If you work from home, you may be eligible for a home office deduction on your taxes. This can save you money and help offset the cost of using your home as a workspace. However, it's important to understand the rules and requirements for claiming this deduction to ensure you do it correctly.Home Office Deduction

The pandemic has forced many people to work from home, and this has led to an increase in the number of individuals seeking work from home tax deductions. These deductions can help reduce your taxable income and potentially save you hundreds or even thousands of dollars on your tax bill.Work From Home Tax Deductions

The IRS allows taxpayers to deduct certain expenses related to the use of a home office for business purposes. This includes things like rent, utilities, and even a portion of your mortgage or rent. However, there are specific criteria that must be met in order to claim this deduction.IRS Home Office Deduction

One of the main requirements for claiming a home office deduction is that the space must be used exclusively for business purposes. This means that you cannot also use the space for personal activities, such as watching TV or playing video games. It must be used solely for work.Home Office Tax Deduction

In addition to the exclusive use requirement, there are other rules and guidelines that must be followed in order to claim a home office deduction. These include having a designated space for your office, having a legitimate business purpose for the use of the space, and keeping accurate records of your expenses.Home Office Deduction Rules

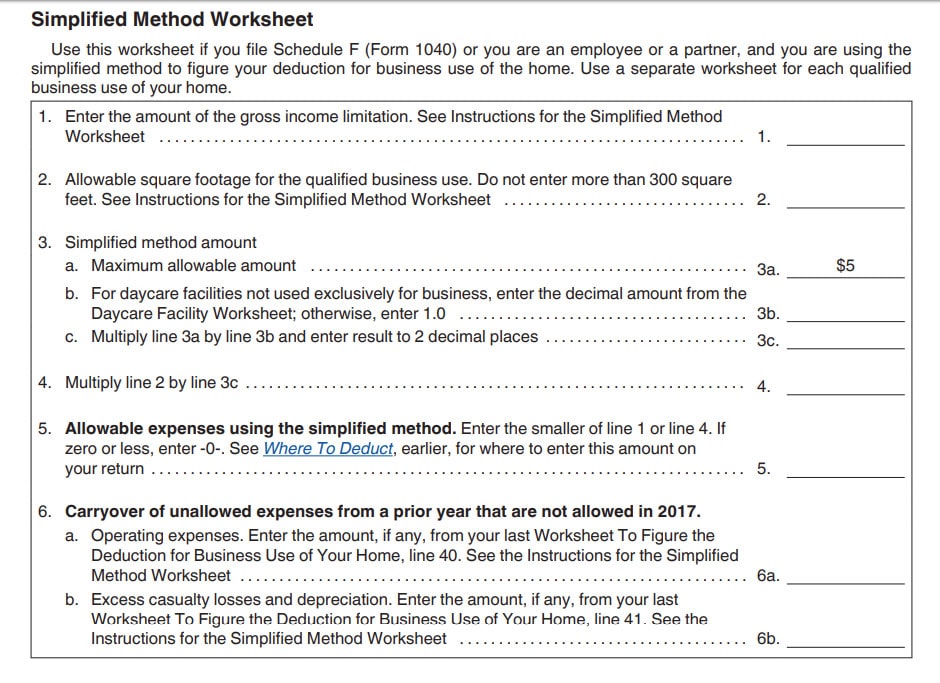

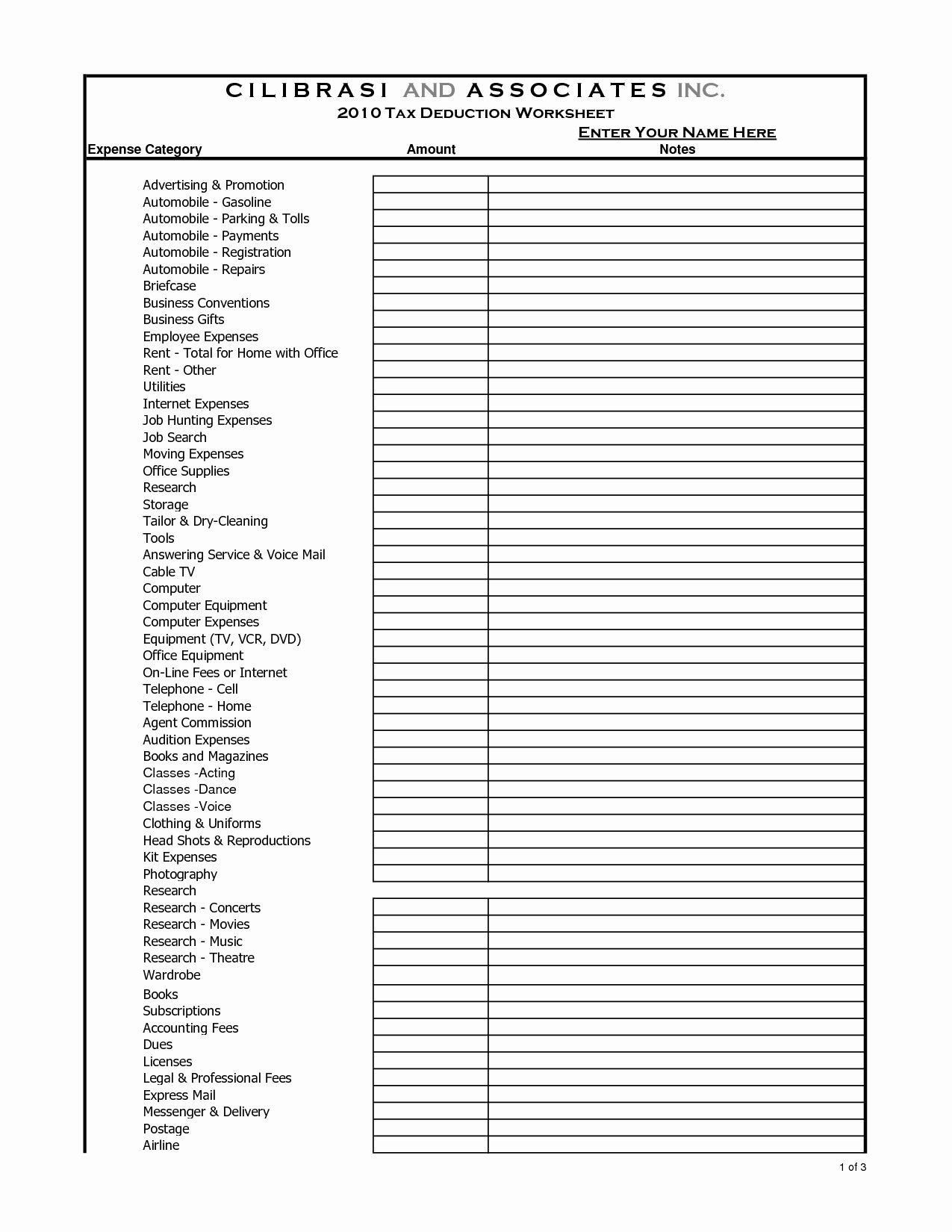

Calculating your home office deduction can be a complex process, as it involves determining the percentage of your home that is used for business purposes and applying that percentage to your eligible expenses. Fortunately, there are many online calculators available that can help you accurately determine this deduction.Home Office Deduction Calculator

