If you or a loved one suffers from bedsores or other skin conditions, a doctor may recommend an air loss mattress. These specialized mattresses are designed to distribute weight evenly and reduce pressure on certain areas of the body. However, the cost of these mattresses can be expensive, making it difficult for many seniors to afford. Fortunately, Medicare may provide coverage for air loss mattresses to those who qualify. Here's what you need to know about Medicare coverage for air loss mattresses.Medicare Coverage for Air Loss Mattresses

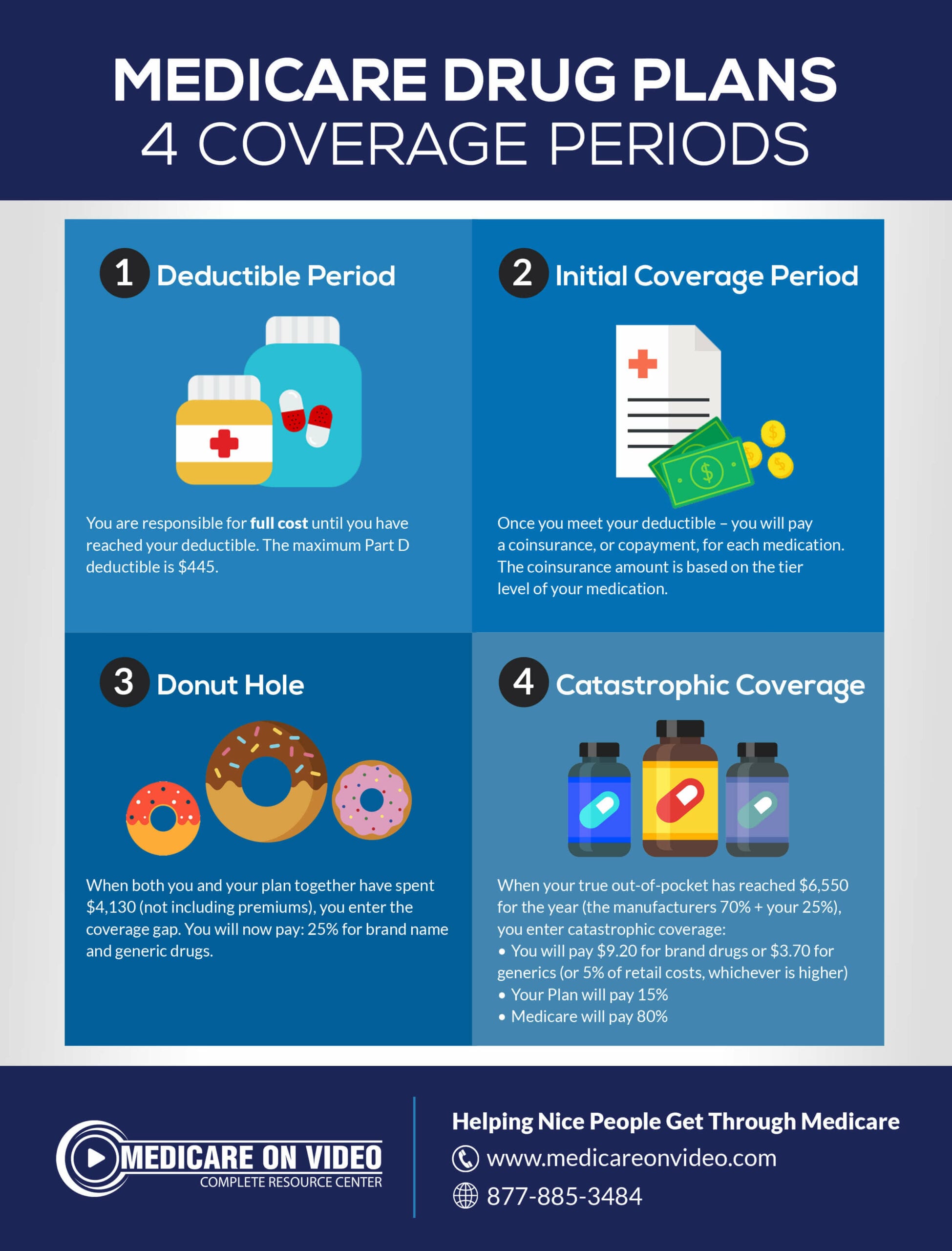

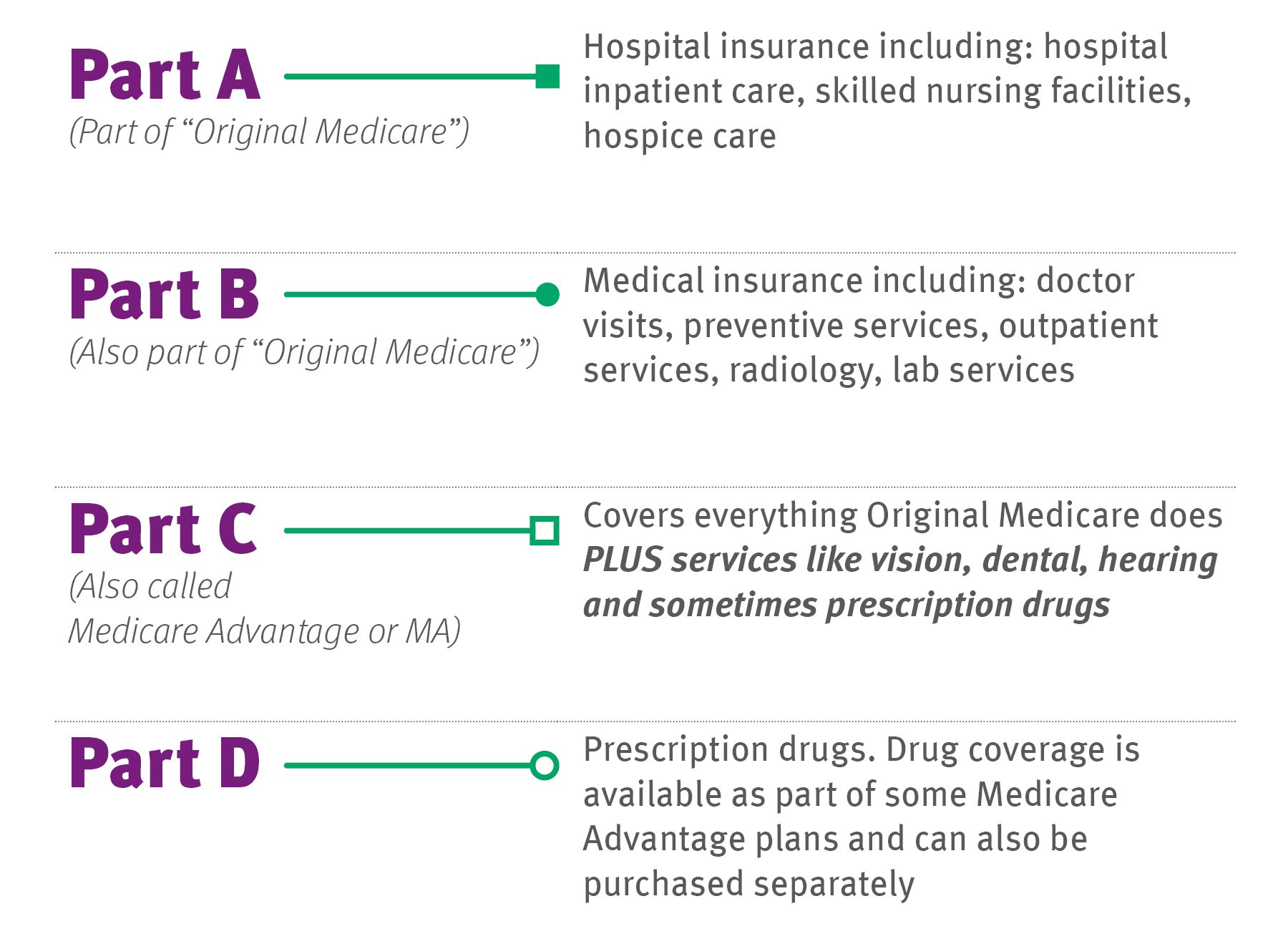

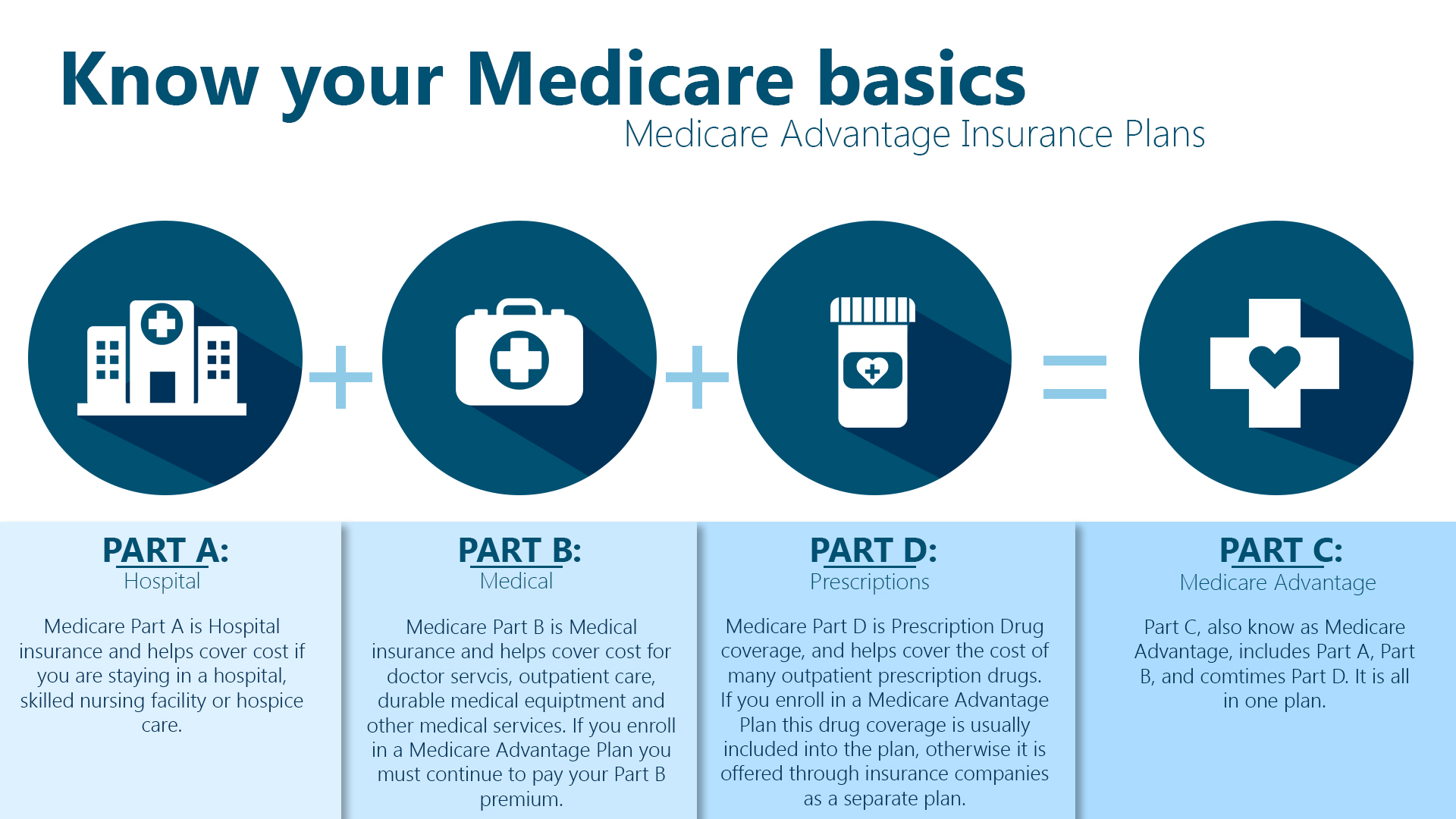

Medicare Part B may cover the cost of an air loss mattress if it is deemed medically necessary by a doctor. This means that the mattress must be prescribed to treat a specific medical condition, such as bedsores, skin ulcers, or other pressure-related injuries. In order for Medicare to provide coverage, the mattress must also be purchased from a Medicare-approved supplier.Air Loss Mattresses and Medicare Coverage

