If you're in the market for a new mattress, look no further than 1800mattress.com. With a wide selection of top-quality mattresses at affordable prices, you're sure to find the perfect mattress for your needs. Plus, with their ongoing mattress sales and promotions, you can save even more on your purchase. But before you start shopping, don't forget to factor in sales tax. In this article, we'll take a closer look at the top 10 MAIN_1800 mattress sales tax, so you can make an informed decision on your purchase.1. 1800mattress.com

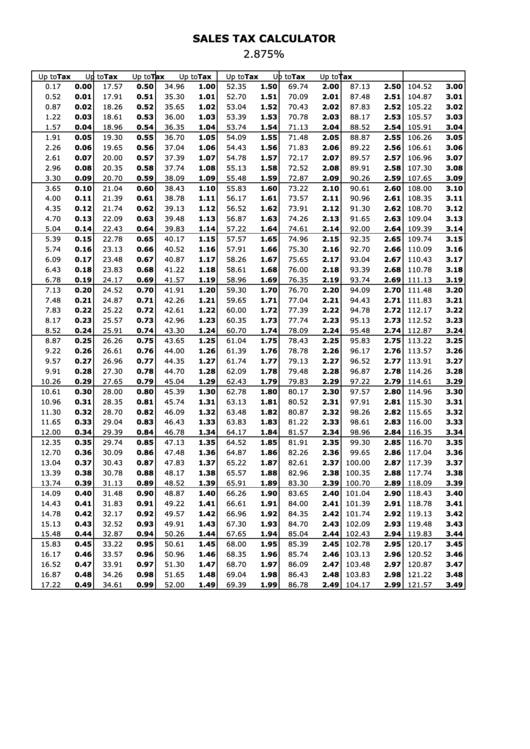

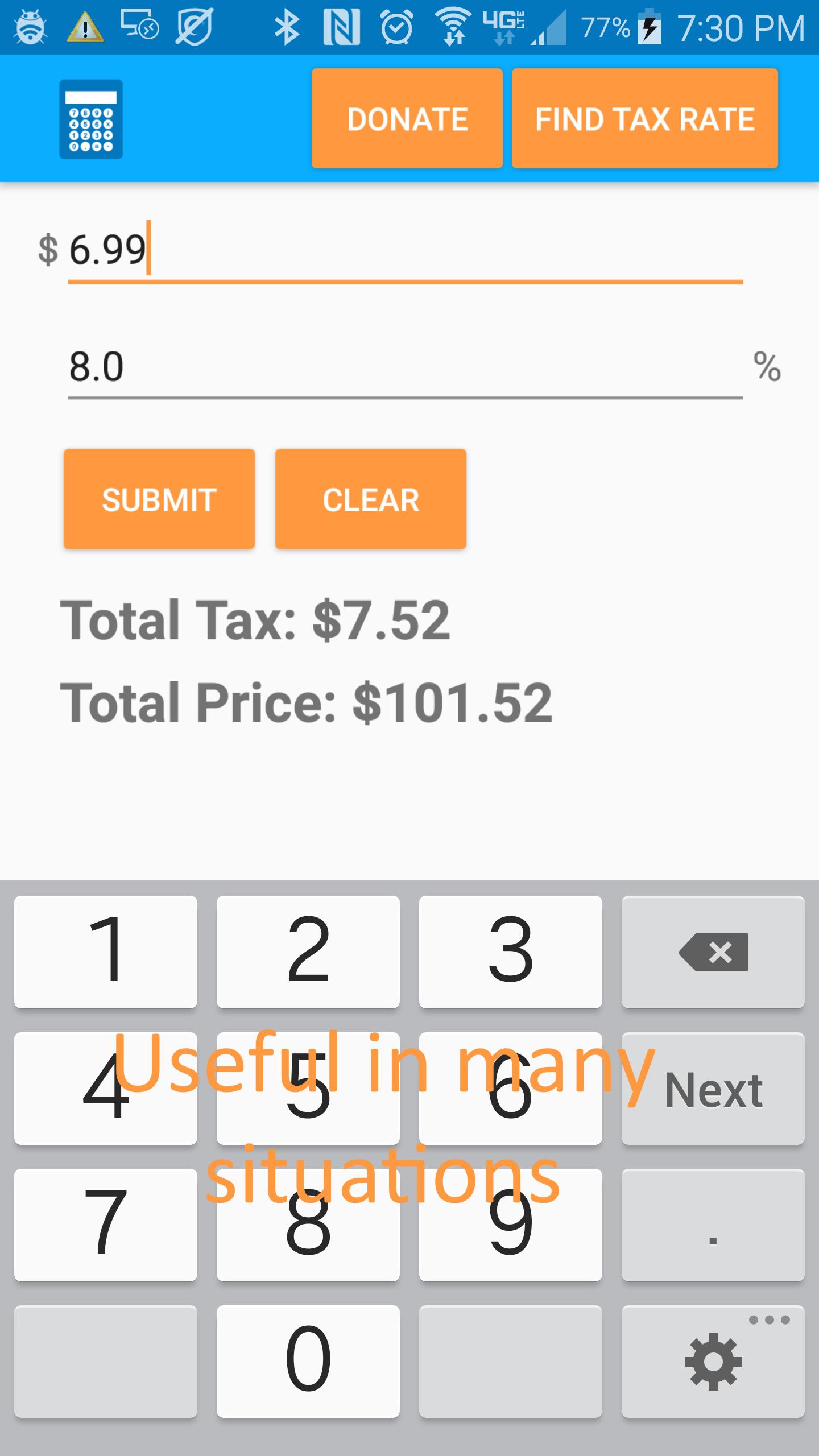

Before you make a purchase, it's important to know the exact amount of sales tax you'll be charged. This is where a sales tax calculator comes in handy. Simply input the price of the mattress and your location, and the calculator will give you an accurate estimate of how much sales tax you'll be paying. This is especially helpful for those who are shopping online at 1800mattress.com and may not be familiar with the sales tax rates in their area.2. Sales Tax Calculator

Another popular mattress retailer, Mattress Firm, also offers a wide selection of mattresses at competitive prices. However, it's important to note that sales tax may vary depending on the location of the store. Be sure to check the sales tax rates in your area before making a purchase at Mattress Firm.3. Mattress Firm

