Can I Expense a Mattress?

Many people wonder if they can expense a mattress on their taxes. The short answer is yes, but it depends on certain factors. Let's dive into the details and find out if you can deduct a mattress on your taxes.

Can I Deduct a Mattress on My Taxes?

As mentioned before, you can deduct a mattress on your taxes, but it's not a straightforward process. The Internal Revenue Service (IRS) has specific rules and regulations regarding what can and cannot be claimed as a tax deduction. However, if you meet certain criteria, you may be able to write off a mattress on your taxes.

Are Mattresses Tax Deductible?

According to the IRS, you can only claim a mattress as a tax deduction if you use it for medical reasons or for business purposes. This means that if you purchase a new mattress for your personal use, you cannot deduct it on your taxes.

Can I Write Off a Mattress?

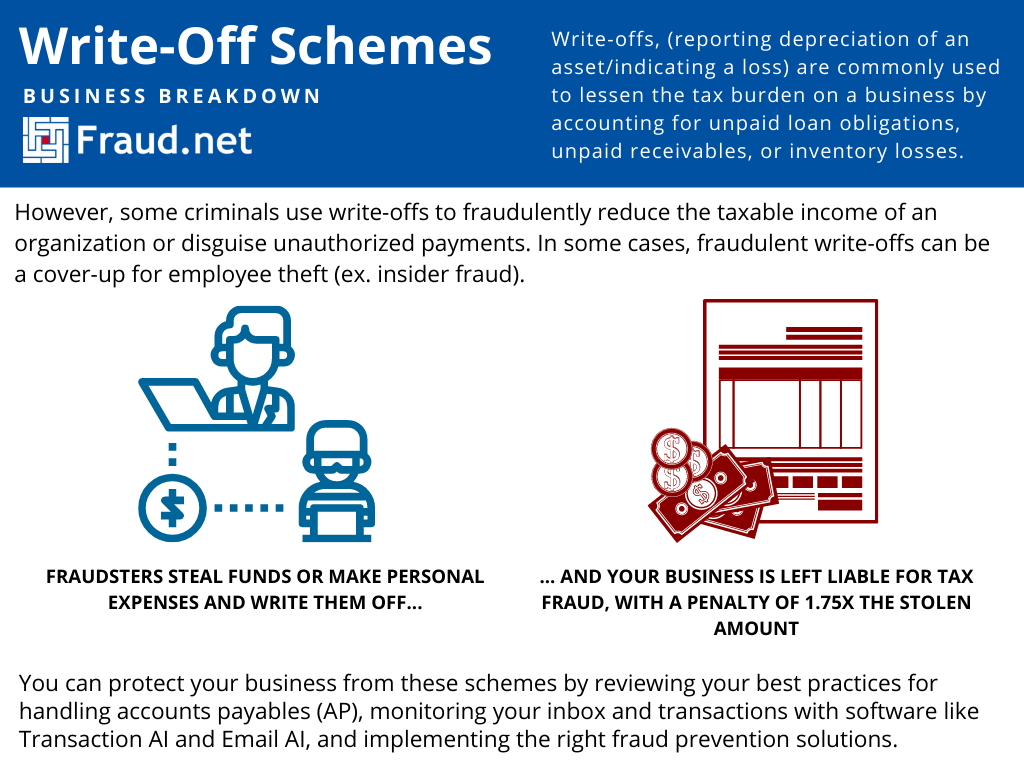

If you are self-employed or own a business, you may be able to write off a mattress as a business expense. To qualify for this deduction, the mattress must be used exclusively for business purposes. This means that it cannot be used for personal use, such as sleeping on it at night. It also must be considered a necessary expense for your business.

Expensing a Mattress for Business

If you are self-employed or own a business, you may be able to expense a mattress on your taxes. This means that you can deduct the full cost of the mattress as a business expense in the year that you purchase it. However, you must meet certain criteria to qualify for this deduction.

