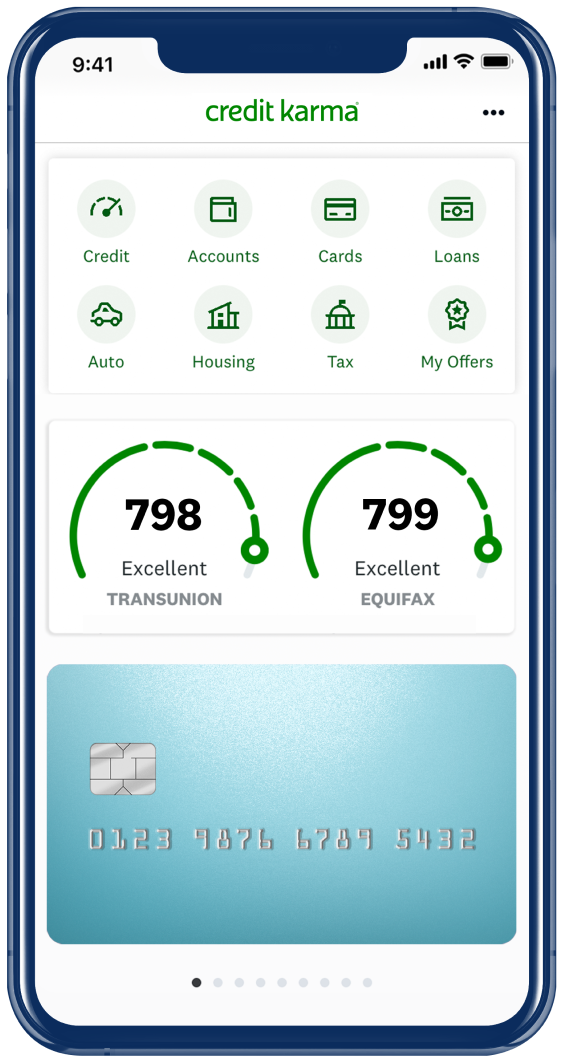

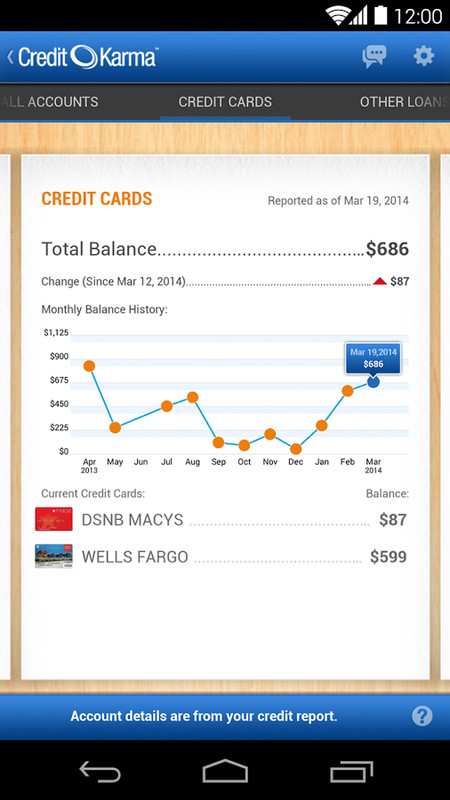

Credit Karma is a popular financial management platform that offers consumers free access to their credit scores and credit reports, as well as credit monitoring services. With over 100 million members, Credit Karma has become a trusted source for individuals looking to stay on top of their finances and improve their credit scores. One of the main benefits of using Credit Karma is that it provides free credit scores and reports from two of the major credit bureaus, TransUnion and Equifax. This allows users to get a comprehensive view of their credit standing and identify any potential issues that may be affecting their scores. But that's not all - Credit Karma also offers credit monitoring services that can help alert users to any changes or potential fraud on their credit reports. This can be especially helpful in preventing identity theft and other fraudulent activity. So how does Credit Karma make money if it's offering all of these services for free? The platform makes money through partnerships with financial institutions and credit card companies. It will recommend certain credit cards or loans to users based on their credit profiles and earn a commission if the user applies and is approved for the recommended product. Overall, Credit Karma is a great resource for individuals looking to improve their credit scores and stay on top of their financial health. With its easy-to-use platform and free services, it's no wonder why it has gained such a large following.Credit Karma: Free Credit Score & Free Credit Reports With Monitoring

