Firm run credit checks?

The Answer

The short answer is yes , Mattress Firm does run credit checks for their financing options. This is because they offer financing through third-party lenders , such as Synchrony Bank or Acima Credit. These lenders have their own criteria for approving applicants, which often includes a credit check.

This means that if you are planning to finance your mattress purchase through Mattress Firm, your credit score will likely be taken into consideration. However, this does not mean that those with less-than-perfect credit will automatically be denied financing.

Why Credit Checks Matter

Credit checks are a standard part of the financing process for many retailers, including Mattress Firm. They are used to determine an individual's creditworthiness , or their ability to pay back a loan or financing agreement. This includes looking at factors such as credit score, payment history, and debt-to-income ratio.

While a credit check may seem like a barrier for those with less-than-ideal credit , it is actually there to protect both the lender and the borrower. Lenders want to ensure that they are lending money to someone who is likely to pay it back, while borrowers want to make sure they are getting a fair and manageable financing agreement.

Alternatives to Financing

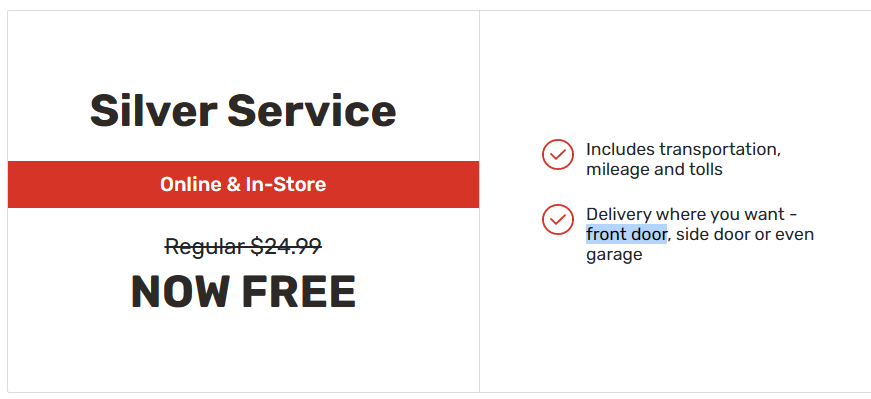

If you are concerned about a credit check or do not feel comfortable with financing your mattress purchase, there are alternative payment options available at Mattress Firm. These include paying with cash, credit card, or using a layaway program.

Additionally, if you are worried about your credit score and are planning to finance a mattress purchase in the future, there are steps you can take to improve your credit . This includes paying bills on time, keeping credit card balances low, and monitoring your credit report for any errors.

In conclusion, while Mattress Firm does run credit checks for their financing options, it should not deter you from considering them for your mattress purchase. With alternative payment options available and the opportunity to improve your credit, you can still find the perfect mattress at Mattress Firm.