Tax Deductions for Furniture: Can You Write Off a Kitchen Table?

As tax season rolls around, many people start thinking about potential deductions they can take to lower their tax bill. One common area that people look to for deductions is furniture, particularly large purchases like a kitchen table. But can you really write off a kitchen table on your taxes? Let's take a closer look.

How to Write Off Furniture on Your Taxes

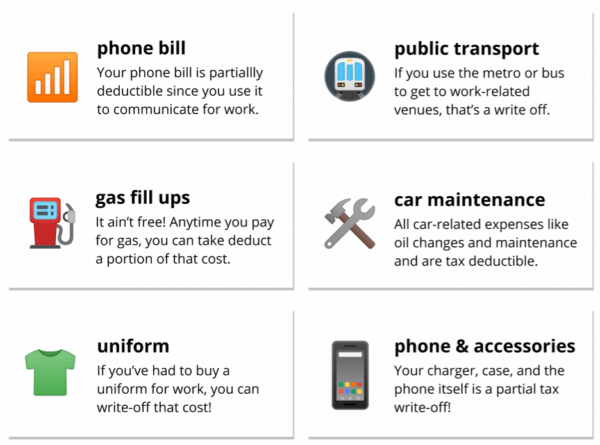

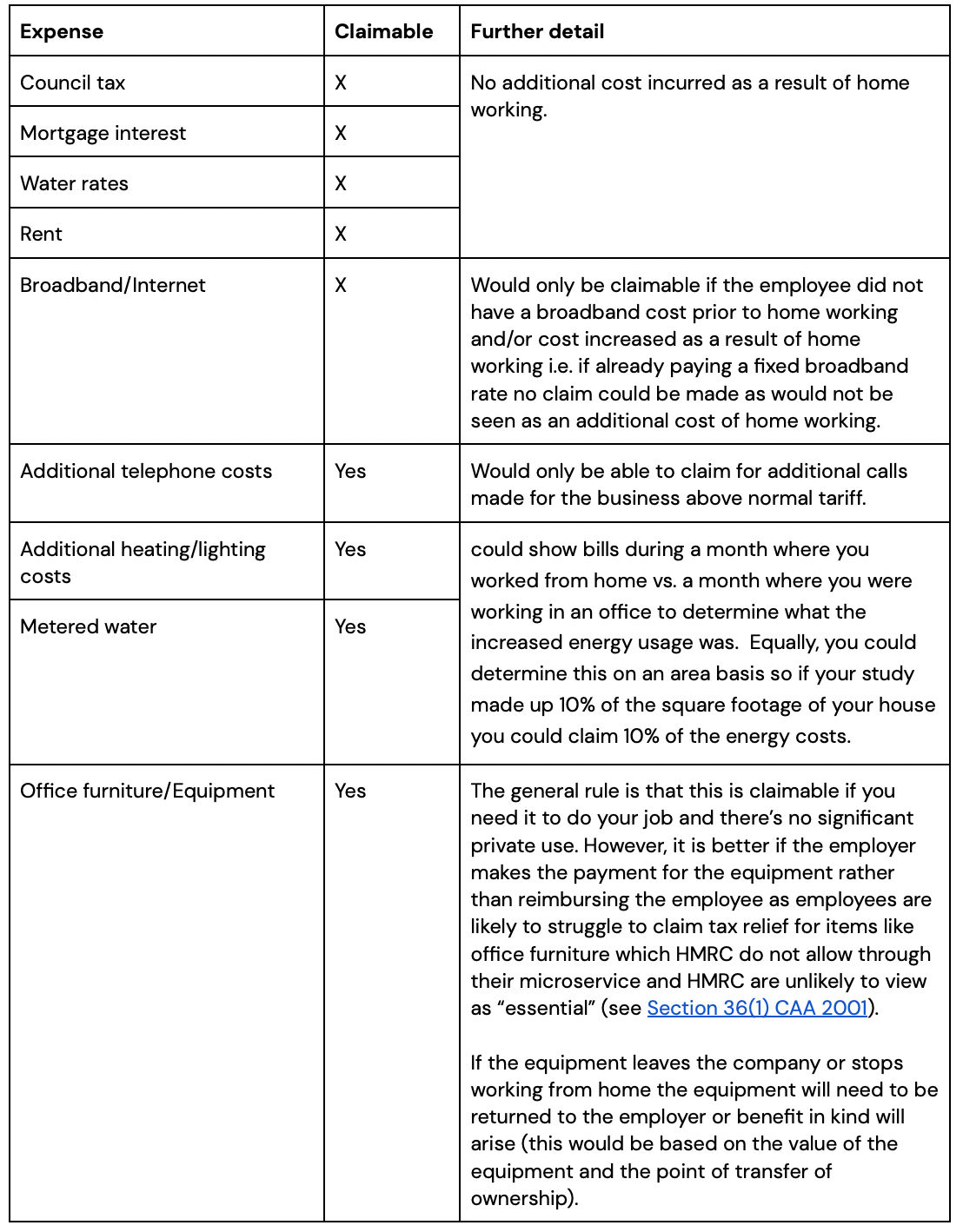

Before we dive into the specifics of writing off a kitchen table, let's first discuss how you can write off furniture on your taxes in general. In order to claim a deduction for furniture, it must be used for business purposes. This means it must be used in a home office or other business setting.