The mattress must be considered a necessary expense for your business. For example, if you own a bed and breakfast, you can expense the cost of a new mattress for one of your guest rooms. Or if you are a massage therapist and need a new mattress for your clients, you can write off the expense.

It's important to keep detailed records and receipts to support your claim for expensing a mattress for business purposes. The IRS may request proof of the expense if you are audited.

Can I Claim a Mattress on My Taxes?

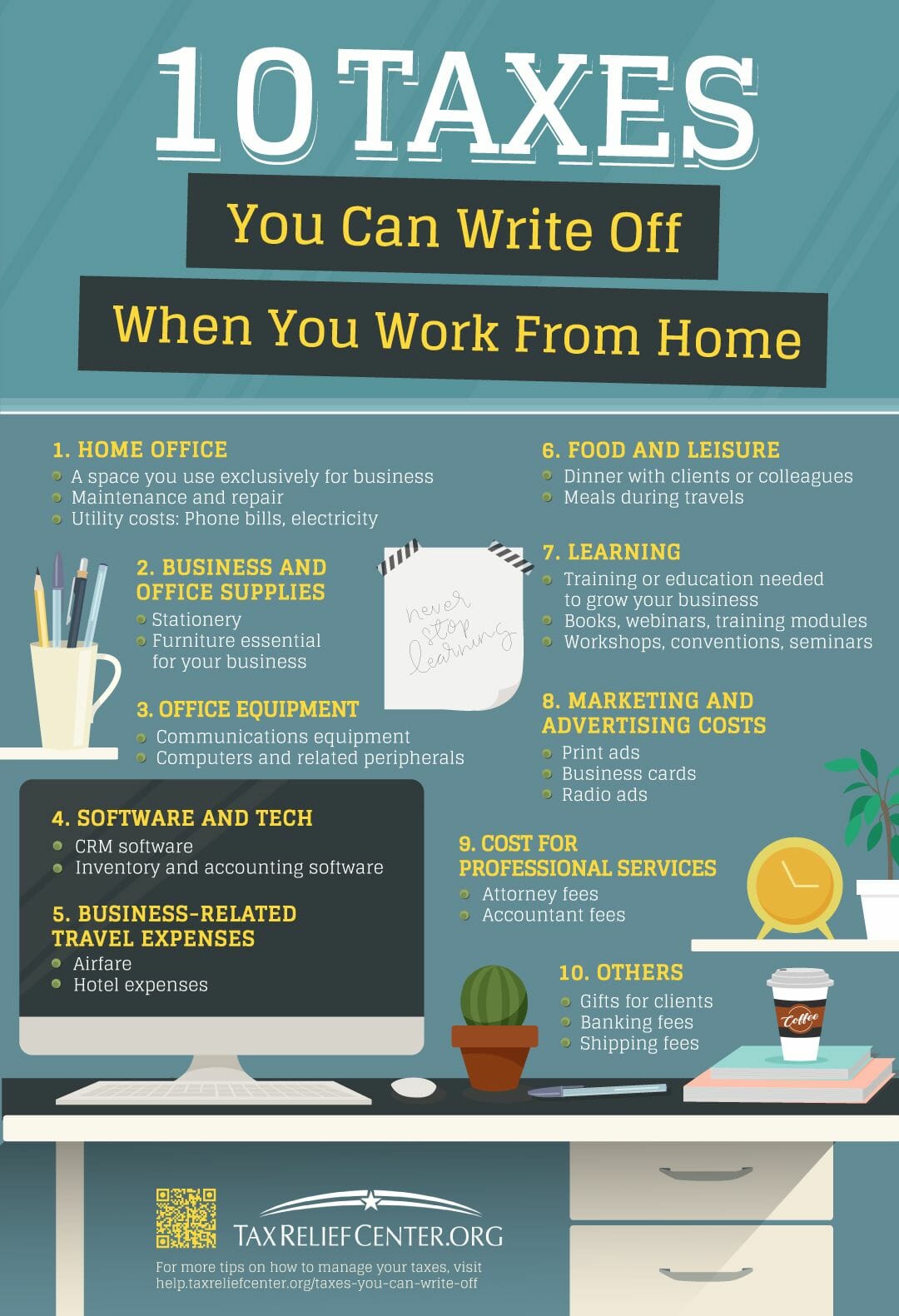

If you are an employee who works from home, you may be able to claim a mattress on your taxes as a home office expense. However, you must meet certain criteria to qualify for this deduction.

