If you're considering a kitchen or bath remodel, you're not alone. These two rooms are among the most popular areas of the home for renovation, and for good reason. A kitchen or bath remodel can significantly increase the value of your home, as well as improve your daily living experience. However, these types of projects can also come with a hefty price tag. That's where financing options come in. Let's take a look at the top 10 ways to finance your kitchen and bath remodel.1. Kitchen and Bath Remodeling Financing: Exploring Your Options

One of the most common ways to finance a kitchen or bath remodel is through a home improvement loan. These loans can come from a variety of sources, such as banks, credit unions, or online lenders. They typically offer fixed interest rates and repayment terms ranging from a few years to several decades, depending on the loan amount. Home improvement loans are a great option for those who need a flexible funding solution.2. Home Improvement Loans: A Flexible Funding Solution

Another popular option for financing a kitchen or bath remodel is through renovation financing, also known as a renovation loan. This type of loan allows you to borrow against the equity in your home, using your home's value as collateral. Renovation loans can come in the form of a home equity loan or a home equity line of credit (HELOC). These loans usually offer lower interest rates than personal loans or credit cards.3. Renovation Financing: Borrowing Against Your Home's Value

A home equity loan is a type of renovation financing that allows you to borrow a lump sum of money against the equity you've built up in your home. This type of loan typically has a fixed interest rate and a set repayment term, usually ranging from 5 to 30 years. Home equity loans are a good option for those who have a specific renovation project in mind and need a large sum of money upfront.4. Home Equity Loans: Accessing Your Home's Built-Up Equity

If you need to access funds quickly or don't want to use your home as collateral, a personal loan may be a good option for financing your kitchen or bath remodel. Personal loans are unsecured loans, meaning you don't need to put up any collateral. They typically have higher interest rates than home equity loans, but they also offer a faster and simpler application process.5. Personal Loans: Quick and Easy Funding