If you are self-employed or a freelancer, you can deduct the cost of furniture used in your home office as a business expense. However, if you are an employee working from home, you cannot deduct furniture as a business expense unless your employer specifically requires you to have a home office.

Can You Write Off Furniture on Your Taxes?

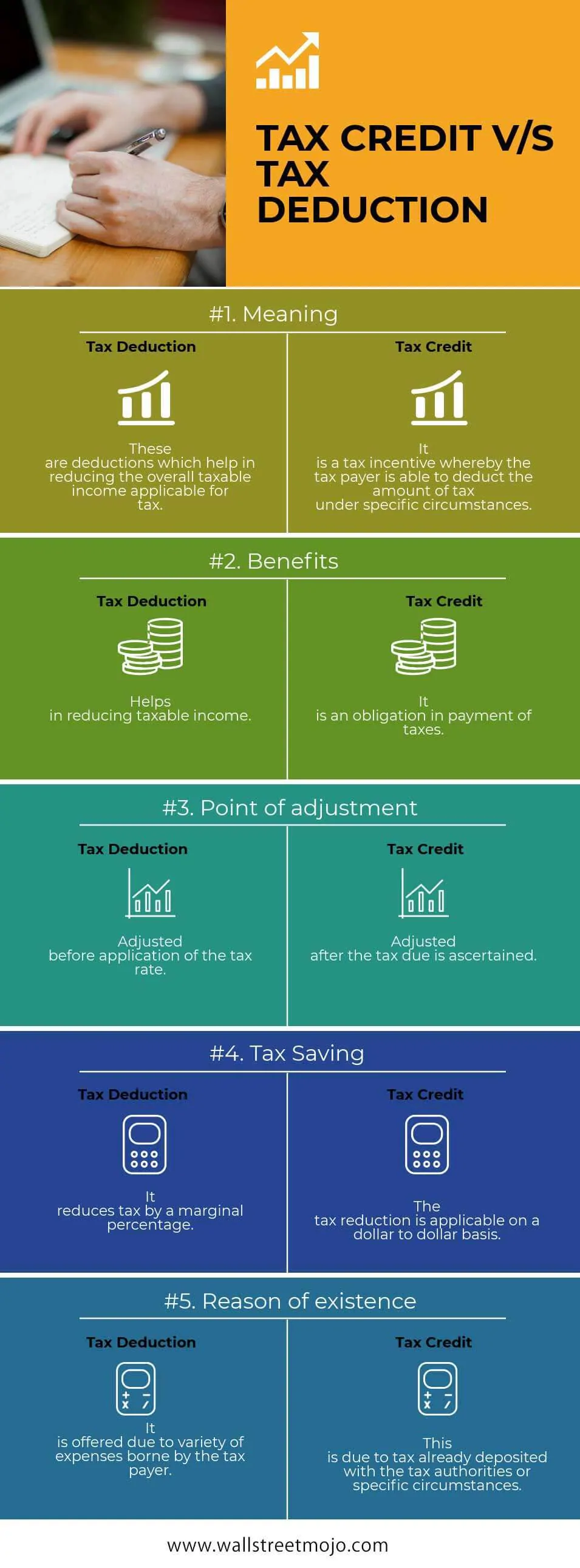

Now, let's get to the main question: can you write off a kitchen table on your taxes? The answer is yes, but with some limitations. As mentioned before, the furniture must be used for business purposes. This means that the kitchen table must be used in a home office or other business setting in order to be eligible for a deduction.

