If you've ever had to pay for medical expenses out of your own pocket, you know how quickly they can add up. From doctor's visits to prescription medications, medical bills can put a strain on your finances. But did you know that some medical expenses may be tax deductible? This means that you can potentially save money on your taxes by claiming these expenses. Let's take a closer look at the tax deductions available for medical expenses.1. Tax Deductions for Medical Expenses

One question that often comes up when discussing medical expense deductions is whether or not you can deduct the cost of a new mattress as a medical expense. The short answer is yes, in some cases you can. The IRS allows for the deduction of medical expenses that are considered "medically necessary." This means that if a doctor has prescribed a new mattress for you for medical reasons, you may be able to deduct the cost on your taxes.2. Can You Deduct Your Mattress as a Medical Expense?

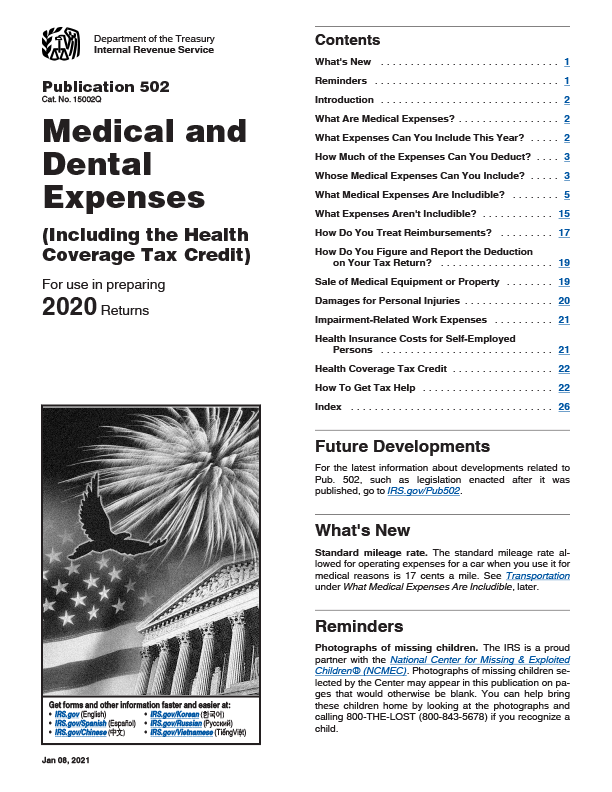

To determine which medical expenses are deductible, it's important to consult the official guidelines set by the IRS. The IRS Publication 502 outlines the rules and regulations for claiming medical and dental expenses on your tax return. This publication covers a wide range of medical expenses, including the cost of a new mattress if it is deemed medically necessary.3. IRS Publication 502: Medical and Dental Expenses

