When it comes to buying a new mattress, most people focus on the price tag and the comfort level. However, one important factor that is often overlooked is sales tax. In the US, sales tax on mattresses can vary depending on the state and even the city you live in. Understanding how sales tax works on mattresses can help you make a more informed decision when making a purchase. According to the National Conference of State Legislatures, all but five states in the US have a statewide sales tax. This means that when you buy a mattress in these states, you will be charged a percentage of the purchase price in addition to the listed price. This is known as sales tax and it goes towards funding various state and local programs and services.Understanding Sales Tax on Mattresses in the US

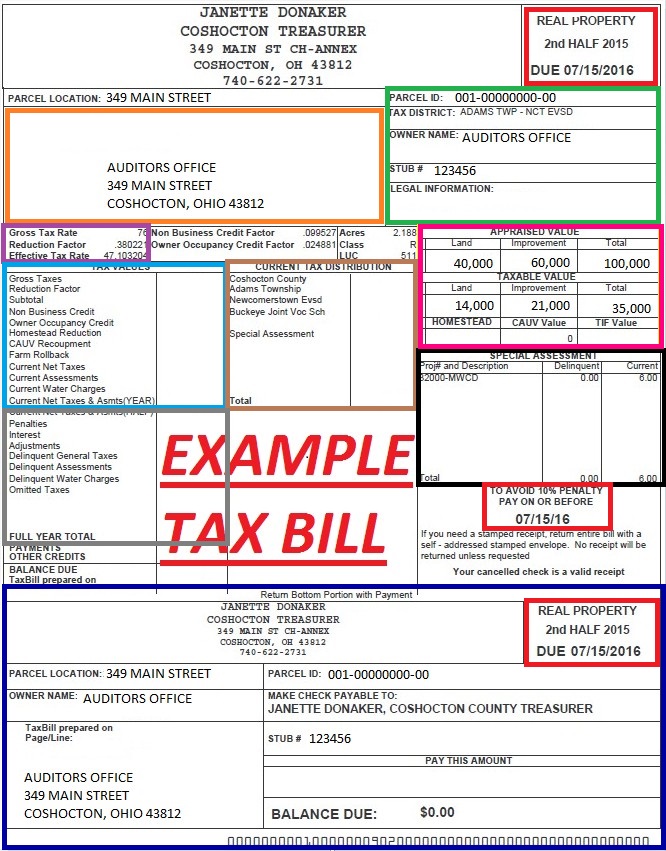

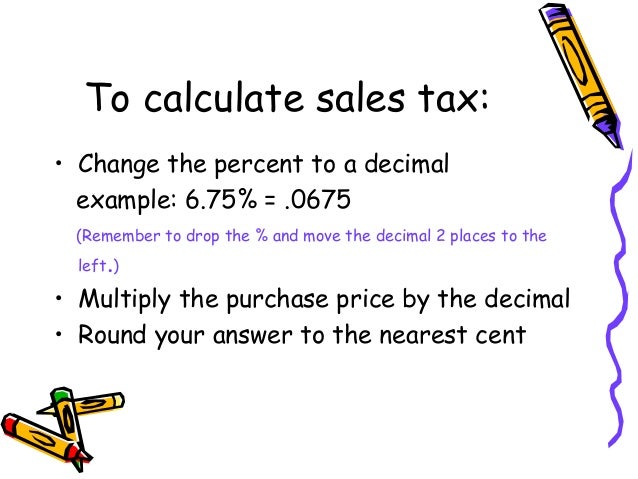

The sales tax rate on mattresses can vary greatly from state to state. For example, some states have a flat sales tax rate while others have a variable rate based on the price of the mattress. To calculate the sales tax on a mattress, you will need to know the sales tax rate in your state and the price of the mattress. For example, if you live in a state with a flat sales tax rate of 6% and you purchase a mattress for $1000, you will pay an additional $60 in sales tax. However, if you live in a state with a variable sales tax rate of 8% and you purchase a mattress for $1000, you will pay $80 in sales tax.How to Calculate Sales Tax on Mattresses in the US