The mattress must be used exclusively for work purposes and must be considered a necessary expense for your job. Additionally, your home office must be your primary place of business and you must use it regularly and exclusively for work.

It's important to note that if you are an employee, you cannot claim a mattress as a home office expense if your employer provides you with a bed to use for work purposes.

Deducting a Mattress for Medical Reasons

If you have a medical condition that requires a specific type of mattress, you may be able to deduct the cost of the mattress on your taxes. However, there are limitations to this deduction.

The mattress must be prescribed by a doctor as a necessary treatment for your medical condition. Additionally, the cost of the mattress must exceed 7.5% of your adjusted gross income for the year in which you are claiming the deduction. This means that if your adjusted gross income is $50,000, the cost of the mattress must be at least $3,750 to qualify for the deduction.

It's important to keep detailed records and a prescription from your doctor to support your claim for deducting a mattress for medical reasons. The IRS may request this evidence if you are audited.

Expensing a Mattress for Work from Home

With the rise of remote work, many people are wondering if they can expense a mattress on their taxes for working from home. As mentioned before, you can only claim a mattress as a home office expense if you are self-employed or own a business.

If you are an employee who works from home, you cannot claim a mattress as a home office expense. However, you may be able to negotiate with your employer to provide you with a bed or mattress for work purposes. In this case, the cost of the mattress would be considered a business expense for your employer, not for you.

Tax Benefits of Purchasing a Mattress

Although you may not be able to expense or deduct a mattress on your taxes, there are still some tax benefits to purchasing a new mattress. Some states offer tax-free weekends where certain items, including mattresses, can be purchased without sales tax.

Additionally, if you finance your mattress, the interest you pay on the loan may be tax deductible if you itemize your deductions on your tax return. However, this would only apply if the mattress is used for business or medical purposes.

Can I Get Reimbursed for a Mattress?

If you are an employee and your employer requires you to purchase a specific type of mattress for work purposes, you may be able to get reimbursed for the expense. However, this would need to be agreed upon beforehand with your employer and it would not be considered a tax deduction for you.

It's important to keep detailed records and receipts to support your claim for reimbursement from your employer. The IRS may request this evidence if you are audited.