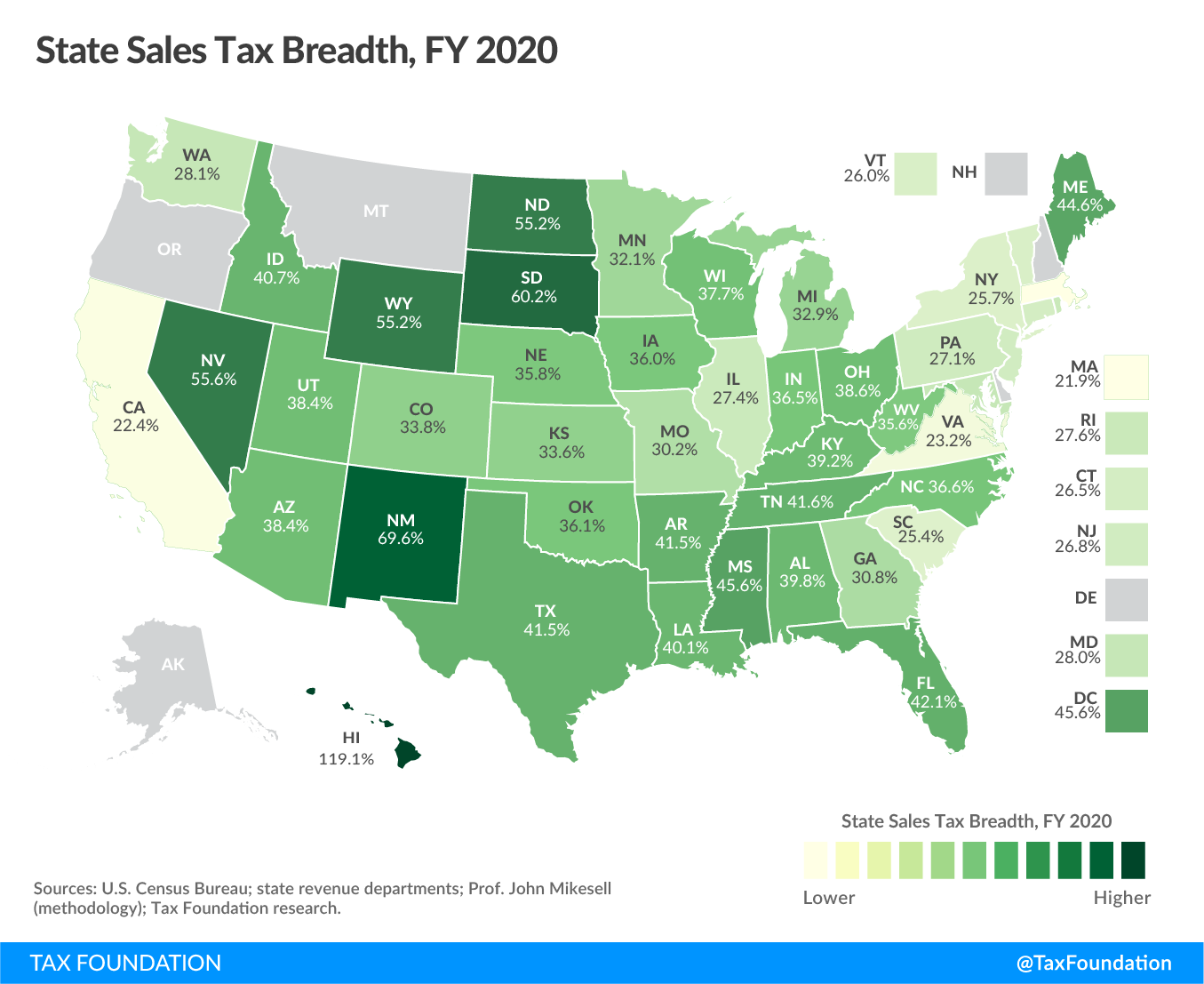

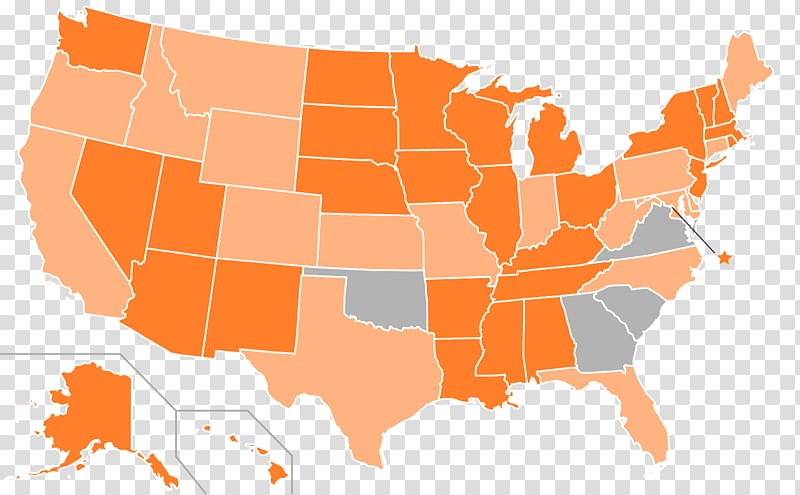

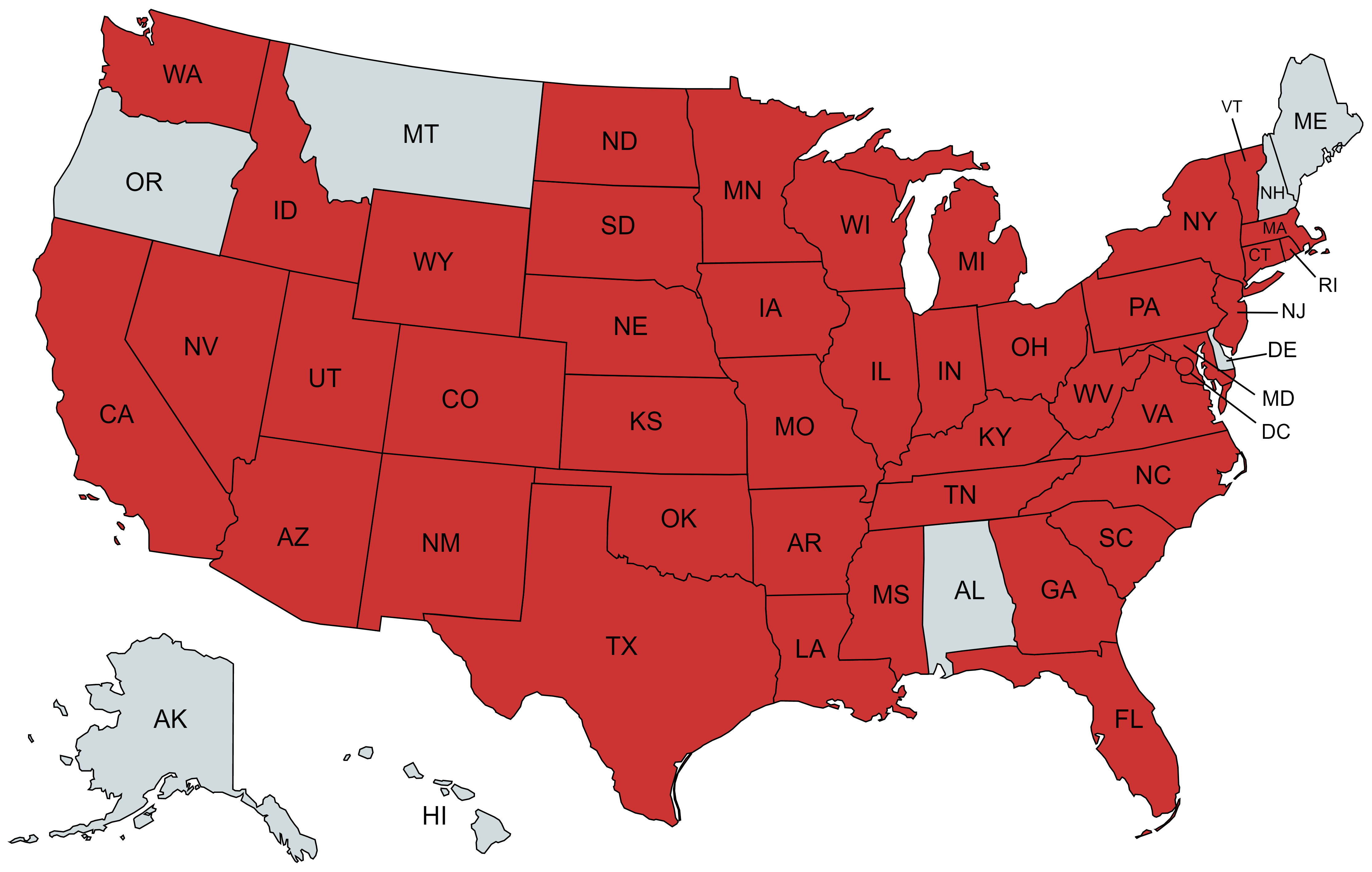

Sales tax rates can vary greatly from state to state. In some states, there is no sales tax on mattresses, while in others, the tax rate can be as high as 10%. It's important to research the sales tax rates in your state before making a purchase, so you can budget accordingly. You can easily find this information online or by using a sales tax calculator.4. Sales Tax by State

Who doesn't love a good sale? Keep an eye out for mattress sales at 1800mattress.com and other retailers. During these promotions, you can often find discounts on the mattress itself, as well as potential sales tax exemptions. This can be a great way to save money on your new mattress purchase.5. Mattress Sale