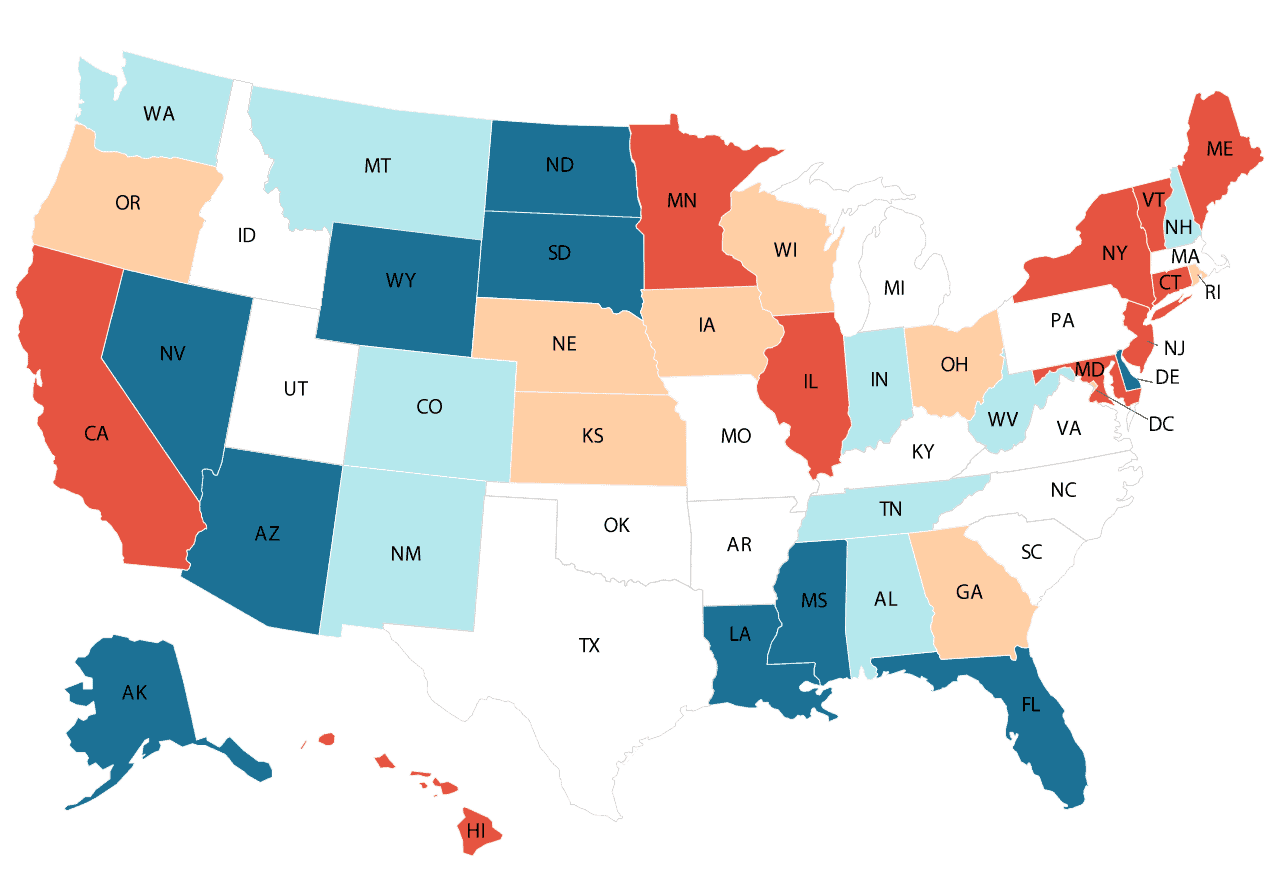

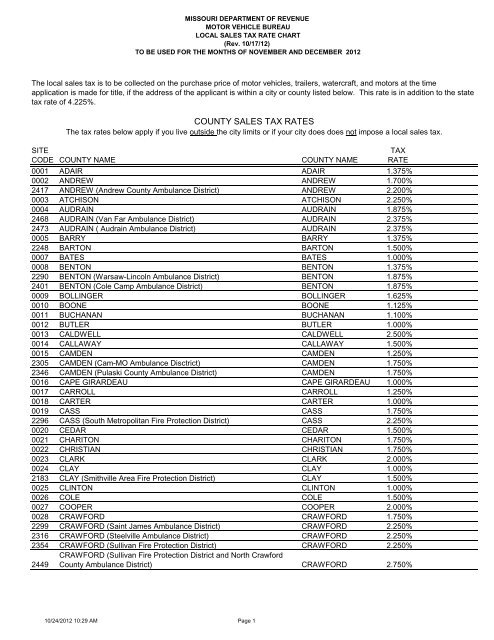

As mentioned earlier, sales tax on mattresses can vary greatly from state to state. Here is a breakdown of the sales tax rates for each state in the US:State-by-State Guide to Mattress Sales Tax