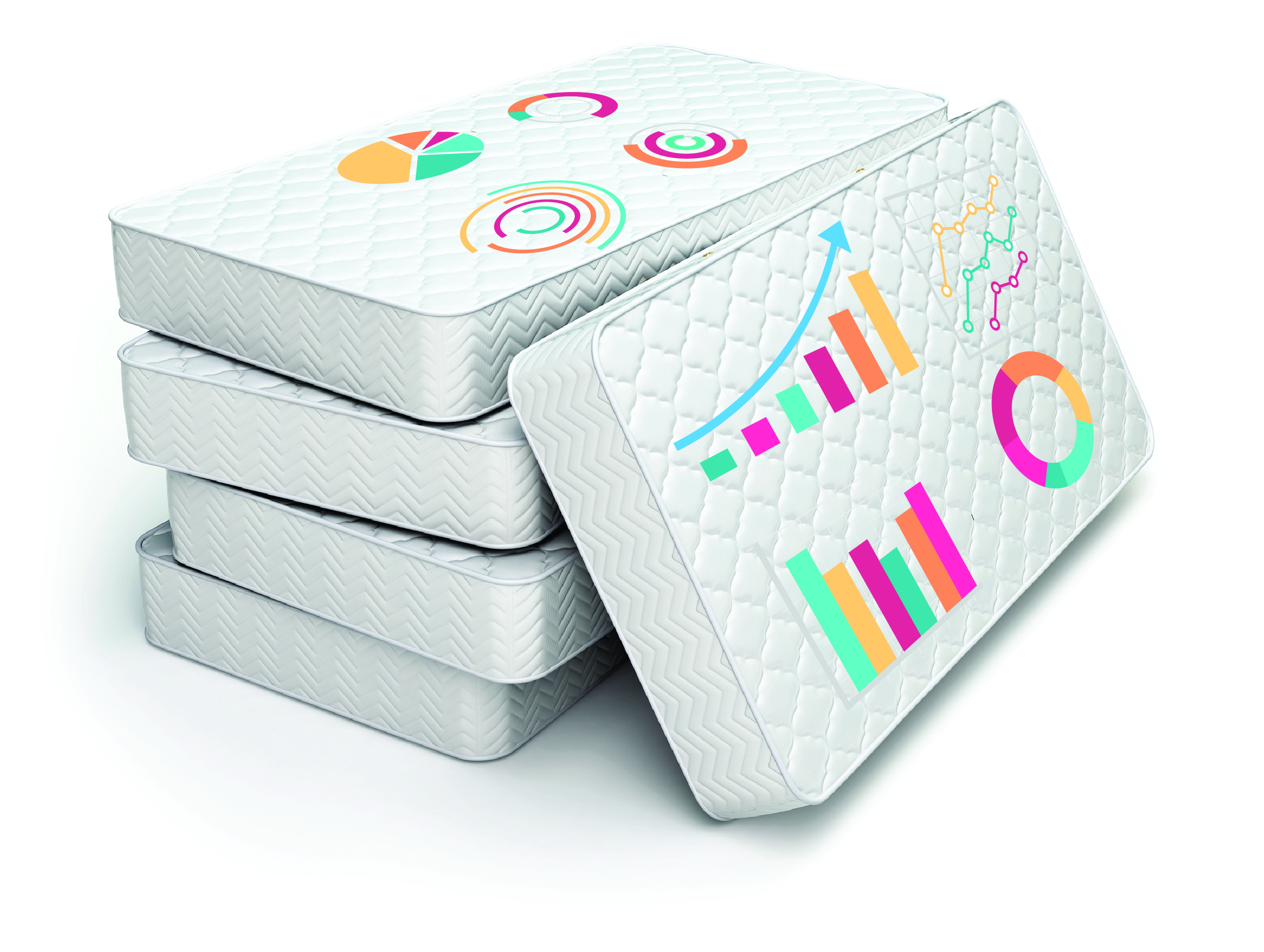

Can I Expense a Mattress for My House Design?

Understanding the Importance of a Good Mattress in House Design

When designing a house, most people tend to focus on the big-ticket items such as furniture, appliances, and decor. However, one important aspect that is often overlooked is the

mattress

. A good mattress is essential for a comfortable and well-designed living space, yet many people hesitate to invest in one due to the expense. This begs the question, can a mattress be expensed in house design?

When designing a house, most people tend to focus on the big-ticket items such as furniture, appliances, and decor. However, one important aspect that is often overlooked is the

mattress

. A good mattress is essential for a comfortable and well-designed living space, yet many people hesitate to invest in one due to the expense. This begs the question, can a mattress be expensed in house design?