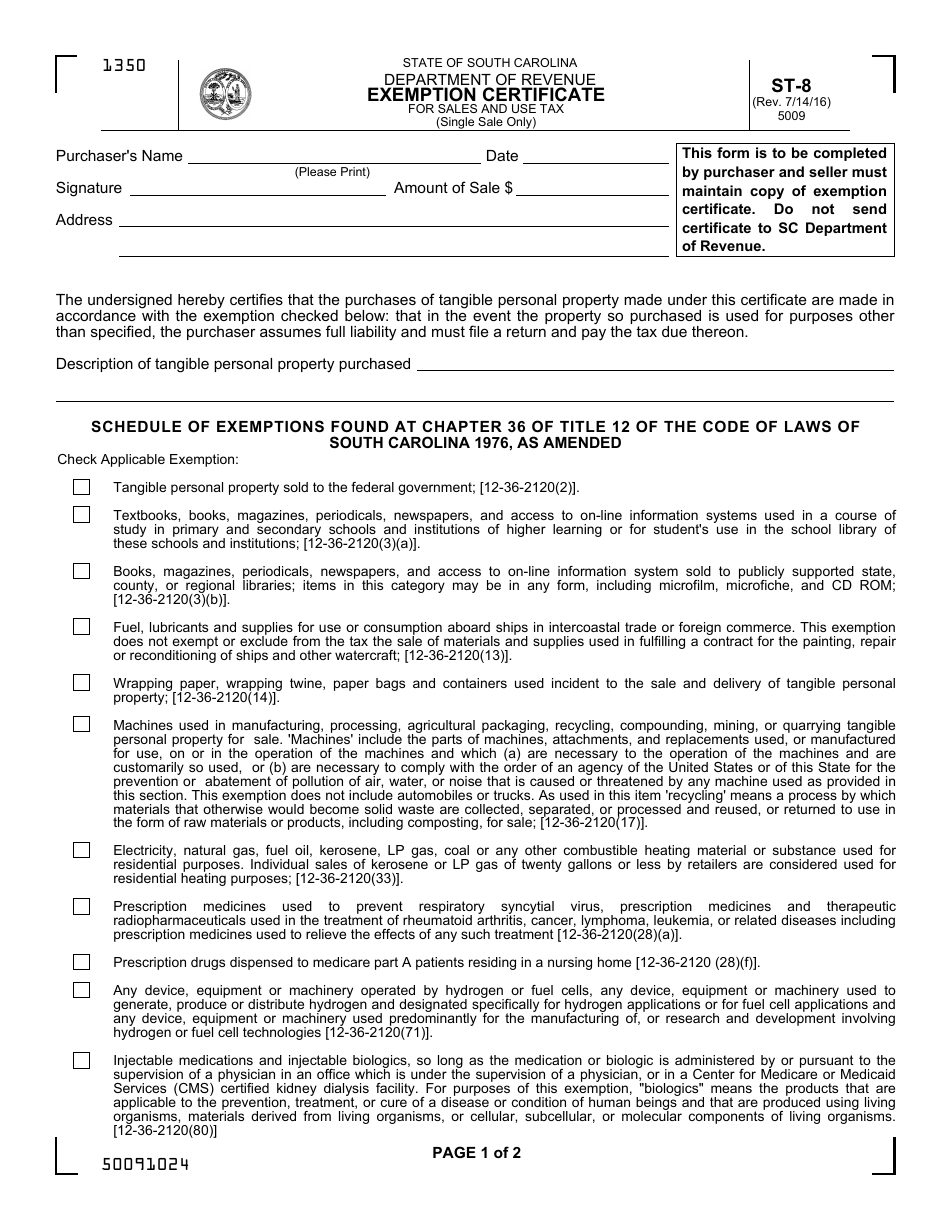

In some states, there are certain items that are exempt from sales tax, including mattresses. This can vary depending on the state and the specific sales tax laws. However, it's worth looking into to see if you can save money on your purchase by taking advantage of a tax-free mattress sale.6. Tax-Free Mattress

Before making a big purchase like a mattress, it's always a good idea to do some research and read reviews from other customers. 1800mattress.com has a 4.5-star rating on Trustpilot, with many customers raving about the quality of their mattresses and the great deals they received. Reading reviews can give you a better idea of what to expect from your purchase and can help you make a more informed decision.7. 1800mattress Reviews