While most states charge sales tax on mattresses, there are some exemptions that can help you save money. For example, some states offer a sales tax holiday where certain items, including mattresses, are exempt from sales tax for a limited time. There are also exemptions for certain groups such as veterans, senior citizens, and individuals with disabilities. Another common exemption from mattress sales tax is for medical reasons. In some states, if you have a prescription from a doctor for a specific type of mattress to help with a medical condition, you may be exempt from paying sales tax on that mattress.Exemptions from Mattress Sales Tax in the US

In recent years, online mattress shopping has become increasingly popular. However, many people are confused about whether or not they need to pay sales tax when purchasing a mattress online. The answer is yes, you are still responsible for paying sales tax on online mattress purchases in most states. The Supreme Court ruling in 2018, South Dakota v. Wayfair, Inc., gave states the authority to require online retailers to collect and remit sales tax, even if they do not have a physical presence in the state. This means that if you live in a state with a sales tax and you purchase a mattress online from a retailer that has a physical presence in that state, you will be charged sales tax on your purchase.Online Mattress Sales Tax Laws in the US

Many people assume that they can avoid paying sales tax on a mattress by purchasing it in a state with a lower sales tax rate. However, this is not always the case. If you live in a state with a higher sales tax rate and you purchase a mattress in a state with a lower sales tax rate, you will still be responsible for paying the difference in sales tax when you bring the mattress back to your home state. Another common misconception is that buying a mattress online will help you avoid paying sales tax altogether. As mentioned earlier, this is not true in most cases. The only way to avoid paying sales tax on a mattress is if you live in a state with no sales tax, and even then, you may still be responsible for use tax.Common Misconceptions about Mattress Sales Tax in the US

While you may not be able to completely avoid paying sales tax on a mattress, there are some ways to save money on your purchase. One option is to wait for a sales tax holiday in your state, if available, to purchase your mattress. You can also look for retailers that offer discounts or promotions that may help offset the cost of sales tax. If you have a medical condition that requires a specific type of mattress, be sure to research if your state offers an exemption for medical reasons. Additionally, if you are purchasing a mattress online, consider buying from a retailer that does not have a physical presence in your state to potentially avoid paying sales tax.Tips for Saving Money on Mattress Sales Tax in the US