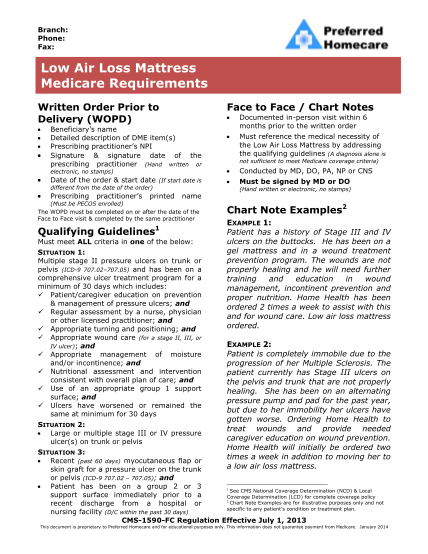

Before Medicare will agree to cover the cost of an air loss mattress, the supplier must submit a detailed written order from a doctor. This order must include the patient's diagnosis, the medical need for an air loss mattress, and the specific features required for the mattress. It is important to note that Medicare will only cover the cost of the most basic air loss mattress, so any additional features or upgrades may not be covered.Understanding Medicare Coverage for Air Loss Mattresses

If you believe you or a loved one may qualify for Medicare coverage for an air loss mattress, the first step is to talk to your doctor. They will need to provide a written order and documentation supporting the medical necessity of the mattress. Once this is submitted to Medicare, they will review the request and determine if coverage will be provided. It is important to note that Medicare coverage for air loss mattresses is not guaranteed, and it may take some time for the request to be processed.How to Get an Air Loss Mattress Covered by Medicare

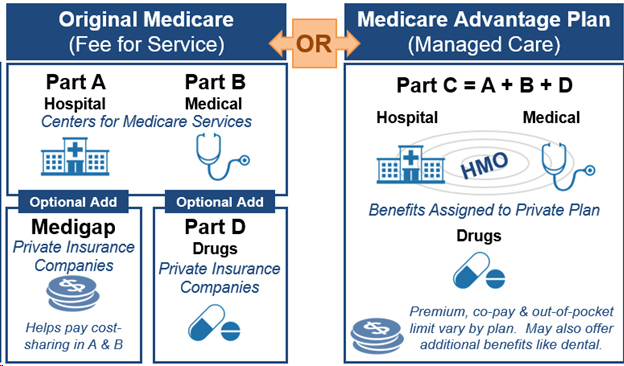

If Medicare approves coverage for an air loss mattress, they will typically cover 80% of the Medicare-approved amount. This means that you will still be responsible for the remaining 20% plus any deductibles or coinsurance. However, if you have a Medigap policy, it may cover some or all of these costs. It is important to check with your specific policy to understand your coverage.Air Loss Mattresses and Medicare Reimbursement

In order for an air loss mattress to be covered by Medicare, it must meet certain guidelines. These guidelines include being durable, reusable, and capable of being cleaned and disinfected. The mattress must also be used in the patient's home, rather than a hospital or skilled nursing facility. If the mattress does not meet these guidelines, it may not be covered by Medicare.Medicare Guidelines for Air Loss Mattresses

If you are approved for Medicare coverage for an air loss mattress, the supplier will handle all billing directly with Medicare. You should not be required to pay upfront for the mattress. If you are, this may be a red flag and you should speak to Medicare immediately. If Medicare denies coverage, you have the right to appeal the decision.Air Loss Mattresses and Medicare Billing

In order to qualify for Medicare coverage for an air loss mattress, you must be enrolled in Medicare Part B. You must also have a medical need for the mattress and have a written order from a doctor. The mattress must be purchased from a Medicare-approved supplier, and it must meet Medicare's guidelines for coverage. If you meet these requirements, you may be eligible for Medicare coverage for an air loss mattress.Qualifying for Medicare Coverage for Air Loss Mattresses