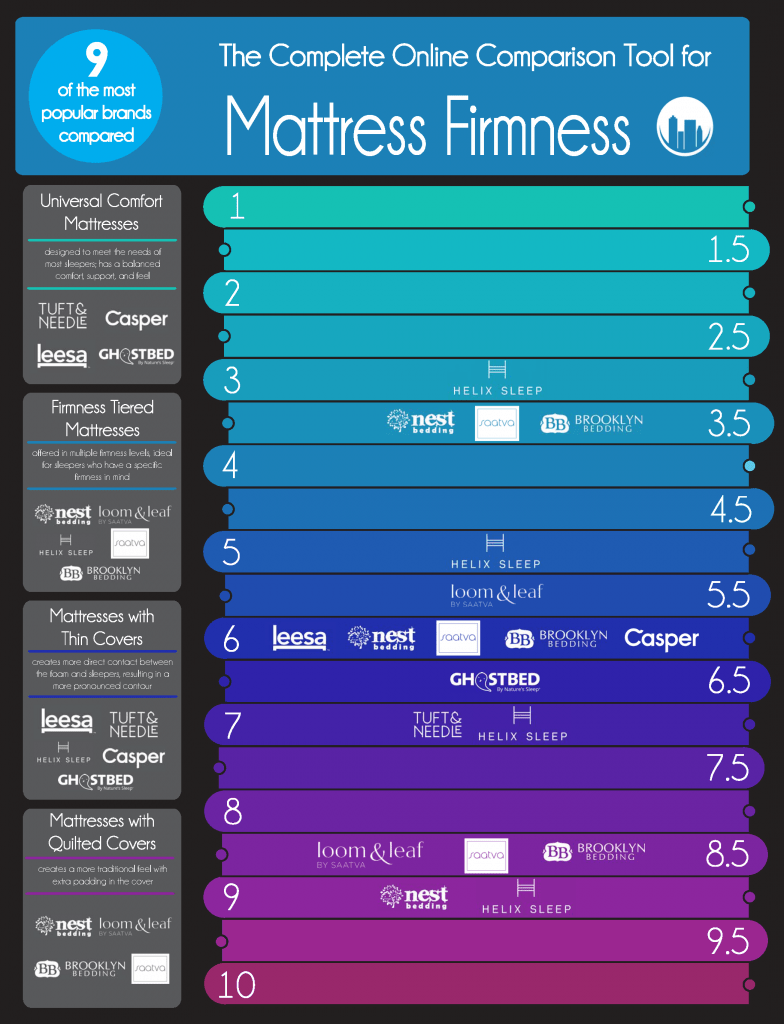

If you're in the market for a new mattress, you may have come across the Mattress Firm Credit Card. This store credit card offers special financing options and rewards for purchases made at Mattress Firm. But is it worth it? The Mattress Firm Credit Card is issued by Synchrony Bank and can only be used at Mattress Firm locations. It offers 0% APR financing for up to 6 years on select purchases, as well as a rewards program where users can earn points for every dollar spent. These points can then be redeemed for discounts on future purchases. But before you get too excited about the potential savings, it's important to note that the Mattress Firm Credit Card has a high APR of 29.99% if the balance is not paid in full within the promotional period. This can end up costing you a lot of money in interest if you're not careful with your payments. Additionally, the rewards program has a fairly low redemption rate, with 2,500 points only equating to a $25 discount. This may not be worth it for those who don't make frequent purchases at Mattress Firm. In conclusion, the Mattress Firm Credit Card may be worth considering if you're planning to make a large purchase and can pay it off within the promotional period. However, it's important to carefully read the terms and conditions and consider if the rewards program is worth it for your spending habits.Mattress Firm Credit Card - Manage your account