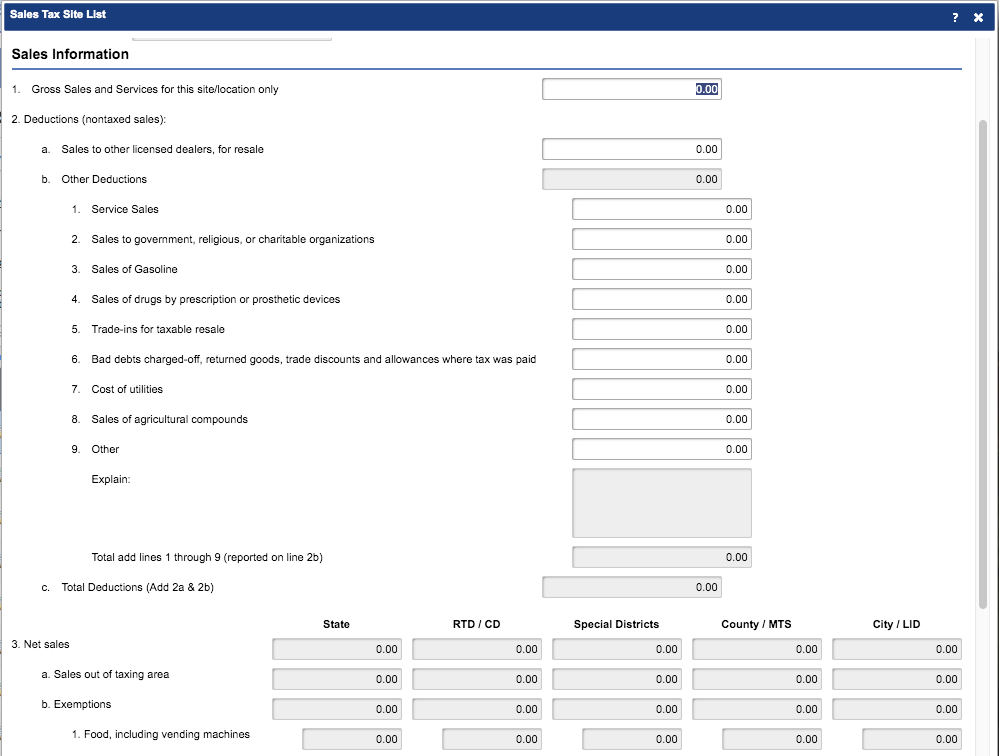

In addition to state sales tax, some cities and counties in the US also have a local sales tax. This means that the sales tax rate on a mattress may be different depending on where you live. It is important to check with your local government to see if there is a local sales tax and what the rate is before making a mattress purchase. Some states have a destination-based sales tax, which means that the sales tax rate is based on the location where the product is delivered, rather than where it is purchased. This can result in a higher sales tax rate if you live in a city or county with a higher local sales tax rate.Understanding Local Sales Tax on Mattresses in the US

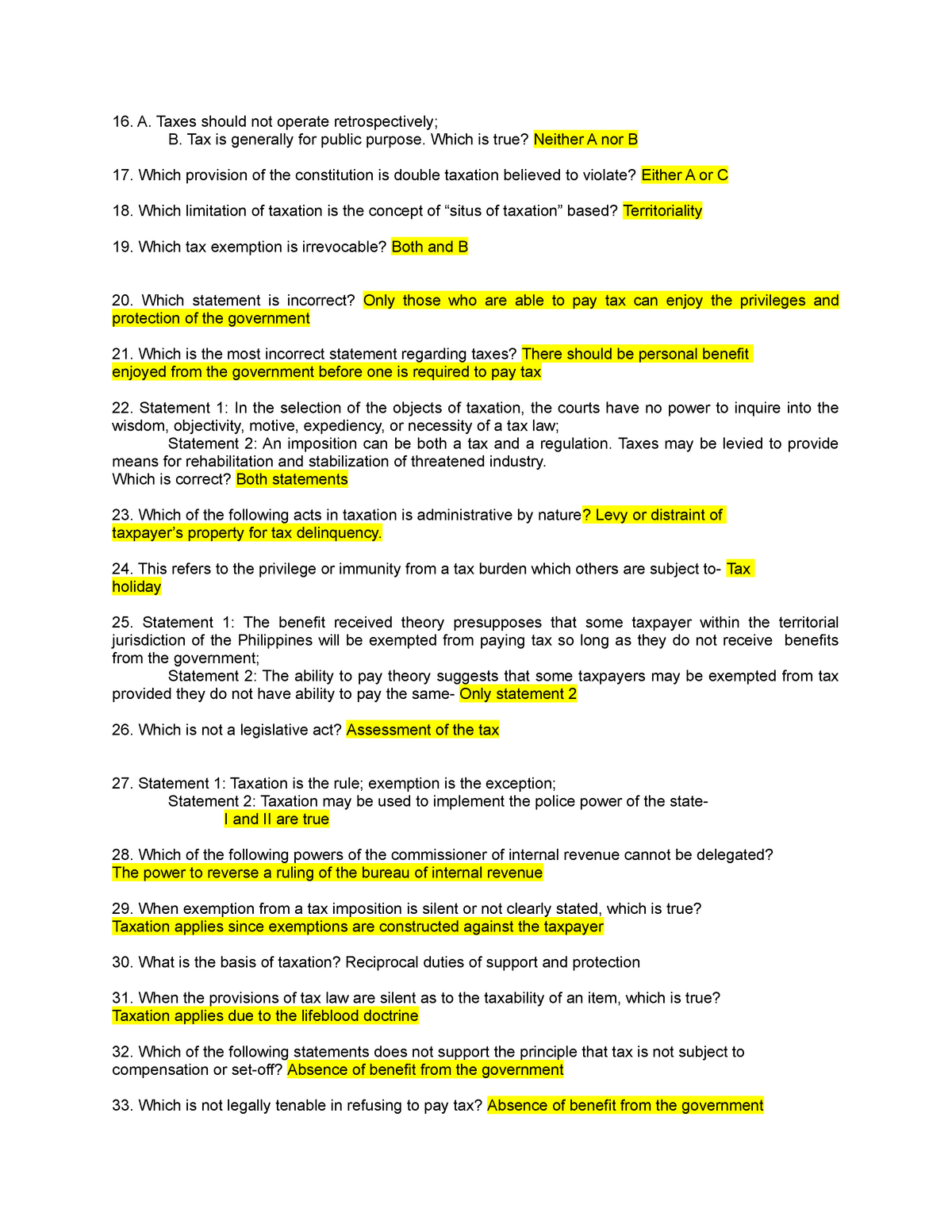

If you are a consumer purchasing a mattress for personal use, you will not need to file sales tax. The retailer is responsible for collecting and remitting the sales tax to the state. However, if you are a business purchasing a mattress, you may be responsible for paying sales tax directly to the state. It is important to keep track of your mattress purchases and the sales tax paid in case you need to report it for tax purposes. You can also speak to a tax professional for more information on how to properly report sales tax on your mattress purchases.How to File Sales Tax for Mattress Purchases in the US