Expensing a Mattress: The Basics

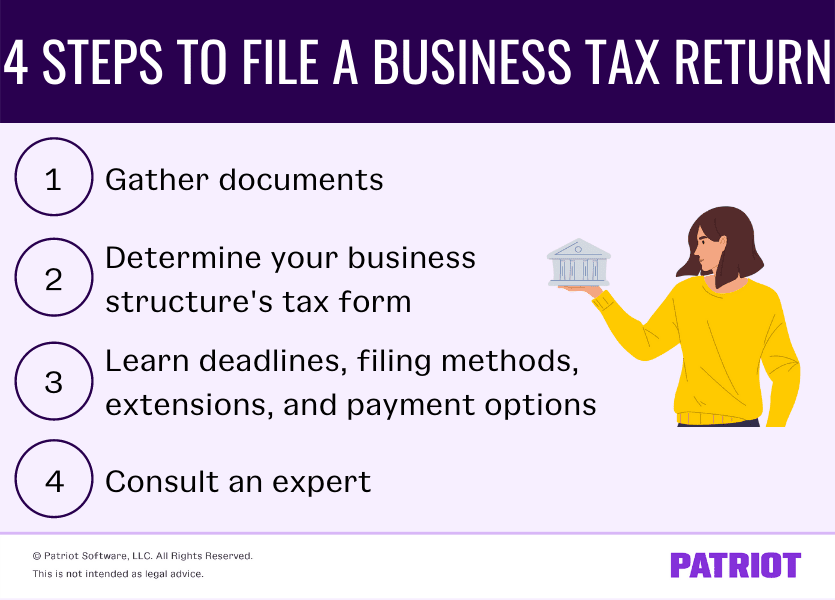

Before we dive into whether or not you can expense a mattress in your house design, it's important to understand what exactly is meant by "expensing". In simple terms, expensing refers to the process of deducting the cost of an item from your taxes. This is often done by businesses for items used for business purposes, but can also be applicable to certain expenses in personal finances.

Before we dive into whether or not you can expense a mattress in your house design, it's important to understand what exactly is meant by "expensing". In simple terms, expensing refers to the process of deducting the cost of an item from your taxes. This is often done by businesses for items used for business purposes, but can also be applicable to certain expenses in personal finances.

The IRS and Deductible Expenses

The Internal Revenue Service (IRS) allows individuals to deduct certain expenses from their taxes, including those related to home improvement and maintenance. However, when it comes to mattresses, the rules become a bit more complex. According to the IRS, in order for a mattress to be considered a deductible expense, it must be deemed a medical necessity. This means that if you have a medical condition that requires a specific type of mattress for treatment, you may be able to expense it.

The Internal Revenue Service (IRS) allows individuals to deduct certain expenses from their taxes, including those related to home improvement and maintenance. However, when it comes to mattresses, the rules become a bit more complex. According to the IRS, in order for a mattress to be considered a deductible expense, it must be deemed a medical necessity. This means that if you have a medical condition that requires a specific type of mattress for treatment, you may be able to expense it.

Using a Mattress for Business Purposes

If you work from home or run a business from your house, you may be able to expense a mattress under certain circumstances. For example, if you use your bed as a workspace or regularly have clients or employees staying overnight, you may be able to deduct the cost of a mattress as a business expense. However, it's important to keep detailed records and consult with a tax professional to ensure you are following the proper guidelines.

If you work from home or run a business from your house, you may be able to expense a mattress under certain circumstances. For example, if you use your bed as a workspace or regularly have clients or employees staying overnight, you may be able to deduct the cost of a mattress as a business expense. However, it's important to keep detailed records and consult with a tax professional to ensure you are following the proper guidelines.

The Bottom Line

So, can you expense a mattress for your house design? The answer is, it depends. If you have a medical necessity or use your mattress for business purposes, you may be able to deduct the cost from your taxes. However, if you are simply looking to upgrade your mattress for aesthetic or comfort reasons, it is unlikely that it will be considered a deductible expense. As with any tax-related matter, it's always best to consult with a professional for personalized advice.

So, can you expense a mattress for your house design? The answer is, it depends. If you have a medical necessity or use your mattress for business purposes, you may be able to deduct the cost from your taxes. However, if you are simply looking to upgrade your mattress for aesthetic or comfort reasons, it is unlikely that it will be considered a deductible expense. As with any tax-related matter, it's always best to consult with a professional for personalized advice.

In conclusion, a mattress may not be the first thing that comes to mind when designing a house, but it is certainly an important element to consider. While it may not always be possible to expense a mattress in your house design, it is worth exploring if you have a valid reason. After all, a good night's sleep is essential for a happy and healthy home.