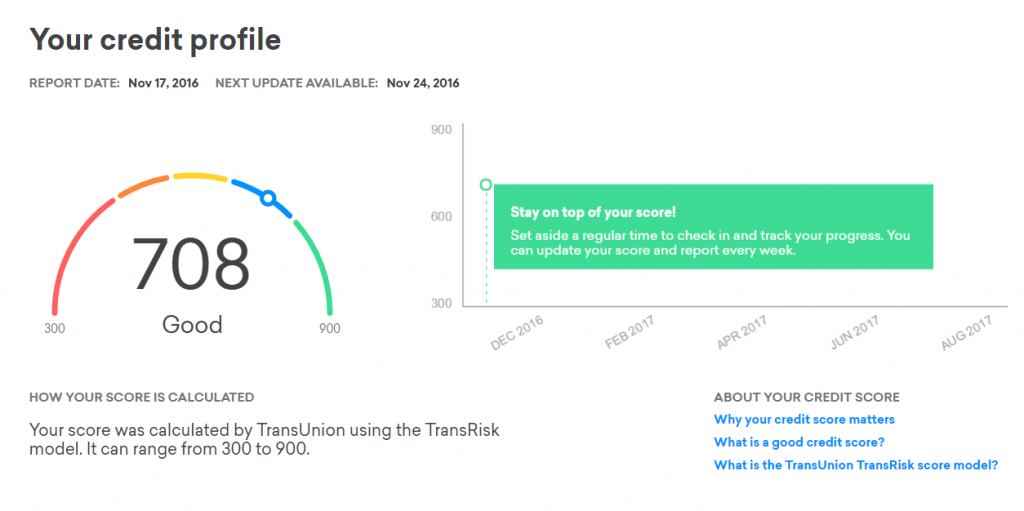

For those who are unfamiliar with Credit Karma, you may be wondering - is it a legitimate source for credit information or just another scam? The answer is yes, Credit Karma is a legitimate platform that has been around since 2007. Credit Karma provides users with free credit scores and reports, as well as credit monitoring services. It has strict security measures in place to protect user information and is certified by Norton, TRUSTe, and VeriSign. One thing to note is that Credit Karma does not provide FICO scores, which are the most widely used credit scores by lenders. Instead, it offers VantageScore, which is calculated using similar factors but may not be the exact same score that lenders see. However, this does not mean that Credit Karma's scores are inaccurate or unreliable. It still provides a good indication of your credit standing and any changes that may occur. And with its large user base and positive reviews, it's clear that Credit Karma has gained the trust of many individuals looking to monitor their credit.Credit Karma - Wikipedia

When considering any credit card, it's always a good idea to read reviews from other users to get a better understanding of their experiences. WalletHub, a popular financial website, has over 200 reviews for the Mattress Firm Credit Card, with an average rating of 2.5 stars. Many users appreciate the 0% financing options and rewards program, but also note the high APR and low redemption rate. Some have also reported issues with customer service and difficulty with making payments. Ultimately, the reviews are mixed, with some users finding the card beneficial and others regretting their decision to apply. It's important to carefully consider your own financial situation and spending habits before deciding if the Mattress Firm Credit Card is right for you.Mattress Firm Credit Card Reviews - WalletHub

Credit Karma also has a strong presence on social media, with over 1.6 million followers on Facebook. Its page is filled with helpful tips and advice for managing finances and improving credit scores. In addition to providing credit scores and reports, Credit Karma also offers resources such as credit card and loan calculators, budgeting tools, and personalized recommendations for financial products. Its Facebook page is a great way to stay updated on new features and promotions. Furthermore, Credit Karma actively engages with its followers, responding to questions and comments and providing additional resources and support. This shows that the platform truly cares about its users and is committed to helping them achieve financial success.Credit Karma - Home | Facebook