Additionally, the IRS has strict guidelines for what is considered a business expense. The furniture must be considered "ordinary and necessary" for your business. This means that it must be a common and accepted expense in your field of work, and it must also be essential for your business operations.

What Furniture Can You Write Off on Your Taxes?

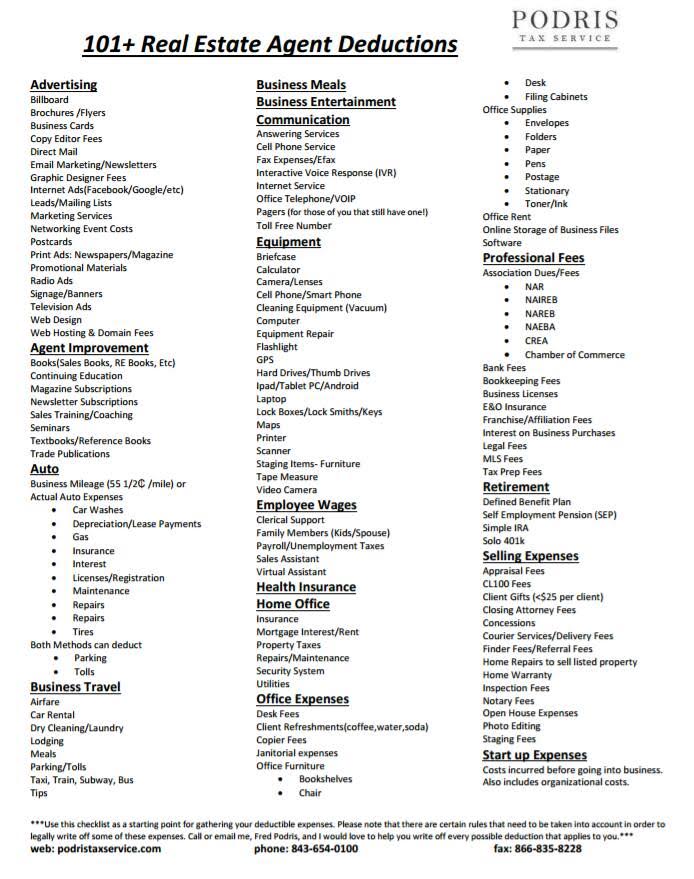

Now that we know the requirements for writing off furniture on your taxes, let's discuss what types of furniture are eligible for a deduction. The IRS allows for deductions on a wide range of furniture items, including desks, chairs, bookcases, and, yes, even kitchen tables.

When it comes to a kitchen table, it must be used for business purposes in order to be eligible for a deduction. This means that it must be used for meetings with clients, working on projects, or other business-related activities. If the table is used for personal meals or activities, it cannot be claimed as a deduction.