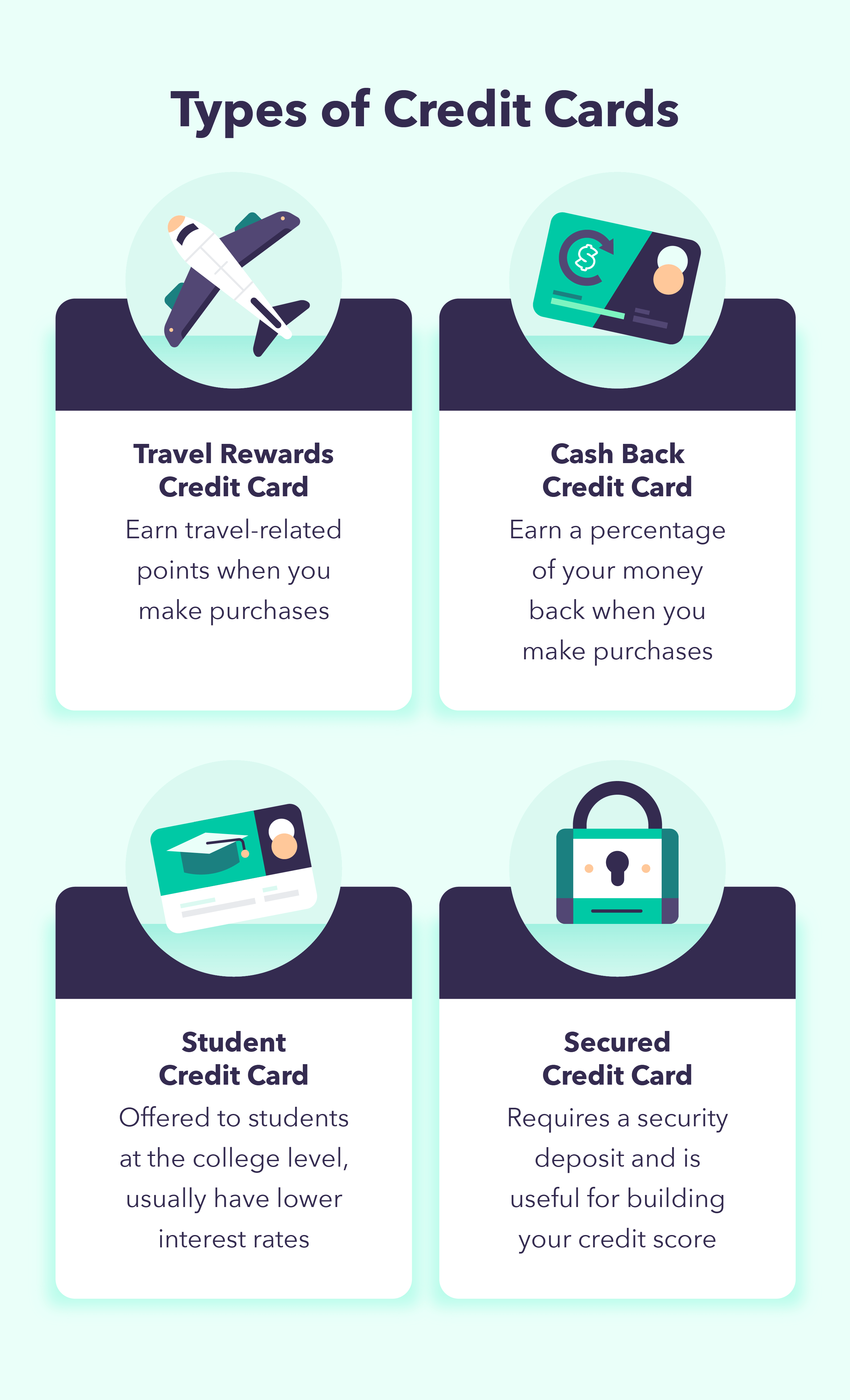

Credit cards are another option for financing your kitchen or bath remodel. They offer convenience and flexibility, as you can use them to make purchases for your project as needed. However, credit cards often come with higher interest rates than other financing options, so it's important to pay off your balance as quickly as possible to avoid paying too much in interest.6. Credit Cards: A Convenient Solution

If you're purchasing a fixer-upper home that needs major renovations, an FHA 203(k) loan can help you finance both the purchase of the home and the cost of the renovations. These loans are insured by the Federal Housing Administration and offer competitive interest rates and flexible repayment terms. They are a good option for those who want to buy a home that needs a lot of work.7. FHA 203(k) Loans: Financing for Fixer-Uppers

A home equity line of credit (HELOC) is another type of renovation financing that allows you to borrow against the equity in your home. However, unlike a home equity loan, a HELOC works more like a credit card. You are given a credit limit and can draw on that credit as needed. This can be a good option if you're not sure exactly how much your kitchen or bath remodel will cost and want the flexibility to borrow as needed.8. Home Equity Lines of Credit: A Flexible Credit Line

Some contractors may offer their own financing options for your kitchen or bath remodel. This can be a convenient option as you can get the financing and complete the project all through the same company. However, it's important to carefully review the terms and interest rates to make sure it's the best option for you.9. Contractor Financing: Financing Offered by Your Contractor