To get a more recent and comprehensive view of user experiences with the Mattress Firm Credit Card, we turn to SuperMoney, a financial review website that collects user feedback and ratings for various financial products. Currently, the Mattress Firm Credit Card has a rating of 2.9 stars out of 5, with over 250 reviews. Some users have praised the card for its financing options and rewards program, while others have reported issues with customer service and high interest rates. It's important to note that these reviews are constantly being updated and may change over time. It's always a good idea to read a variety of reviews and consider your own financial needs before making a decision about any credit card.Mattress Firm Credit Card Reviews (June 2021) | SuperMoney

For those interested in the business side of Credit Karma, Crunchbase provides a detailed overview of the company's funding and investors. Interestingly, Credit Karma has raised over $869 million in funding and has a valuation of over $3 billion. This shows that the company has a strong backing and is seen as a valuable asset in the financial technology industry. This may give users peace of mind in knowing that Credit Karma is a stable and reliable platform to use for their credit monitoring needs.Credit Karma - Crunchbase Company Profile & Funding

In conclusion, the Mattress Firm Credit Card can be a good option for those looking to make a large purchase at Mattress Firm and can pay it off within the promotional period. However, it's important to carefully read the terms and conditions and consider if the rewards program is worth it for your spending habits. Additionally, Credit Karma is a legitimate platform for credit monitoring and has gained a large following for its free services and helpful resources. With its easy-to-use platform and commitment to user security, it's a great tool for individuals looking to improve their credit scores and stay on top of their finances. But as with any financial decision, it's important to do your own research and consider your personal financial situation before making any decisions. And remember, credit scores are just one aspect of your overall financial health - it's important to also focus on budgeting, saving, and responsible spending habits to achieve financial success.Mattress Firm Credit Card Review: Is It Worth It? | Credit Karma

The Benefits of Using Credit Karma for Purchasing a Mattress from Mattress Firm

Introducing a New Way to Finance Your Mattress Purchase

If you're in the market for a new mattress, you may have heard about Credit Karma's partnership with Mattress Firm. This collaboration offers a new and convenient way to finance your mattress purchase, making it easier and more affordable to upgrade your sleeping experience. Let's take a closer look at the benefits of using Credit Karma for purchasing a mattress from Mattress Firm.

If you're in the market for a new mattress, you may have heard about Credit Karma's partnership with Mattress Firm. This collaboration offers a new and convenient way to finance your mattress purchase, making it easier and more affordable to upgrade your sleeping experience. Let's take a closer look at the benefits of using Credit Karma for purchasing a mattress from Mattress Firm.

Easy and Flexible Financing Options

One of the main advantages of using Credit Karma for purchasing a mattress from Mattress Firm is the flexible financing options available. Credit Karma offers a variety of payment plans to choose from, including interest-free financing for a certain period of time. This allows you to spread out the cost of your mattress over several months, making it more budget-friendly and manageable.

One of the main advantages of using Credit Karma for purchasing a mattress from Mattress Firm is the flexible financing options available. Credit Karma offers a variety of payment plans to choose from, including interest-free financing for a certain period of time. This allows you to spread out the cost of your mattress over several months, making it more budget-friendly and manageable.

No Hidden Fees or Surprises

Another great perk of using Credit Karma for your mattress purchase is the transparency in their financing terms. With no hidden fees or surprises, you can rest assured that you are getting a fair and straightforward deal. This is especially important when making a big purchase like a mattress, where unexpected fees and charges can quickly add up.

Another great perk of using Credit Karma for your mattress purchase is the transparency in their financing terms. With no hidden fees or surprises, you can rest assured that you are getting a fair and straightforward deal. This is especially important when making a big purchase like a mattress, where unexpected fees and charges can quickly add up.

