As tax season approaches, many homeowners are wondering if they can save money by deducting their bedroom furniture on their taxes. The short answer is yes, you may be able to deduct some or all of your bedroom furniture on your taxes. However, there are certain criteria that must be met in order to do so. In this article, we will explore the ins and outs of deducting bedroom furniture on your taxes and provide you with some tips to maximize your savings.Can you deduct bedroom furniture on your taxes?

When it comes to deducting furniture on your taxes, there are certain guidelines that must be followed. The furniture must be used for business purposes or as a rental property. This means that if you use your bedroom furniture solely for personal use, you will not be able to deduct it on your taxes. However, if you have a home office or rent out a room in your house, you may be able to deduct a portion of your bedroom furniture as a business expense or rental expense.What furniture can you deduct on your taxes?

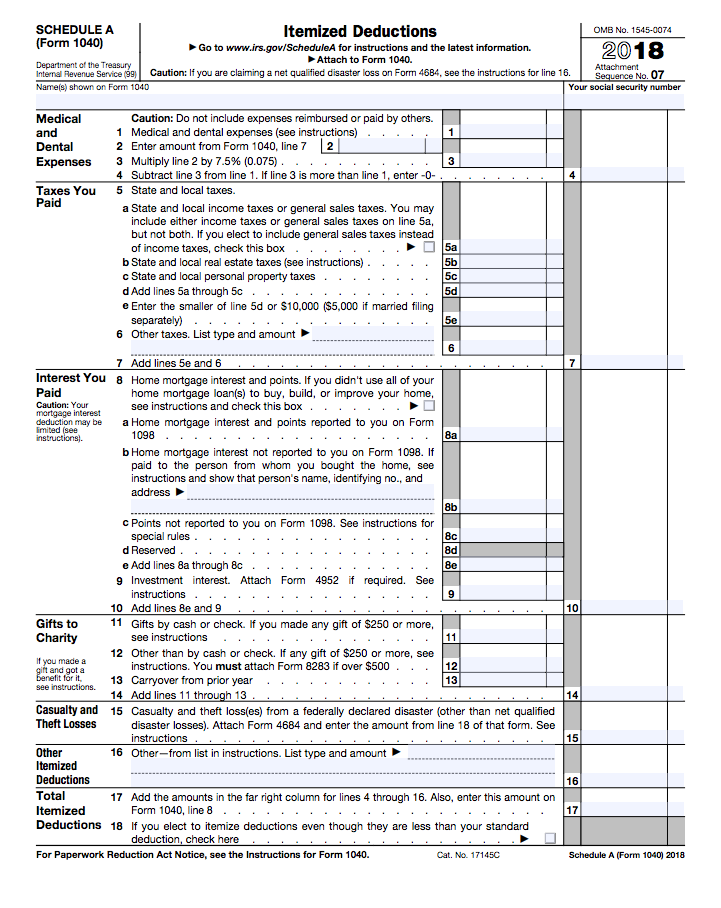

In order to deduct your bedroom furniture on your taxes, you will need to itemize your deductions instead of taking the standard deduction. This means keeping track of all your expenses and claiming them on your tax return. You will also need to determine the percentage of your bedroom furniture that is used for business or rental purposes. This can be calculated based on the square footage of your office or rental space compared to the total square footage of your home.How to deduct bedroom furniture on your taxes

There are several types of bedroom furniture that may be eligible for tax deductions. These include desks, chairs, bookcases, and filing cabinets for a home office, and beds, dressers, and nightstands for a rental property. You can also deduct the cost of any repairs or improvements made to your bedroom furniture, as long as they are necessary and directly related to the business or rental property.Bedroom furniture tax deductions

When claiming bedroom furniture on your taxes, it is important to keep detailed records and receipts to support your deductions. This will help you in case of an audit and ensure that you are accurately claiming the correct amount. You should also consult with a tax professional or use tax software to ensure that you are following the proper procedures and maximizing your savings.Claiming bedroom furniture on your taxes

There are a few ways to maximize your tax deductions for bedroom furniture. First, make sure that you are meeting all the criteria for deducting furniture, such as using it for business or rental purposes. Additionally, you can consider purchasing furniture that is specifically designed for business or rental use, as these may have a higher percentage of deductibility. Finally, be sure to keep track of all expenses and consult with a tax professional to ensure that you are taking advantage of all possible deductions.Maximizing tax deductions for bedroom furniture

Even if you are not able to deduct your bedroom furniture on your taxes, there are still tax benefits to purchasing new furniture. If you are a homeowner, you may be able to claim a tax credit for energy-efficient furniture, such as mattresses, that meet certain criteria. This can help offset the cost of purchasing new furniture and save you money in the long run.Tax benefits of purchasing bedroom furniture