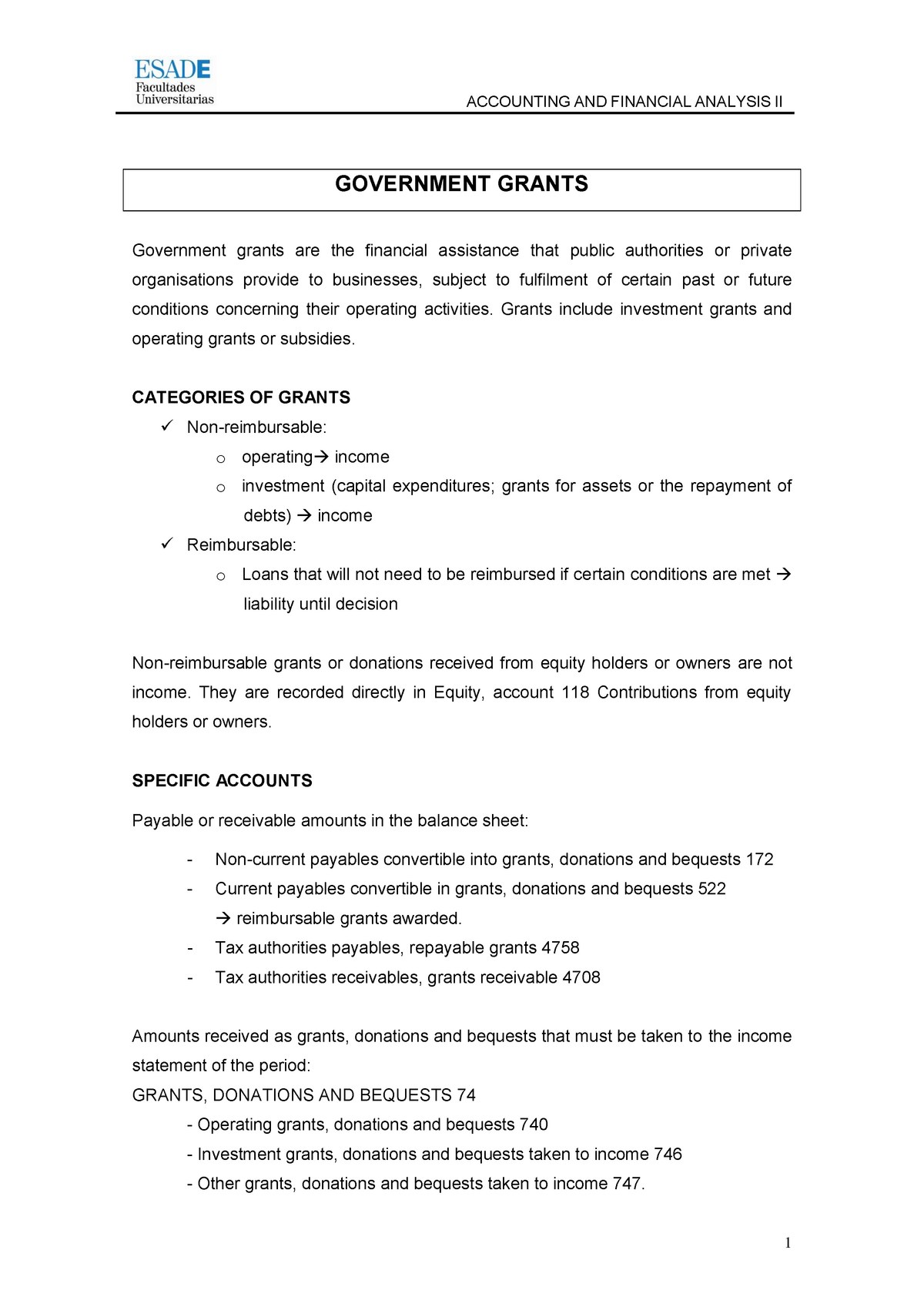

For low-income households, there may be government grants and loans available to help finance a kitchen or bath remodel. These programs are often offered at the state or local level and have specific eligibility requirements. They can be a great option for those who need financial assistance with their home renovation project.10. Government Grants and Loans: Help for Low-Income Households

The Importance of Kitchen and Bath Remodeling Financing

Transforming Your House into a Dream Home

When it comes to creating the house of your dreams, the kitchen and bathroom are two of the most important spaces to consider. These are the rooms where we spend a significant amount of time, and they often serve as the hub of the home. However, the cost of a kitchen and bath remodel can be daunting for many homeowners. That's where

kitchen and bath remodeling financing

comes in.

When it comes to creating the house of your dreams, the kitchen and bathroom are two of the most important spaces to consider. These are the rooms where we spend a significant amount of time, and they often serve as the hub of the home. However, the cost of a kitchen and bath remodel can be daunting for many homeowners. That's where

kitchen and bath remodeling financing

comes in.

Why Financing is a Smart Choice

Whether you're looking to update your outdated kitchen or transform your bathroom into a spa-like oasis, financing can help make your dream a reality. Many homeowners may be hesitant to take on the expense of a remodel, but with the right financing options, you can achieve the design you've always wanted without breaking the bank.