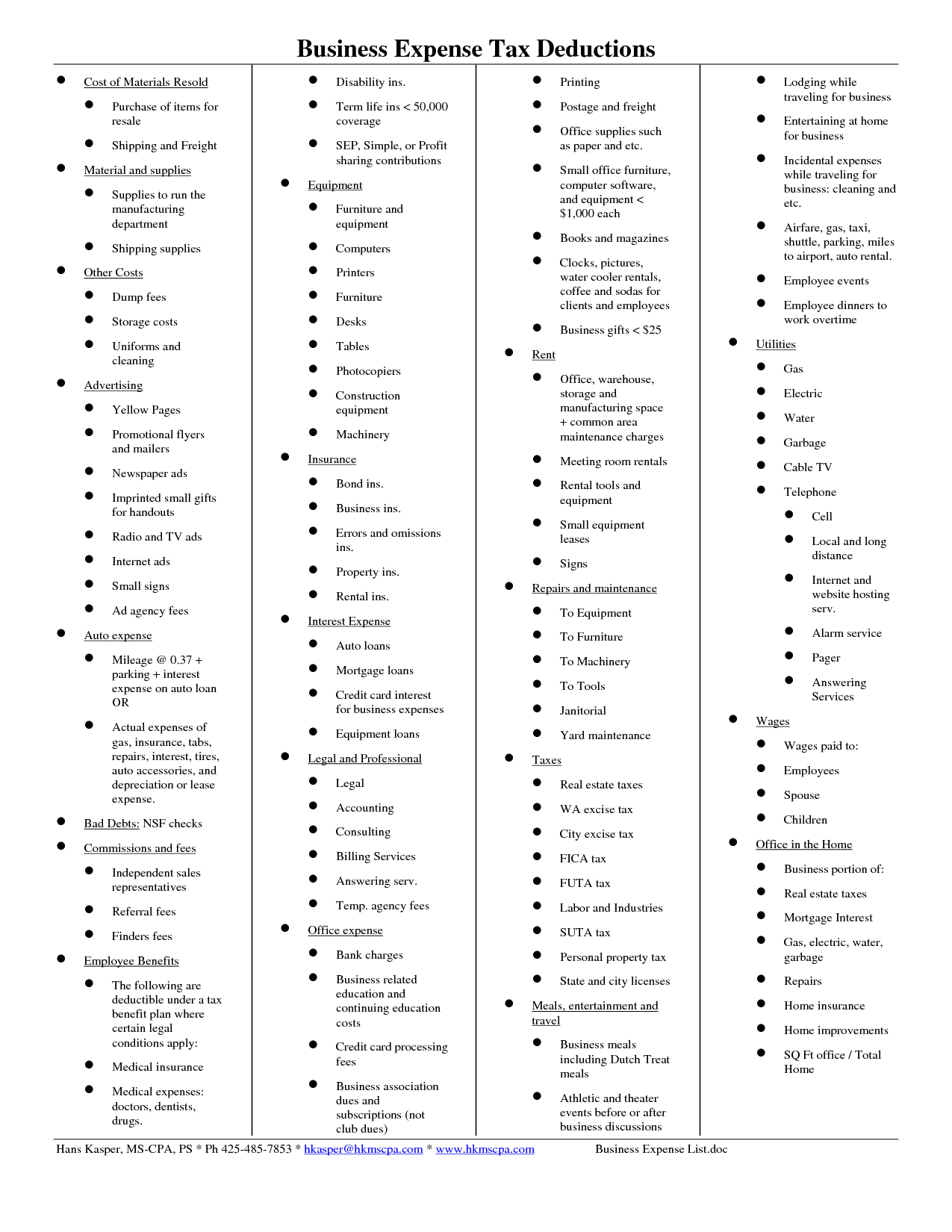

In addition to the cost of a new mattress, there are many other medical expenses that you may be able to deduct on your taxes. Some common examples include doctor's visits, prescription medications, and medical equipment. You can also deduct the cost of transportation to and from medical appointments, as well as the cost of lodging if you have to travel for medical treatment.4. What Medical Expenses are Tax Deductible?

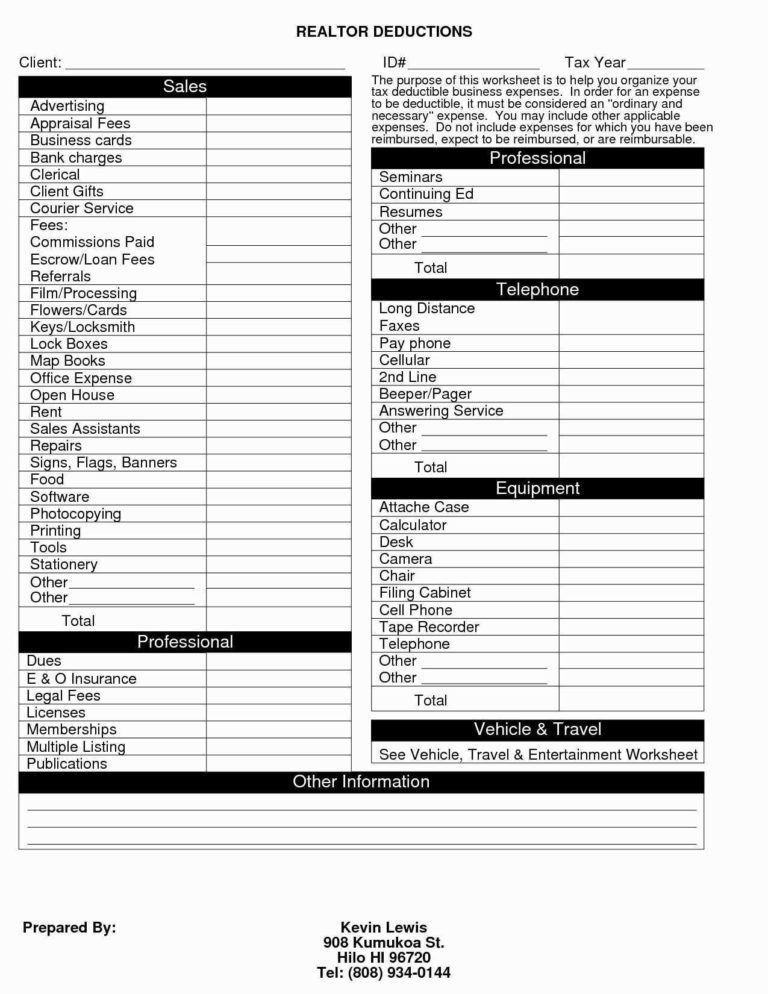

To claim the medical expense tax deduction, you will need to itemize your deductions on your tax return. This means that you will need to keep detailed records and receipts of all your medical expenses throughout the year. It's a good idea to keep a separate folder or file specifically for medical expenses to make this process easier.5. How to Claim the Medical Expense Tax Deduction