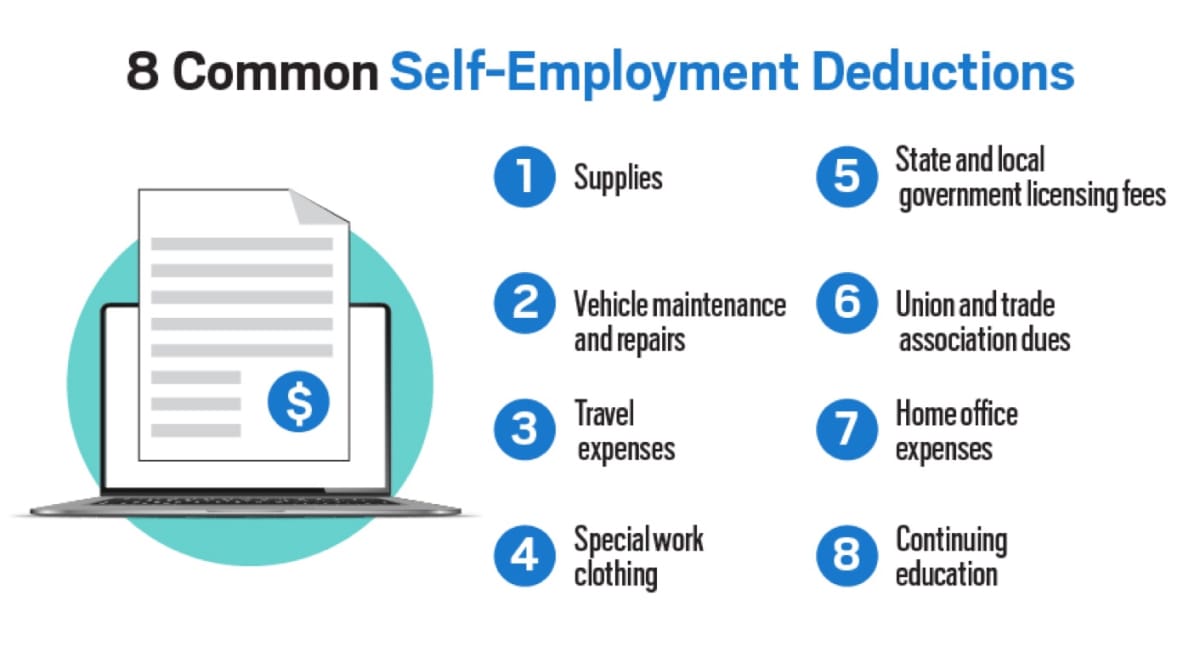

In addition to the exclusive use requirement, there are other requirements that must be met in order to claim a home office deduction. These include being self-employed or an independent contractor, having a designated space for your office, and using the space regularly and exclusively for business purposes.Home Office Deduction Requirements

