1. Can you use HSA to buy a mattress?

Many people wonder if they can use their Health Savings Account (HSA) to purchase a new mattress. The answer is yes, but there are some guidelines and restrictions to keep in mind.

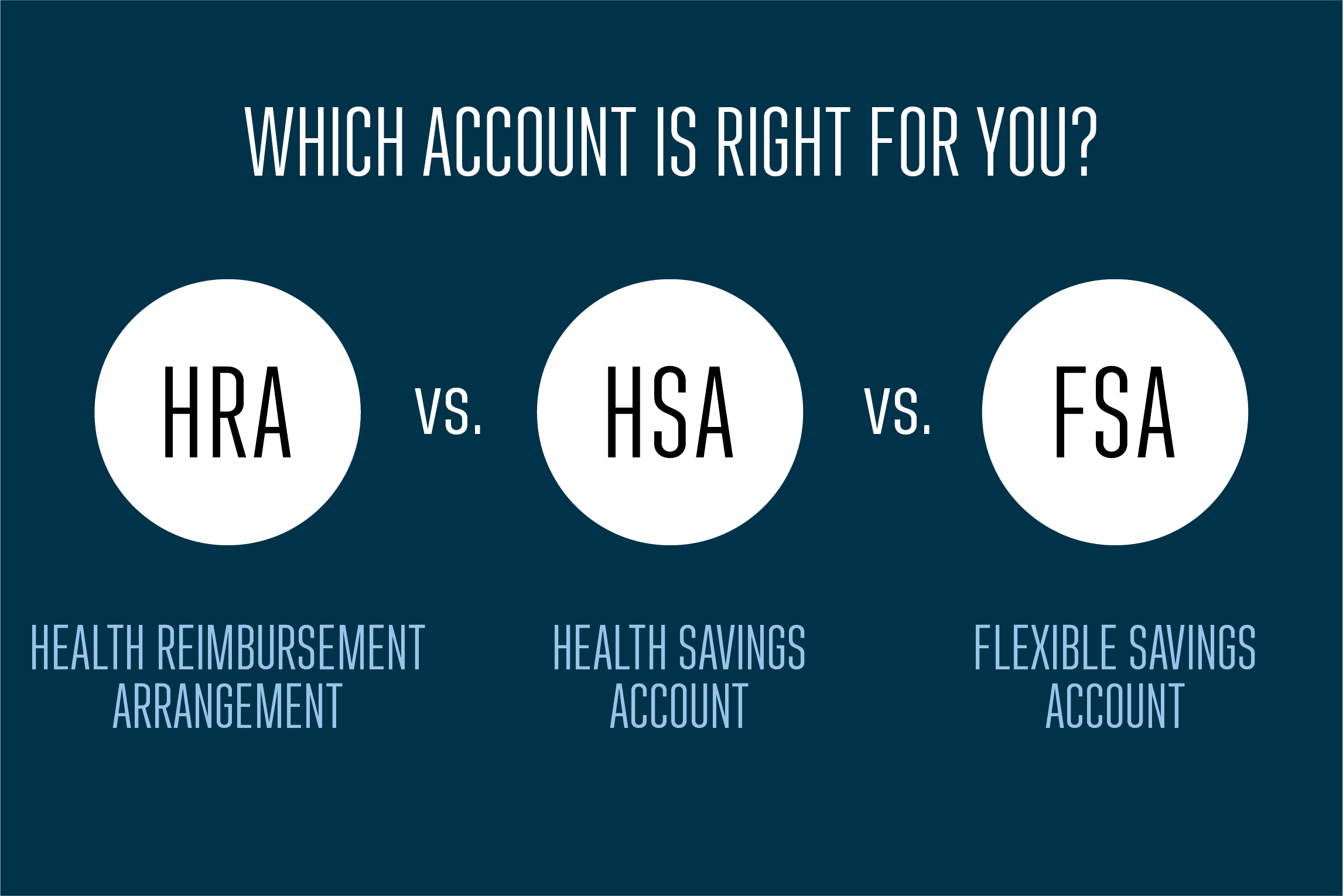

HSA stands for Health Savings Account, which is a type of savings account that allows individuals to set aside pre-tax money for medical expenses. This account is only available to those who have a high-deductible health plan.