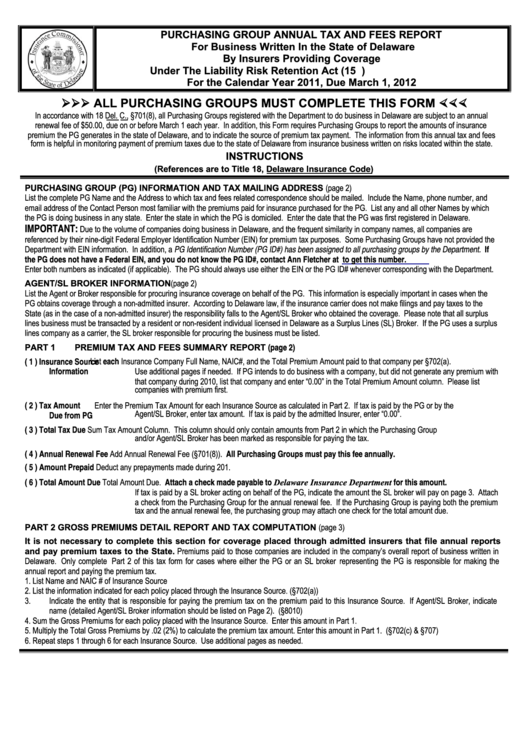

When itemizing your bedroom furniture on your taxes, you will need to use IRS Form 4562 to claim depreciation or Section 179 deduction for business furniture, and Schedule E for rental furniture. You will also need to keep records of how much you paid for each piece of furniture and the dates they were placed in service. Again, it is important to consult with a tax professional to ensure that you are following the proper procedures.How to itemize bedroom furniture on your taxes

It is important to have a clear understanding of the tax deductions available for bedroom furniture. If you are unsure about whether your furniture qualifies for deductions, it is best to consult with a tax professional. They can help you navigate the complex tax laws and ensure that you are utilizing all available deductions.Understanding tax deductions for bedroom furniture

To summarize, here are some tips to keep in mind when deducting bedroom furniture on your taxes:Tips for deducting bedroom furniture on your taxes

Maximizing Your Tax Deductions: Adding Bedroom Furniture to the List

Is It Possible to Deduct Bedroom Furniture from Your Taxes?

When it comes to tax deductions, homeowners are often curious about what they can and cannot deduct from their taxes. One common question is whether or not

bedroom furniture

can be deducted. The answer is not a simple yes or no, as it depends on a few factors.

Firstly, the

Internal Revenue Service (IRS)

allows for certain deductions for expenses that are necessary and reasonable for your

business

or

investment

. This includes expenses related to

rental properties

or home offices. So, if you are a

landlord

or have a home office, you may be able to deduct the cost of your bedroom furniture as a necessary expense.

When it comes to tax deductions, homeowners are often curious about what they can and cannot deduct from their taxes. One common question is whether or not

bedroom furniture

can be deducted. The answer is not a simple yes or no, as it depends on a few factors.

Firstly, the

Internal Revenue Service (IRS)

allows for certain deductions for expenses that are necessary and reasonable for your

business

or

investment

. This includes expenses related to

rental properties

or home offices. So, if you are a

landlord

or have a home office, you may be able to deduct the cost of your bedroom furniture as a necessary expense.

Criteria for Deducting Bedroom Furniture

In order to deduct your bedroom furniture, it must meet certain criteria. Firstly, it must be used exclusively for

business

or

investment

purposes. This means that the furniture cannot be used for personal use, such as a guest bedroom for family or friends. Additionally, the furniture must be considered a necessary expense for the

business

or

investment

. This means that it must be essential for the functioning of the

business

or

investment

and not simply for aesthetic purposes.

In order to deduct your bedroom furniture, it must meet certain criteria. Firstly, it must be used exclusively for

business

or

investment

purposes. This means that the furniture cannot be used for personal use, such as a guest bedroom for family or friends. Additionally, the furniture must be considered a necessary expense for the

business

or

investment

. This means that it must be essential for the functioning of the

business

or

investment

and not simply for aesthetic purposes.

The Benefits of Deducting Bedroom Furniture

If you are eligible to deduct your bedroom furniture, it can provide significant tax savings. By deducting the cost of your furniture, you can lower your taxable income and potentially decrease the amount of taxes you owe. This can be especially beneficial for those who have a higher tax bracket.

If you are eligible to deduct your bedroom furniture, it can provide significant tax savings. By deducting the cost of your furniture, you can lower your taxable income and potentially decrease the amount of taxes you owe. This can be especially beneficial for those who have a higher tax bracket.

Keep Good Records

It is important to keep thorough records of your bedroom furniture expenses if you plan on deducting them from your taxes. This includes keeping receipts, invoices, and any other relevant documentation that proves the cost and necessity of the furniture for your

business

or

investment

.

In conclusion, while it is possible to deduct bedroom furniture from your taxes, it is not a straightforward process and depends on various factors. If you meet the criteria and keep good records, you may be able to lower your taxable income and save on taxes. However, it is always best to consult with a tax professional or

financial advisor

to ensure that you are following the proper guidelines and maximizing your tax deductions.

It is important to keep thorough records of your bedroom furniture expenses if you plan on deducting them from your taxes. This includes keeping receipts, invoices, and any other relevant documentation that proves the cost and necessity of the furniture for your

business

or

investment

.

In conclusion, while it is possible to deduct bedroom furniture from your taxes, it is not a straightforward process and depends on various factors. If you meet the criteria and keep good records, you may be able to lower your taxable income and save on taxes. However, it is always best to consult with a tax professional or

financial advisor

to ensure that you are following the proper guidelines and maximizing your tax deductions.

:max_bytes(150000):strip_icc()/TipsforDeductingTravelExpensesonTaxes-Westend61-GettyImages-5a70c75fae9ab80037b8beee.jpg)