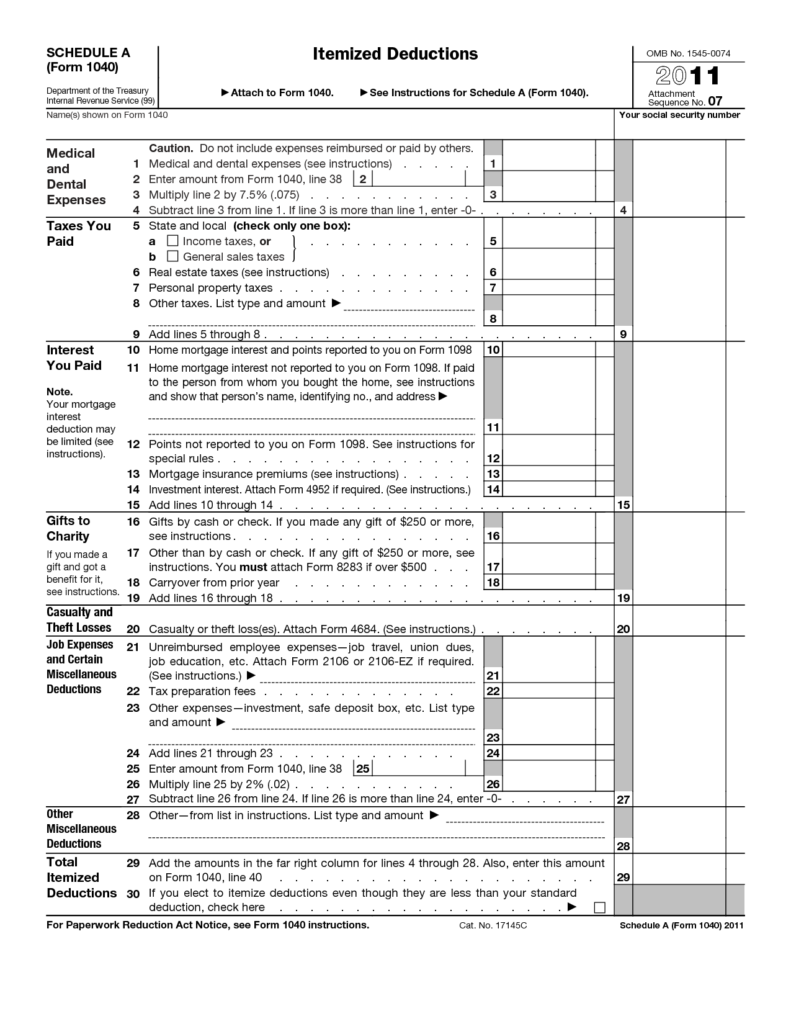

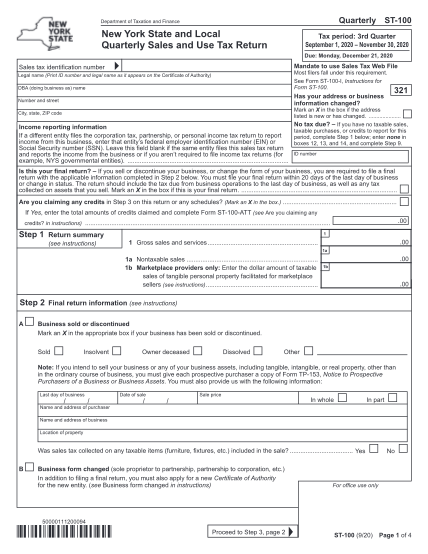

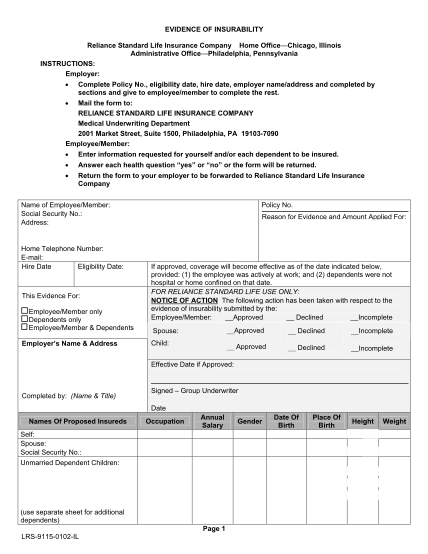

If you meet all of the requirements and are eligible to claim a home office deduction, you will need to fill out Form 8829, Expenses for Business Use of Your Home. This form will help you calculate your deduction and should be attached to your tax return.Home Office Deduction Form

In recent years, the IRS has introduced a simplified method for claiming a home office deduction. This method allows you to deduct $5 per square foot of your home used for business, up to a maximum of 300 square feet. While this may be a simpler option, it may not result in the highest deduction possible.Home Office Deduction Simplified Method