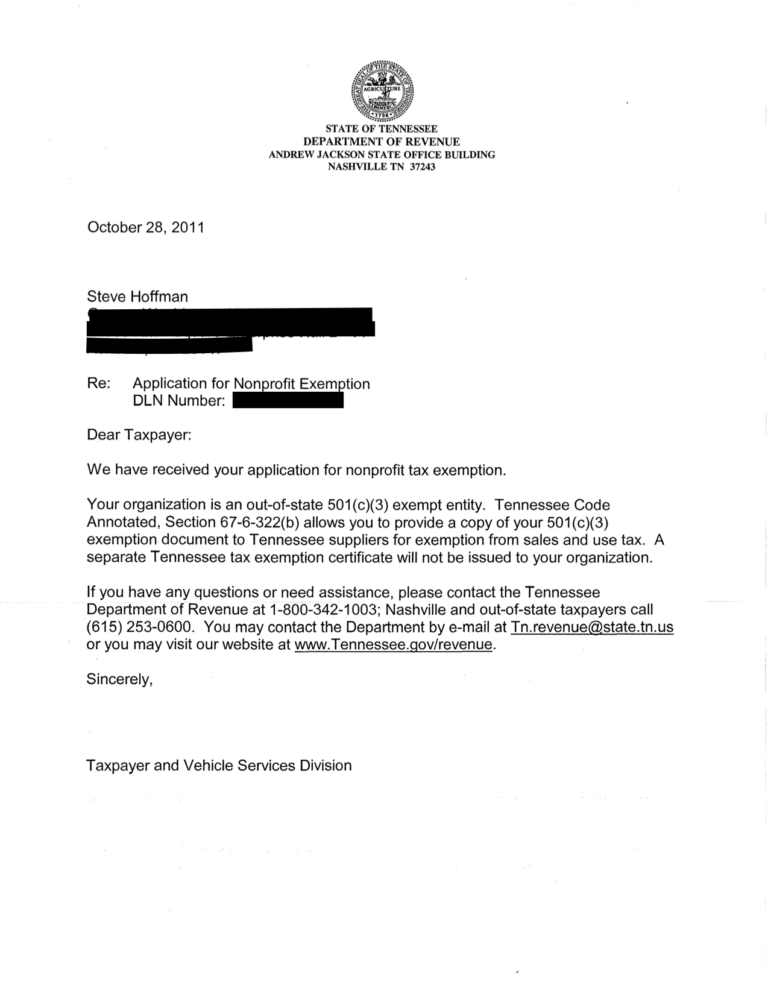

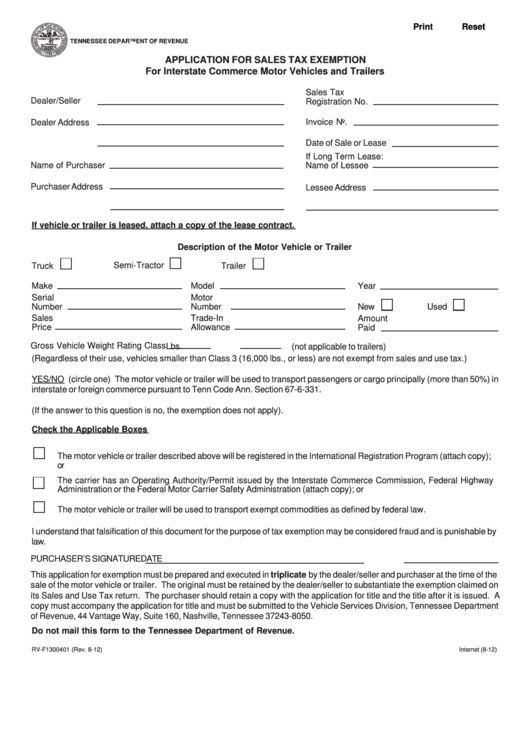

In addition to tax-free mattress sales, there are also certain exemptions that individuals may qualify for. For example, if you are a senior citizen or have a disability, you may be eligible for a sales tax exemption on your mattress purchase. Be sure to check with your state's tax laws to see if you qualify for any exemptions.8. Sales Tax Exemption

If you prefer to shop in-store rather than online, you may be wondering where you can find a mattress sale near you. A quick Google search can help you find local mattress retailers and their current promotions. Be sure to factor in sales tax when comparing prices between different stores.9. Mattress Sale Near Me