So, can you use your HSA to buy a mattress? The short answer is yes, but there are a few things to consider before making your purchase.

2. HSA eligible mattresses

Not all mattresses are eligible for purchase using HSA funds. The Internal Revenue Service (IRS) has strict guidelines on what medical expenses can be covered by an HSA. The mattress must be deemed medically necessary by a qualified medical professional in order to be considered eligible for purchase with HSA funds.

This means that you cannot use your HSA to buy just any mattress. Only those that are recommended by a doctor for a specific medical condition will be eligible.

3. How to buy a mattress with HSA

Now that you know what type of mattress is considered eligible, you may be wondering how to actually purchase it using your HSA funds. The process is fairly simple and similar to using your HSA for other medical expenses.

First, you will need to get a written recommendation from your doctor stating that the mattress is medically necessary. This can be in the form of a prescription or a letter from your doctor.

Next, you will need to keep a record of your purchase and submit it for reimbursement. This can be done through your HSA provider's website or by filling out a reimbursement form and submitting it with your receipt.

4. HSA approved mattresses

When searching for a mattress that is HSA eligible, it's important to look for mattresses that are specifically approved by the IRS. These mattresses are designed to provide proper support and alleviate medical conditions such as back pain, sleep apnea, and acid reflux.

Some popular HSA approved mattresses include memory foam mattresses, adjustable beds, and mattresses with specialized support systems.