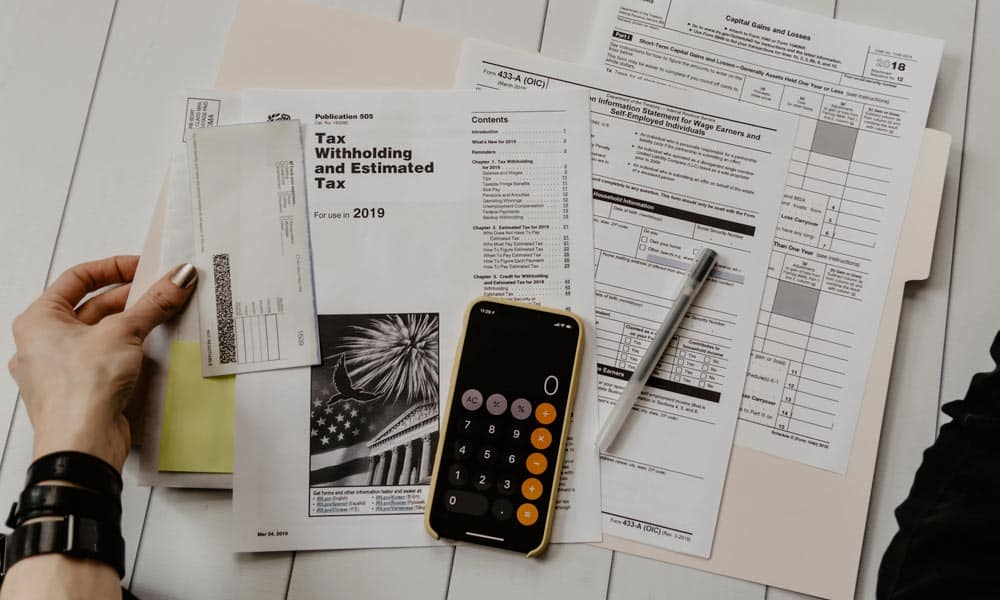

If you are self-employed, you may be able to claim a home office deduction as a business expense. This can include a portion of your rent or mortgage, utilities, and other expenses related to the use of your home for business purposes. It's important to consult with a tax professional to ensure you are claiming the correct deductions as a self-employed individual.Home Office Deduction for Self-Employed

The Benefits of Deducting Home Office Expenses if You Work at the Kitchen Table

Maximize Your Work Space Efficiency

Working from home has become increasingly popular in recent years, and with the current global situation, more and more people are finding themselves setting up makeshift offices at their kitchen tables. While this may seem like a temporary solution, it can actually have some long-term benefits when it comes to tax deductions.

Deducting home office expenses

is a great way to maximize your work space efficiency and save money on your taxes. By designating a specific area in your home, such as your kitchen table, as your primary work space, you can qualify for tax deductions for home office expenses.

Working from home has become increasingly popular in recent years, and with the current global situation, more and more people are finding themselves setting up makeshift offices at their kitchen tables. While this may seem like a temporary solution, it can actually have some long-term benefits when it comes to tax deductions.

Deducting home office expenses

is a great way to maximize your work space efficiency and save money on your taxes. By designating a specific area in your home, such as your kitchen table, as your primary work space, you can qualify for tax deductions for home office expenses.

Claiming Your Home Office Expenses

The first step to

deducting home office expenses

is to determine if your kitchen table meets the criteria for a home office. According to the Internal Revenue Service, a home office must be used regularly and exclusively for business purposes. This means that your kitchen table must be used primarily for work-related tasks and not for personal use.

Once you have determined that your kitchen table meets the requirements for a home office, you can start claiming your expenses. This can include a portion of your rent or mortgage, utilities, internet and phone bills, and even office supplies. By keeping track of these expenses and including them on your tax return, you can potentially save hundreds or even thousands of dollars.

The first step to

deducting home office expenses

is to determine if your kitchen table meets the criteria for a home office. According to the Internal Revenue Service, a home office must be used regularly and exclusively for business purposes. This means that your kitchen table must be used primarily for work-related tasks and not for personal use.

Once you have determined that your kitchen table meets the requirements for a home office, you can start claiming your expenses. This can include a portion of your rent or mortgage, utilities, internet and phone bills, and even office supplies. By keeping track of these expenses and including them on your tax return, you can potentially save hundreds or even thousands of dollars.

The Advantages of Deducting Home Office Expenses

Aside from the obvious financial benefits,

deducting home office expenses

can also have other advantages. For one, it allows you to create a designated work space in your home, which can help with productivity and separating work from personal life. Additionally, by claiming these deductions, you are showing the IRS that you are a legitimate and responsible business owner, which can help to reduce the likelihood of being audited.

In conclusion, if you find yourself working from your kitchen table, it's important to know that you may be eligible for tax deductions for home office expenses. By taking advantage of these deductions, you can maximize your work space efficiency, save money on your taxes, and potentially improve your work-life balance. So next time you sit down to work at your kitchen table, remember the benefits of

deducting home office expenses

and make sure to include it on your tax return.

Aside from the obvious financial benefits,

deducting home office expenses

can also have other advantages. For one, it allows you to create a designated work space in your home, which can help with productivity and separating work from personal life. Additionally, by claiming these deductions, you are showing the IRS that you are a legitimate and responsible business owner, which can help to reduce the likelihood of being audited.

In conclusion, if you find yourself working from your kitchen table, it's important to know that you may be eligible for tax deductions for home office expenses. By taking advantage of these deductions, you can maximize your work space efficiency, save money on your taxes, and potentially improve your work-life balance. So next time you sit down to work at your kitchen table, remember the benefits of

deducting home office expenses

and make sure to include it on your tax return.