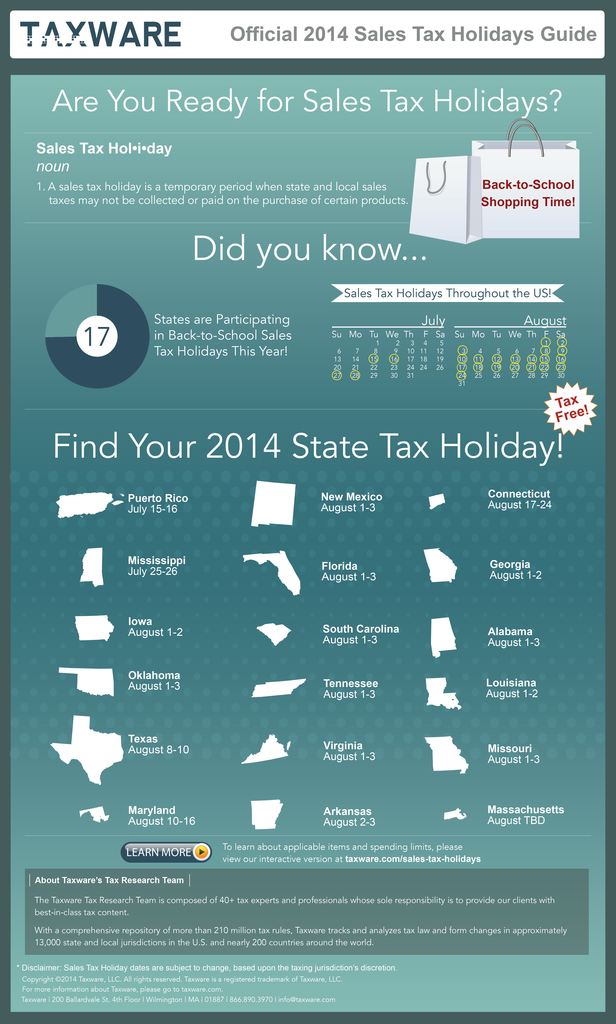

Many states have a designated time of year where they offer a sales tax holiday. This means that for a limited time, certain items are exempt from sales tax, including mattresses. If you're in the market for a new mattress, it may be worth waiting for a sales tax holiday to make your purchase and save some extra money. In conclusion, sales tax is an important factor to consider when purchasing a new mattress. Be sure to do your research, use a sales tax calculator, and take advantage of any sales or exemptions that are available. With the help of this article, you can make an informed decision and find the perfect mattress at a great price. Happy shopping!10. Sales Tax Holiday

The Impact of Sales Tax on 1800 Mattress Sales

The Importance of 1800 Mattresses in House Design

When it comes to designing the perfect house, every detail matters. From the color scheme to the furniture, every element plays a crucial role in creating a space that is both functional and aesthetically pleasing. One of the most important aspects of house design is the choice of mattress. After all, a good night's sleep is essential for our physical and mental well-being. This is where 1800 mattresses come in, offering a wide range of options to cater to different needs and preferences. However, the recent implementation of sales tax on 1800 mattresses has left many wondering about its impact on the market and consumers.

When it comes to designing the perfect house, every detail matters. From the color scheme to the furniture, every element plays a crucial role in creating a space that is both functional and aesthetically pleasing. One of the most important aspects of house design is the choice of mattress. After all, a good night's sleep is essential for our physical and mental well-being. This is where 1800 mattresses come in, offering a wide range of options to cater to different needs and preferences. However, the recent implementation of sales tax on 1800 mattresses has left many wondering about its impact on the market and consumers.

The Impact of Sales Tax on 1800 Mattress Sales

The introduction of sales tax on 1800 mattresses has undoubtedly caused some concern among consumers. With prices already on the higher end, the additional tax may discourage potential buyers from investing in a high-quality mattress. This could result in a decrease in sales for 1800 mattresses, ultimately affecting the company's revenue. Moreover, the sales tax may also lead to a shift in consumer behavior, with people opting for cheaper, lower-quality mattresses instead. This not only compromises their sleep quality but also affects the overall house design aesthetic.

Related Keyword: 1800 mattress sales tax

On the other hand, the sales tax may also have a positive impact on 1800 mattress sales. With the tax revenue generated, the company may be able to invest in research and development, resulting in even better and innovative products. This could attract more consumers who are willing to pay a premium for a high-quality mattress. Additionally, the sales tax could also lead to better customer service and after-sales support, further enhancing the overall experience of buying a 1800 mattress.

The introduction of sales tax on 1800 mattresses has undoubtedly caused some concern among consumers. With prices already on the higher end, the additional tax may discourage potential buyers from investing in a high-quality mattress. This could result in a decrease in sales for 1800 mattresses, ultimately affecting the company's revenue. Moreover, the sales tax may also lead to a shift in consumer behavior, with people opting for cheaper, lower-quality mattresses instead. This not only compromises their sleep quality but also affects the overall house design aesthetic.

Related Keyword: 1800 mattress sales tax

On the other hand, the sales tax may also have a positive impact on 1800 mattress sales. With the tax revenue generated, the company may be able to invest in research and development, resulting in even better and innovative products. This could attract more consumers who are willing to pay a premium for a high-quality mattress. Additionally, the sales tax could also lead to better customer service and after-sales support, further enhancing the overall experience of buying a 1800 mattress.

In Conclusion

While the implementation of sales tax on 1800 mattresses may have its drawbacks, it is essential to consider the long-term effects it may have on the company and the market. Ultimately, a good night's sleep is priceless, and investing in a high-quality mattress is a crucial aspect of house design. With the right balance of cost and quality, 1800 mattresses continue to hold their position as a top choice for many homeowners.

While the implementation of sales tax on 1800 mattresses may have its drawbacks, it is essential to consider the long-term effects it may have on the company and the market. Ultimately, a good night's sleep is priceless, and investing in a high-quality mattress is a crucial aspect of house design. With the right balance of cost and quality, 1800 mattresses continue to hold their position as a top choice for many homeowners.