How to Claim a Tax Deduction for Furniture

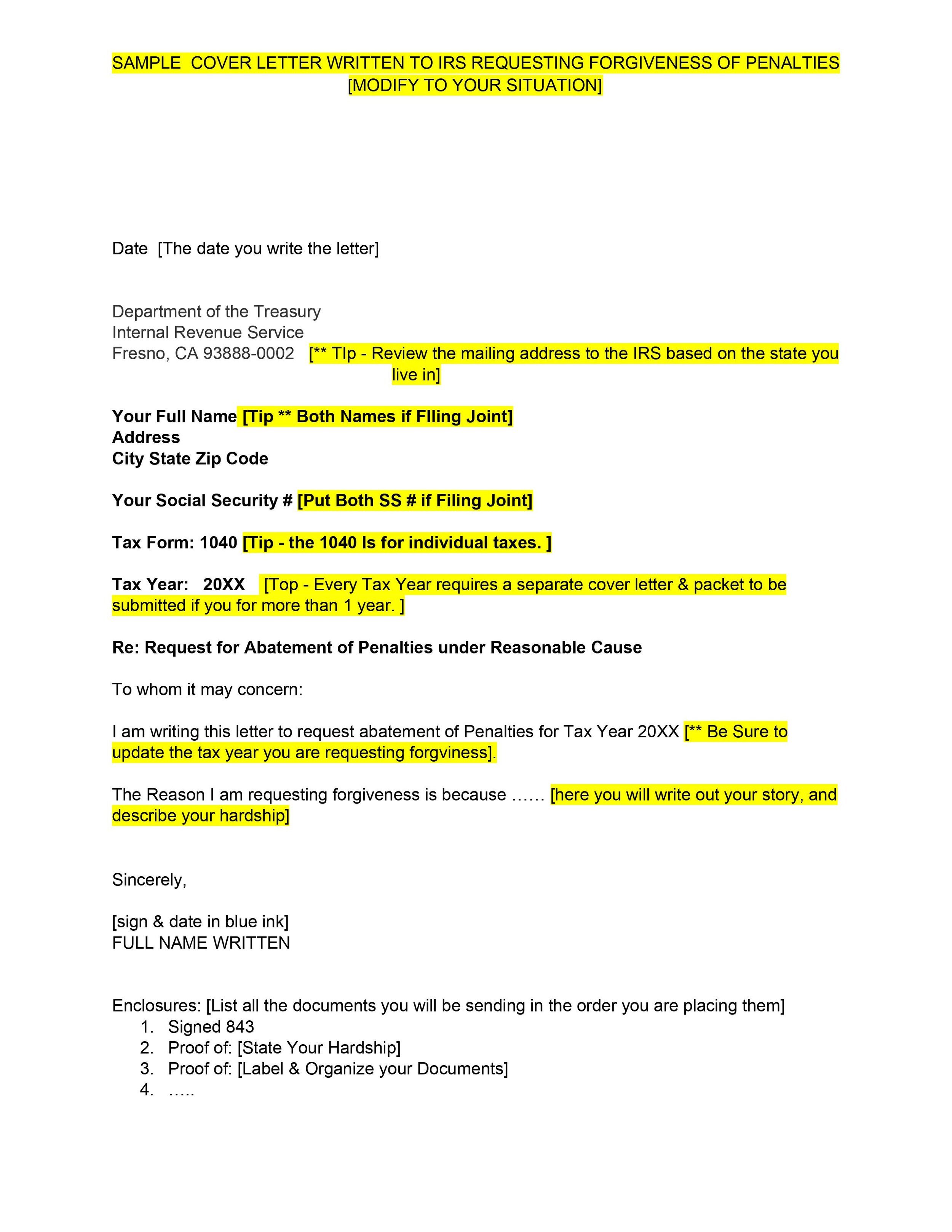

If you have determined that your kitchen table is eligible for a deduction, you may be wondering how to claim it on your taxes. The process is fairly straightforward. You will need to keep records of the purchase, such as a receipt or invoice, and then report the expense on your tax return using Form 8829, which is used for claiming home office deductions.

It's important to note that the amount you can deduct for furniture is based on the percentage of your home that is used for business purposes. For example, if your kitchen table is used in a home office that takes up 20% of your home's total square footage, you can deduct 20% of the cost of the table as a business expense.

Understanding Tax Deductions for Furniture

While it may seem tempting to deduct the full cost of a new kitchen table on your taxes, it's important to understand the rules and limitations of tax deductions for furniture. It's also important to keep detailed records and only deduct the portion of the furniture that is used for business purposes.

Additionally, it's always a good idea to consult with a tax professional or accountant to ensure that you are following all of the rules and regulations when it comes to claiming deductions on your taxes.

Maximizing Tax Deductions for Furniture Purchases

When it comes to purchasing furniture for your business, it's important to consider the tax implications. By understanding the rules for deducting furniture on your taxes, you can make smarter purchasing decisions and potentially lower your tax bill.

One way to maximize your deductions for furniture purchases is to plan ahead. If you know you will need to purchase new furniture for your home office, consider doing so at the end of the tax year. This will allow you to deduct the full cost of the furniture in the current year rather than having to wait until the following year.

The Ins and Outs of Writing Off Furniture on Your Taxes

As you can see, writing off furniture on your taxes is not as simple as just deducting the full cost of a kitchen table. There are rules and limitations that must be followed in order to claim a deduction, and it's important to keep detailed records and consult with a professional if needed.

While it may require a bit more effort and planning, taking advantage of tax deductions for furniture can be a great way to lower your tax bill and save some money in the long run.