In recent years, there have been some changes to mattress sales tax laws in the US. As mentioned earlier, the Supreme Court ruling in 2018 gave states the authority to require online retailers to collect and remit sales tax, which has resulted in more people paying sales tax on online mattress purchases. Additionally, some states have made changes to their sales tax laws, such as increasing the sales tax rate or expanding the types of items that are subject to sales tax. It is important to stay updated on any changes to sales tax laws in your state to avoid any surprises when making a mattress purchase.Recent Changes to Mattress Sales Tax Laws in the US

The Impact of Sales Tax on US Mattress Sales

Understanding the Role of Sales Tax in the Mattress Industry

When it comes to purchasing a new mattress, many consumers are aware of the costs associated with the actual product. However, what many do not consider is the impact of sales tax on their purchase. In the United States, sales tax is a common way for state and local governments to generate revenue and fund various programs and services. But how does this tax affect the mattress industry, and ultimately, the consumer?

Sales tax is a percentage of the sale price that is added to the total cost of a purchase.

This tax varies by state, with some states having no sales tax at all. However, for the majority of states, the sales tax rate can range from 4% to 10% of the purchase price. This means that for every $100 spent on a mattress, the consumer could be paying an additional $4 to $10 in sales tax.

When it comes to purchasing a new mattress, many consumers are aware of the costs associated with the actual product. However, what many do not consider is the impact of sales tax on their purchase. In the United States, sales tax is a common way for state and local governments to generate revenue and fund various programs and services. But how does this tax affect the mattress industry, and ultimately, the consumer?

Sales tax is a percentage of the sale price that is added to the total cost of a purchase.

This tax varies by state, with some states having no sales tax at all. However, for the majority of states, the sales tax rate can range from 4% to 10% of the purchase price. This means that for every $100 spent on a mattress, the consumer could be paying an additional $4 to $10 in sales tax.

The Impact on Consumers

When purchasing a new mattress, the added cost of sales tax can significantly impact the overall price. For example, a $1,000 mattress with a 7% sales tax would cost an additional $70, bringing the total cost to $1,070. This can be a considerable expense for many consumers, especially those on a tight budget.

In addition to the cost, sales tax can also affect the type of mattress a consumer chooses.

With higher sales tax rates, consumers may opt for a less expensive mattress to avoid paying a higher tax amount.

This can lead to them purchasing a mattress that may not meet their needs or provide the level of comfort and support they desire.

When purchasing a new mattress, the added cost of sales tax can significantly impact the overall price. For example, a $1,000 mattress with a 7% sales tax would cost an additional $70, bringing the total cost to $1,070. This can be a considerable expense for many consumers, especially those on a tight budget.

In addition to the cost, sales tax can also affect the type of mattress a consumer chooses.

With higher sales tax rates, consumers may opt for a less expensive mattress to avoid paying a higher tax amount.

This can lead to them purchasing a mattress that may not meet their needs or provide the level of comfort and support they desire.