5. Buying a mattress with HSA funds

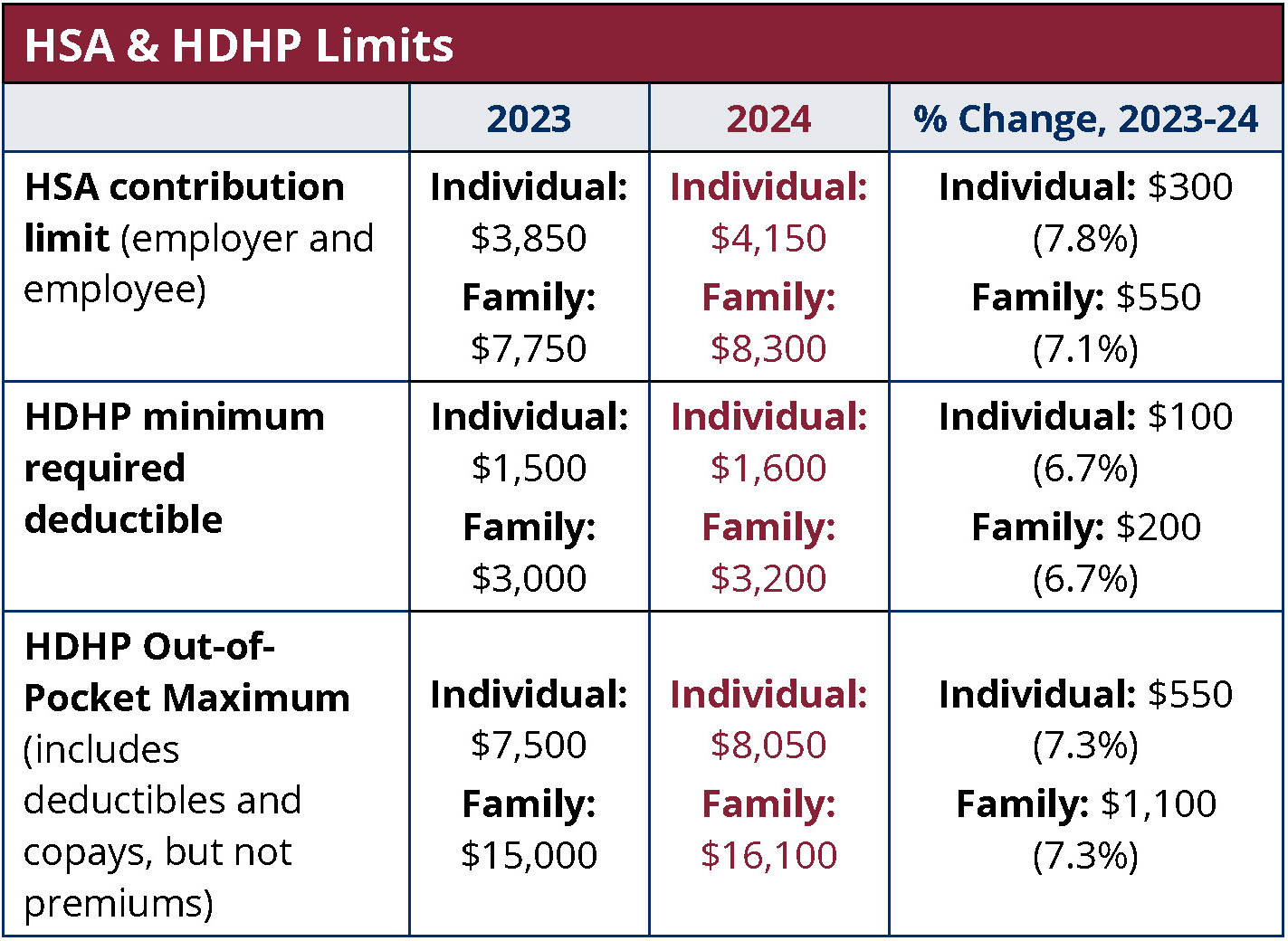

Using HSA funds to purchase a mattress can be a great way to improve your sleep and alleviate any medical issues you may be experiencing. However, it's important to keep in mind that there are limits to how much you can contribute to your HSA each year.

In 2021, the maximum contribution for an individual is $3,600 and for a family is $7,200. If you have already reached your contribution limit for the year, you will not be able to use HSA funds to purchase a mattress.

6. HSA mattress options

There are many options available when it comes to purchasing a mattress with HSA funds. Memory foam mattresses, adjustable beds, and specialized support mattresses are just a few examples.

When considering which mattress to purchase, it's important to keep in mind the recommendation from your doctor and what will best suit your specific medical needs.

7. Using HSA for mattress purchase

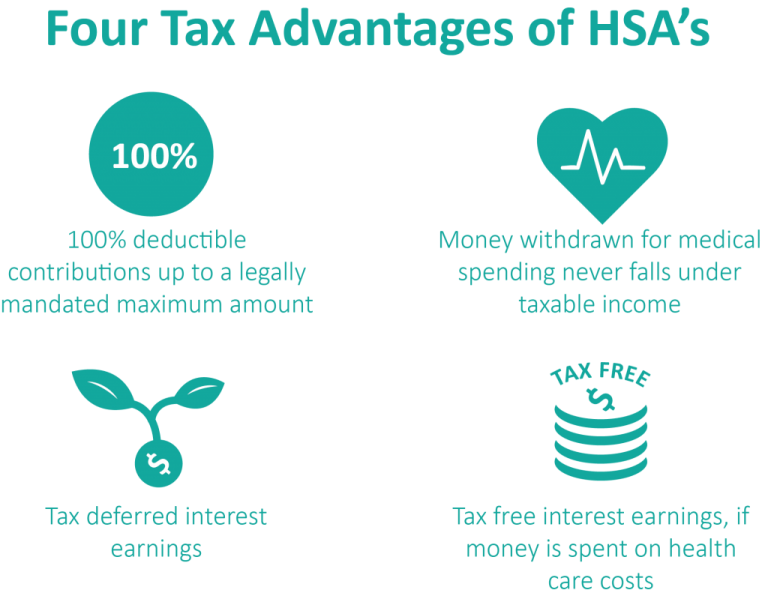

Using your HSA for a mattress purchase can be a smart financial decision. Not only will it improve your sleep and overall health, but it can also provide tax benefits.

Any money contributed to your HSA is tax-deductible and any withdrawals made for qualified medical expenses, including a mattress, are tax-free.

8. HSA and mattress expenses

It's important to keep track of your HSA expenses, including your mattress purchase, for tax purposes. Make sure to keep all receipts and documentation of your purchase in case you are audited by the IRS.

If you are unsure about your HSA expenses or how to properly claim them on your taxes, it's always best to consult a tax professional.

9. HSA mattress reimbursement

If you have purchased a mattress with HSA funds, you will need to submit a reimbursement request to your HSA provider in order to receive the funds back into your account. This process can take a few weeks, so it's important to plan ahead.

Make sure to keep all documentation and receipts of your purchase to ensure a smooth reimbursement process.