What You Need to Know About Writing Off Furniture on Your Taxes

Now that you have a better understanding of tax deductions for furniture, let's recap the key points you need to know. In order to write off a kitchen table or any other furniture on your taxes, it must be used for business purposes and considered "ordinary and necessary" for your business.

You will also need to keep detailed records and report the expense on your tax return using Form 8829. And remember, the amount you can deduct will be based on the percentage of your home that is used for business purposes.

Claiming a Tax Deduction for Furniture: What You Need to Know

In conclusion, writing off furniture on your taxes is possible, but it's important to understand the rules and limitations. By keeping detailed records and following the guidelines set by the IRS, you can potentially lower your tax bill and save money on your furniture purchases.

If you are unsure about whether a specific piece of furniture is eligible for a deduction, it's always best to consult with a tax professional to ensure that you are following the proper procedures and maximizing your deductions.

Maximizing Your Tax Deductions: Can You Write Off a Kitchen Table?

Understanding Tax Write-Offs for Homeowners

As a homeowner, you may be wondering if you can write off certain home-related expenses on your taxes. While there are some deductions available for homeowners, it is important to understand the rules and limitations set by the Internal Revenue Service (IRS). One common question that arises is whether or not you can write off a kitchen table as a tax deduction. The short answer is yes, but it is not always straightforward.

As a homeowner, you may be wondering if you can write off certain home-related expenses on your taxes. While there are some deductions available for homeowners, it is important to understand the rules and limitations set by the Internal Revenue Service (IRS). One common question that arises is whether or not you can write off a kitchen table as a tax deduction. The short answer is yes, but it is not always straightforward.

Qualifying for Tax Deductions on Home Improvements

Before discussing the specifics of writing off a kitchen table, it is important to understand the general rules for tax deductions on home improvements. In order for a home improvement expense to be deductible, it must meet the following criteria:

Before discussing the specifics of writing off a kitchen table, it is important to understand the general rules for tax deductions on home improvements. In order for a home improvement expense to be deductible, it must meet the following criteria:

- The improvement must be considered a capital expense, meaning it adds value to your home and prolongs its useful life.

- The improvement must be made to your primary residence, not a secondary or vacation home.

- The improvement must be necessary for the upkeep, repair, or maintenance of your home.

Writing Off a Kitchen Table as a Home Office Expense

If you use a portion of your home exclusively for business purposes, you may be able to write off certain expenses related to that space. This is known as the home office deduction. In order to qualify for this deduction, the space must be used regularly and exclusively for business activities. This means that a kitchen table used for both personal and business purposes would not qualify.

If you use a portion of your home exclusively for business purposes, you may be able to write off certain expenses related to that space. This is known as the home office deduction. In order to qualify for this deduction, the space must be used regularly and exclusively for business activities. This means that a kitchen table used for both personal and business purposes would not qualify.

Claiming a Home Office Deduction for a Kitchen Table

If you do have a designated home office space and use a kitchen table as your desk, you may be able to write off a portion of the cost as a business expense. The percentage of the table's cost that you can deduct is based on the percentage of your home that is used for business purposes. So if your home office takes up 10% of your total home space, you can deduct 10% of the cost of the kitchen table.

If you do have a designated home office space and use a kitchen table as your desk, you may be able to write off a portion of the cost as a business expense. The percentage of the table's cost that you can deduct is based on the percentage of your home that is used for business purposes. So if your home office takes up 10% of your total home space, you can deduct 10% of the cost of the kitchen table.

Important Considerations

It is important to keep in mind that there are limits and restrictions on home office deductions. The total amount you can deduct for a home office is limited to your business income. Additionally, if you are an employee who also works from home, you must meet certain requirements in order to claim a home office deduction.

Conclusion:

While you can write off a kitchen table as a tax deduction, it is not always a straightforward process. It must meet certain criteria and may only be partially deductible depending on its use. It is always best to consult with a tax professional to ensure you are following the proper guidelines and maximizing your tax deductions as a homeowner.

It is important to keep in mind that there are limits and restrictions on home office deductions. The total amount you can deduct for a home office is limited to your business income. Additionally, if you are an employee who also works from home, you must meet certain requirements in order to claim a home office deduction.

Conclusion:

While you can write off a kitchen table as a tax deduction, it is not always a straightforward process. It must meet certain criteria and may only be partially deductible depending on its use. It is always best to consult with a tax professional to ensure you are following the proper guidelines and maximizing your tax deductions as a homeowner.