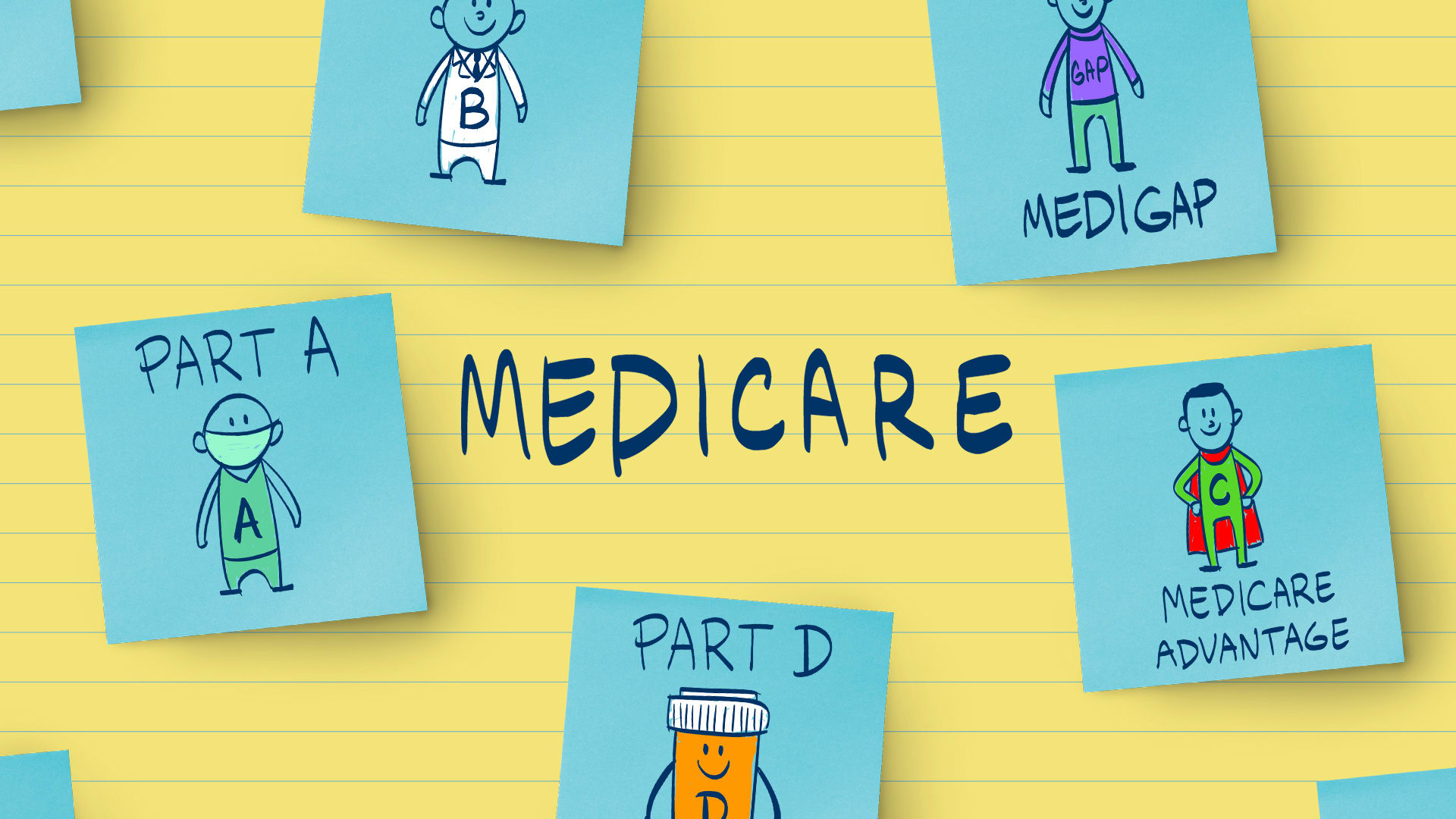

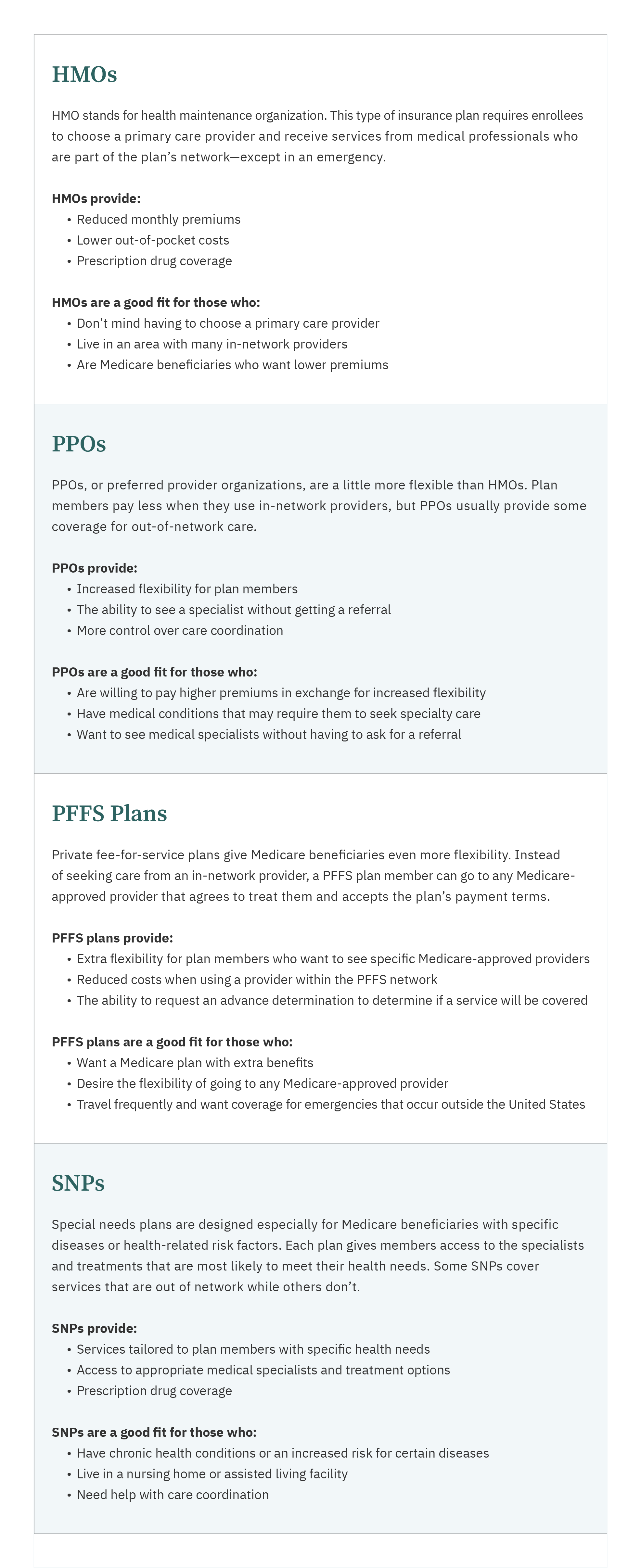

Medicare Advantage plans, also known as Medicare Part C, are offered by private insurance companies and may provide additional coverage for air loss mattresses. These plans must provide at least the same coverage as original Medicare, but they may also offer additional benefits such as coverage for prescription drugs, dental, and vision care. If you have a Medicare Advantage plan, it is important to check with your specific plan to see if air loss mattresses are covered.Air Loss Mattresses and Medicare Advantage Plans

Medicare Part B, also known as medical insurance, may cover the cost of an air loss mattress if it is deemed medically necessary. This can be a huge relief for those who suffer from pressure-related injuries and need the support of an air loss mattress. If you believe you or a loved one may qualify for Medicare coverage for an air loss mattress, speak to your doctor and Medicare to see if you are eligible for this valuable benefit.Air Loss Mattresses and Medicare Part B Coverage

The Importance of Choosing the Right Air Loss Mattress for Medicare Patients

Understanding the Medical Necessity for an Air Loss Mattress

When it comes to caring for Medicare patients, it is important to consider every aspect of their health and well-being. This includes their comfort and safety, especially when it comes to their sleep. For those who are bedridden or have limited mobility, an air loss mattress can provide numerous benefits. This specialized type of mattress is designed to help prevent pressure ulcers, also known as bedsores, which can be a serious and painful condition for those who are confined to a bed. As a result, many Medicare patients may be eligible to receive coverage for an air loss mattress through their insurance plan.

When it comes to caring for Medicare patients, it is important to consider every aspect of their health and well-being. This includes their comfort and safety, especially when it comes to their sleep. For those who are bedridden or have limited mobility, an air loss mattress can provide numerous benefits. This specialized type of mattress is designed to help prevent pressure ulcers, also known as bedsores, which can be a serious and painful condition for those who are confined to a bed. As a result, many Medicare patients may be eligible to receive coverage for an air loss mattress through their insurance plan.

What is an Air Loss Mattress?