When it comes time to file your taxes, you will need to fill out Form 1040 and Schedule A to claim the medical expense deduction. On Schedule A, you will need to list all of your medical expenses, including the cost of a new mattress if applicable. It's important to note that there is a threshold for deducting medical expenses – you can only deduct expenses that exceed 7.5% of your adjusted gross income.6. Deducting Medical Expenses on Your Tax Return

In addition to the cost of a new mattress, there are many other medical expenses that you may be able to deduct on your taxes. Some examples include dental treatments, vision care, and mental health services. You can also deduct the cost of certain medical equipment, such as crutches or wheelchairs.7. Medical Expenses You Can Deduct on Your Taxes

As mentioned earlier, you can deduct the cost of a new mattress on your taxes if it is deemed medically necessary. This means that you will need a doctor's prescription stating that a new mattress is necessary for your medical condition. Additionally, the mattress must be used primarily for medical purposes – it cannot be used for personal or household use.8. Can You Deduct the Cost of a New Mattress on Your Taxes?

Another way to potentially save money on your taxes is by deducting home improvements that are medically necessary. For example, if you need to install a ramp or handrails for medical reasons, you may be able to deduct the cost on your taxes. This can also include modifications to your home to make it more accessible for someone with a disability.9. Tax Deductions for Home Improvements

To deduct home improvements on your taxes, you will need to keep detailed records and receipts of the expenses. You will also need a letter from a doctor stating that the improvements were medically necessary. These improvements must also exceed 7.5% of your adjusted gross income in order to be deducted. In conclusion, if you have medical expenses that are considered medically necessary, you may be able to deduct them on your taxes. This can include the cost of a new mattress, as well as other medical expenses and home improvements. Be sure to consult the official guidelines from the IRS and keep detailed records to ensure you are claiming all the deductions you are eligible for.10. How to Deduct Home Improvements on Your Taxes

The Importance of a Quality Mattress in House Design

In the world of interior design, every detail matters. From the color scheme to the furniture choices, every element plays a role in creating the perfect living space. However, one aspect that is often overlooked is the humble mattress. While it may seem like a minor detail, the quality of your mattress can greatly impact the overall design and functionality of your home. So, the question arises, can you deduct your mattress as a design expense?

The Role of a Mattress in House Design

A mattress is more than just a place to sleep. It is a crucial component of any house design. A good mattress can provide comfort and support for your body, improving your sleep quality and overall well-being. It can also add to the aesthetic appeal of your bedroom, serving as a centerpiece or complementing the design elements of the room.

When it comes to house design, every element should work together to create a cohesive and harmonious space. Your mattress should not only be comfortable but also fit in with the overall theme and design of your home. This means considering factors such as size, color, and style when choosing a mattress. A well-chosen mattress can enhance the overall look and feel of your bedroom, making it a more inviting and relaxing space.

The Tax Deductibility of a Mattress in House Design

Now, let's address the burning question – can you deduct your mattress as a design expense? The answer is, it depends. In general, the IRS does not consider a mattress as a tax-deductible expense for house design purposes. However, there are certain circumstances where you may be able to claim it as a deduction.

For example, if you work from home and use your bedroom as a home office, you may be able to deduct a portion of your mattress cost as a business expense. Similarly, if you have a medical condition that requires a specific type of mattress for proper support, you may be able to claim it as a medical expense on your taxes.

It is crucial to consult with a tax professional to determine if your mattress expense is eligible for a tax deduction. While it may not be a straightforward deduction, it is worth exploring if you can save money on your tax bill while investing in a quality mattress for your house design.

Investing in a Quality Mattress

As mentioned earlier, a mattress is an essential element of house design. It not only affects the overall look and feel of your bedroom but also has a significant impact on your health and well-being. So, when it comes to choosing a mattress, it is crucial to invest in a quality one that meets your needs and fits in with your design aesthetic.

Consider factors such as firmness, material, and size when selecting a mattress. Don't be afraid to splurge a little on a high-quality mattress that will provide you with comfort and support for years to come. After all, a good night's sleep is priceless.

In Conclusion

While a mattress may not seem like a significant expense in house design, it plays a crucial role in creating a functional and aesthetically pleasing living space. While it may not be tax-deductible for everyone, investing in a quality mattress is a worthwhile investment for your overall well-being and the design of your home. So, when designing your dream living space, don't forget to give your mattress the attention it deserves.