10. HSA and mattress tax deductions

In addition to the tax benefits of using HSA funds for a mattress purchase, you may also be able to claim a tax deduction for the mattress itself. This is because a medically necessary mattress can be considered a medical expense when filing your taxes.

However, it's important to note that you can only claim a tax deduction for medical expenses that exceed 7.5% of your adjusted gross income. So, if your mattress purchase falls below this threshold, you will not be able to claim it as a tax deduction.

In conclusion, while you can use your HSA to purchase a mattress, it's important to make sure it is deemed medically necessary by a doctor and to keep track of all documentation and receipts for tax purposes. With the right steps and considerations, using HSA funds to buy a mattress can be a smart and beneficial decision for your health and finances.

Finding the Perfect Mattress with your HSA

What is an HSA?

First, let's define what an HSA is. HSA stands for Health Savings Account, which is a type of savings account that allows individuals with a high-deductible health plan to save money for medical expenses. The funds in an HSA can be used for various healthcare costs, including purchasing a mattress.

First, let's define what an HSA is. HSA stands for Health Savings Account, which is a type of savings account that allows individuals with a high-deductible health plan to save money for medical expenses. The funds in an HSA can be used for various healthcare costs, including purchasing a mattress.

Is it Possible to Buy a Mattress with HSA?

The short answer is yes, you can use your HSA funds to buy a mattress. However, there are a few things to keep in mind. According to the IRS, mattresses are considered a "medical expense" if they are prescribed by a doctor to treat a specific condition. This means that you cannot use your HSA funds to buy a mattress for general comfort or sleep. The mattress must be deemed medically necessary by a healthcare professional.

The short answer is yes, you can use your HSA funds to buy a mattress. However, there are a few things to keep in mind. According to the IRS, mattresses are considered a "medical expense" if they are prescribed by a doctor to treat a specific condition. This means that you cannot use your HSA funds to buy a mattress for general comfort or sleep. The mattress must be deemed medically necessary by a healthcare professional.

How to Purchase a Mattress with your HSA

Now that you know it is possible to buy a mattress with your HSA, let's discuss how to do it. The first step is to consult with your doctor and obtain a written prescription for a mattress. This prescription should include the reason why a new mattress is necessary for your health. Keep in mind that your HSA provider may have specific requirements or forms that need to be filled out for this purchase, so be sure to check with them beforehand.

Once you have the necessary documentation, you can start shopping for a mattress. It is essential to keep track of your expenses and save all receipts. You will need to submit these to your HSA provider for reimbursement. It is also recommended to purchase the mattress from a retailer that accepts HSA payments to make the process smoother.

Now that you know it is possible to buy a mattress with your HSA, let's discuss how to do it. The first step is to consult with your doctor and obtain a written prescription for a mattress. This prescription should include the reason why a new mattress is necessary for your health. Keep in mind that your HSA provider may have specific requirements or forms that need to be filled out for this purchase, so be sure to check with them beforehand.

Once you have the necessary documentation, you can start shopping for a mattress. It is essential to keep track of your expenses and save all receipts. You will need to submit these to your HSA provider for reimbursement. It is also recommended to purchase the mattress from a retailer that accepts HSA payments to make the process smoother.

Benefits of Purchasing a Mattress with your HSA

Using your HSA to buy a mattress has several benefits. First, it allows you to use pre-tax dollars to make the purchase, which can save you money. Additionally, having a comfortable and supportive mattress can help improve your overall health and sleep quality, leading to better overall well-being.

In conclusion, it is possible to buy a mattress with your HSA if it is deemed medically necessary by a healthcare professional. Make sure to follow the proper steps and keep track of your expenses for a smooth and successful purchase. With the right mattress, you can improve your health and sleep while also utilizing your HSA funds wisely.

Using your HSA to buy a mattress has several benefits. First, it allows you to use pre-tax dollars to make the purchase, which can save you money. Additionally, having a comfortable and supportive mattress can help improve your overall health and sleep quality, leading to better overall well-being.

In conclusion, it is possible to buy a mattress with your HSA if it is deemed medically necessary by a healthcare professional. Make sure to follow the proper steps and keep track of your expenses for a smooth and successful purchase. With the right mattress, you can improve your health and sleep while also utilizing your HSA funds wisely.