Improve Your Credit Score

Using Credit Karma for your mattress purchase can also have a positive impact on your credit score. By making regular and timely payments, you can improve your credit score and establish a good credit history. This can come in handy for future big purchases, such as a new home or car.

Using Credit Karma for your mattress purchase can also have a positive impact on your credit score. By making regular and timely payments, you can improve your credit score and establish a good credit history. This can come in handy for future big purchases, such as a new home or car.

Convenient Online Process

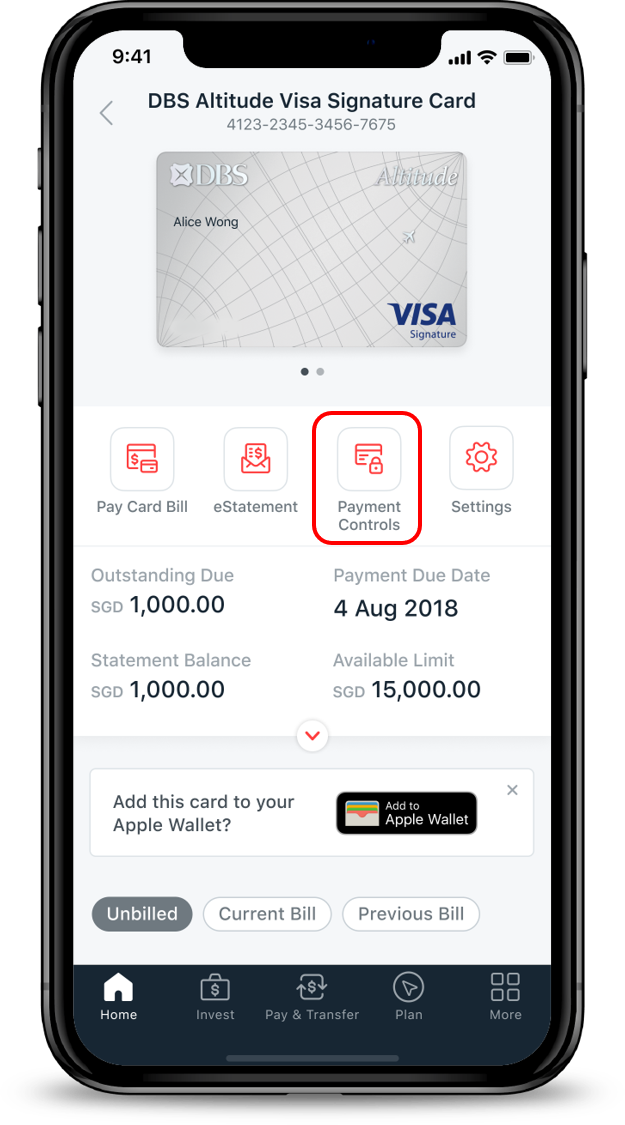

Gone are the days of filling out lengthy paperwork and waiting in line at the store to finance your mattress. With Credit Karma and Mattress Firm, you can complete the entire financing process online from the comfort of your own home. This makes the mattress buying experience even more convenient and hassle-free.

Gone are the days of filling out lengthy paperwork and waiting in line at the store to finance your mattress. With Credit Karma and Mattress Firm, you can complete the entire financing process online from the comfort of your own home. This makes the mattress buying experience even more convenient and hassle-free.

Upgrade Your Sleep with Credit Karma and Mattress Firm

In conclusion, using Credit Karma for purchasing a mattress from Mattress Firm offers a host of benefits, including flexible financing options, transparency, credit score improvement, and a convenient online process. So why settle for a subpar sleeping experience when you can easily upgrade with the help of Credit Karma and Mattress Firm? Explore their financing options today and start enjoying a better night's sleep.

In conclusion, using Credit Karma for purchasing a mattress from Mattress Firm offers a host of benefits, including flexible financing options, transparency, credit score improvement, and a convenient online process. So why settle for a subpar sleeping experience when you can easily upgrade with the help of Credit Karma and Mattress Firm? Explore their financing options today and start enjoying a better night's sleep.