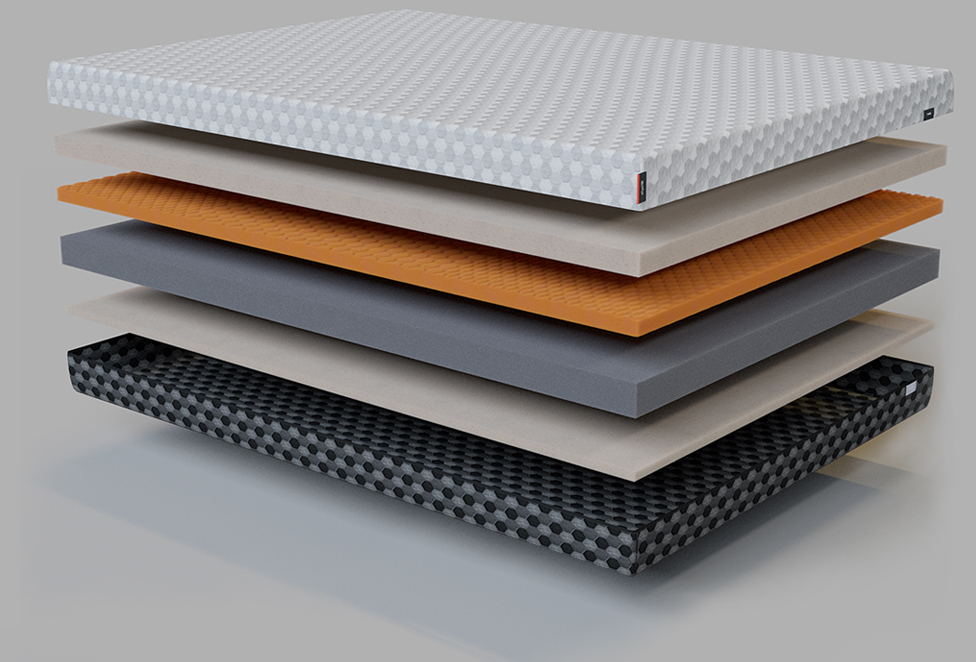

An air loss mattress is a medical device that is specifically designed to help alleviate pressure on the body, particularly in areas that are prone to developing bedsores. It is made up of multiple air chambers that can be adjusted to provide customized support and pressure relief. The air chambers are controlled by a pump, which can be programmed to alternate the pressure in different chambers, redistributing the weight of the body and reducing the risk of pressure ulcers.

An air loss mattress is a medical device that is specifically designed to help alleviate pressure on the body, particularly in areas that are prone to developing bedsores. It is made up of multiple air chambers that can be adjusted to provide customized support and pressure relief. The air chambers are controlled by a pump, which can be programmed to alternate the pressure in different chambers, redistributing the weight of the body and reducing the risk of pressure ulcers.

The Benefits of an Air Loss Mattress for Medicare Patients

For Medicare patients, an air loss mattress can offer several advantages. Not only does it help prevent and manage pressure ulcers, but it can also improve circulation and provide a more comfortable and restful sleep. Additionally, an air loss mattress can be beneficial for those who have respiratory issues, as it can help reduce the amount of pressure on the lungs and improve breathing. This can be especially helpful for patients with conditions such as COPD or asthma.

For Medicare patients, an air loss mattress can offer several advantages. Not only does it help prevent and manage pressure ulcers, but it can also improve circulation and provide a more comfortable and restful sleep. Additionally, an air loss mattress can be beneficial for those who have respiratory issues, as it can help reduce the amount of pressure on the lungs and improve breathing. This can be especially helpful for patients with conditions such as COPD or asthma.

Choosing the Right Air Loss Mattress for Medicare Coverage

When it comes to choosing an air loss mattress for a Medicare patient, it is important to consider the specific needs and requirements of the individual. This includes factors such as weight, mobility, and medical conditions. It is also important to ensure that the mattress meets the criteria for Medicare coverage, as not all air loss mattresses may be eligible. Working with a healthcare professional or durable medical equipment supplier can help ensure that the right air loss mattress is selected for the patient's needs and that the necessary paperwork is completed for Medicare coverage.

When it comes to choosing an air loss mattress for a Medicare patient, it is important to consider the specific needs and requirements of the individual. This includes factors such as weight, mobility, and medical conditions. It is also important to ensure that the mattress meets the criteria for Medicare coverage, as not all air loss mattresses may be eligible. Working with a healthcare professional or durable medical equipment supplier can help ensure that the right air loss mattress is selected for the patient's needs and that the necessary paperwork is completed for Medicare coverage.

In Conclusion , for Medicare patients who are confined to a bed, an air loss mattress can be a vital tool in preserving their health and comfort. By understanding the medical necessity for this specialized mattress and choosing the right one for each individual, healthcare providers can help improve the overall well-being of their patients. With Medicare coverage potentially available for these mattresses, it is important to explore this option and provide the best possible care for those in need.