The Impact on the Mattress Industry

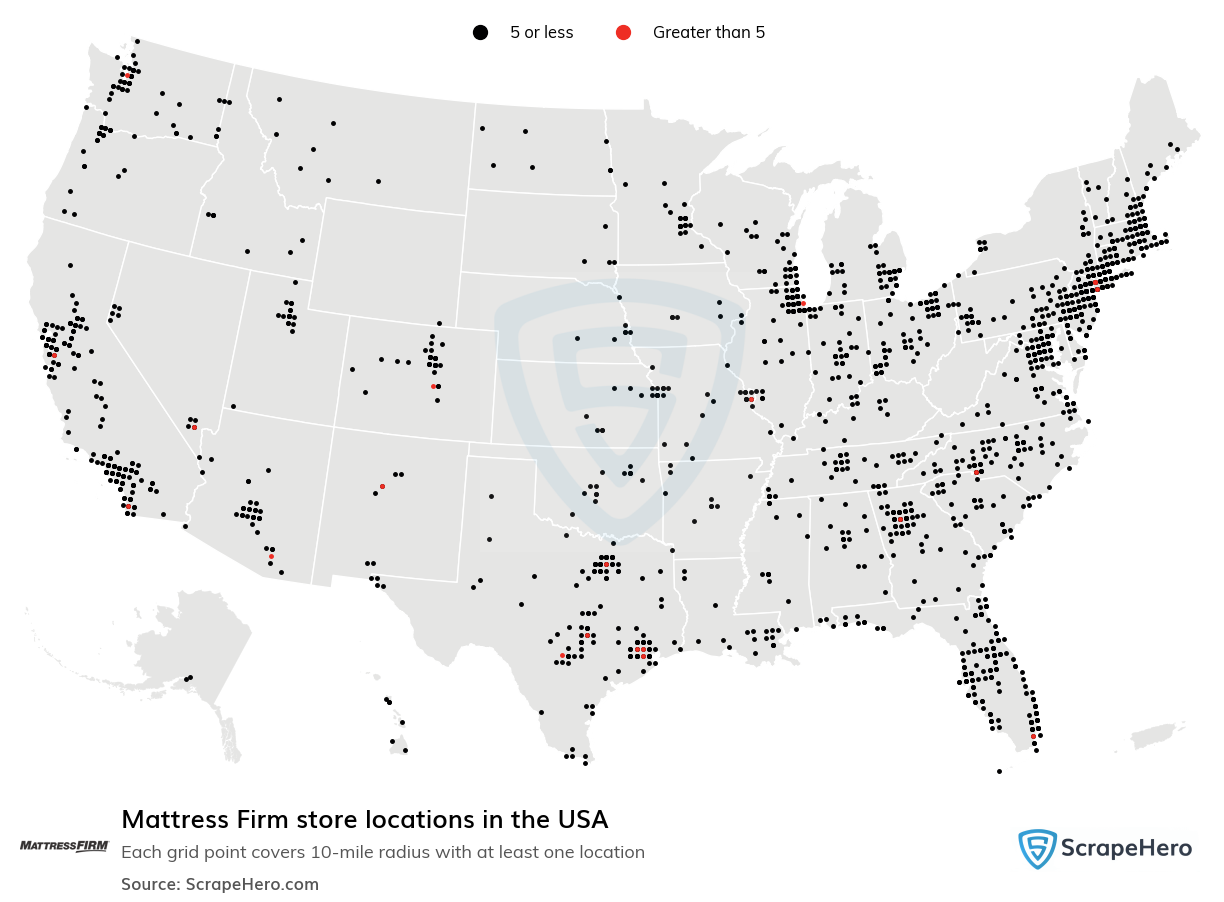

The impact of sales tax on the mattress industry is significant. With higher sales tax rates, consumers may be less inclined to make a purchase, resulting in lower sales for mattress retailers.

This can also lead to decreased competition, as smaller retailers may struggle to compete with larger companies who can offer lower prices due to their economies of scale.

Furthermore, the sales tax rate can also affect the price point of mattresses. Manufacturers and retailers may need to adjust their prices to account for the added cost of sales tax, potentially making mattresses more expensive for consumers.

The impact of sales tax on the mattress industry is significant. With higher sales tax rates, consumers may be less inclined to make a purchase, resulting in lower sales for mattress retailers.

This can also lead to decreased competition, as smaller retailers may struggle to compete with larger companies who can offer lower prices due to their economies of scale.

Furthermore, the sales tax rate can also affect the price point of mattresses. Manufacturers and retailers may need to adjust their prices to account for the added cost of sales tax, potentially making mattresses more expensive for consumers.

The Bottom Line

/cloudfront-us-east-1.images.arcpublishing.com/tgam/ICL7YMXOJFAXZHKW2JYKLUWGDM) In conclusion, sales tax plays a crucial role in the US mattress industry. It not only impacts the cost of mattresses for consumers but also affects the competition and pricing within the industry. As a consumer, it is essential to consider the added cost of sales tax when purchasing a new mattress and to research the sales tax rate in your area to make an informed decision.

In conclusion, sales tax plays a crucial role in the US mattress industry. It not only impacts the cost of mattresses for consumers but also affects the competition and pricing within the industry. As a consumer, it is essential to consider the added cost of sales tax when purchasing a new mattress and to research the sales tax rate in your area to make an informed decision.

-480a.jpg)