Financing allows you to spread out the cost of your remodel over a period of time

, making it more manageable and allowing you to stay within your budget. This is especially beneficial for those who don't have the funds readily available to cover the upfront costs of a remodel. With the right financing plan, you can make small, manageable payments each month and still achieve the home design you desire.

Whether you're looking to update your outdated kitchen or transform your bathroom into a spa-like oasis, financing can help make your dream a reality. Many homeowners may be hesitant to take on the expense of a remodel, but with the right financing options, you can achieve the design you've always wanted without breaking the bank.

Financing allows you to spread out the cost of your remodel over a period of time

, making it more manageable and allowing you to stay within your budget. This is especially beneficial for those who don't have the funds readily available to cover the upfront costs of a remodel. With the right financing plan, you can make small, manageable payments each month and still achieve the home design you desire.

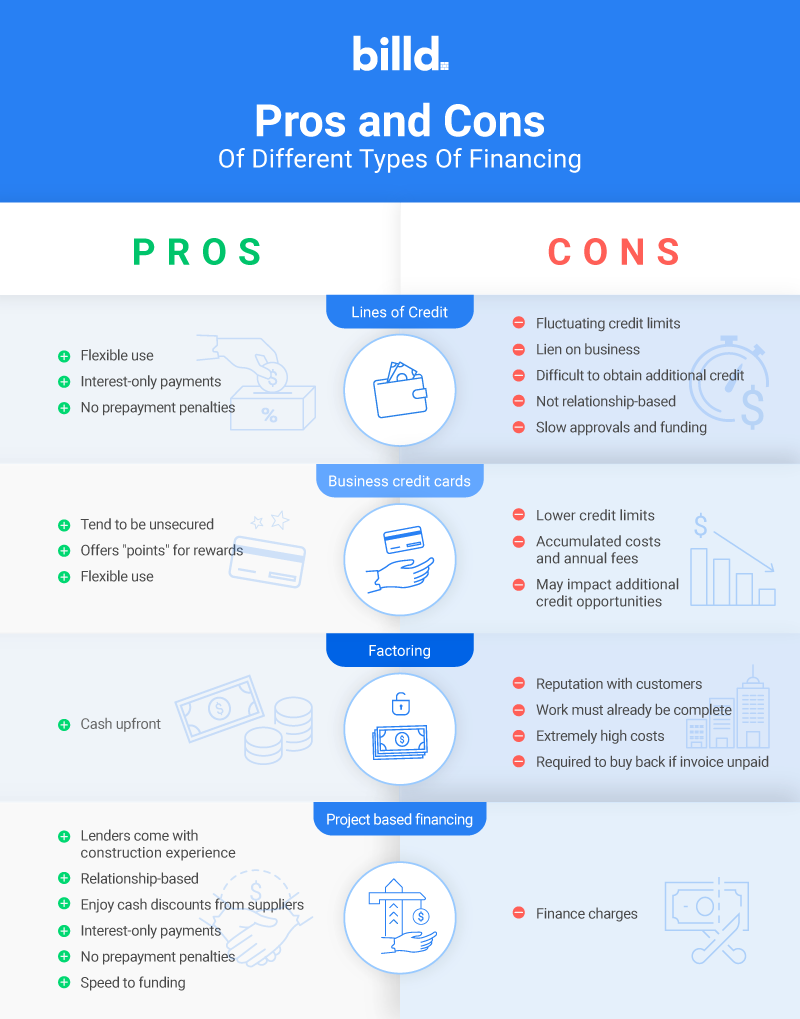

The Different Types of Financing Options

There are several financing options available for kitchen and bath remodeling, and it's important to choose the one that best fits your needs and budget. One popular option is a home equity loan or line of credit, which allows you to borrow against the equity you've built up in your home. Another option is a personal loan, which typically has a lower interest rate and shorter repayment period than a home equity loan.

Some contractors may also offer their own financing plans with low or no interest rates, making it easier to afford your remodel

. It's important to do your research and compare different financing options to find the best fit for your specific project and financial situation.

There are several financing options available for kitchen and bath remodeling, and it's important to choose the one that best fits your needs and budget. One popular option is a home equity loan or line of credit, which allows you to borrow against the equity you've built up in your home. Another option is a personal loan, which typically has a lower interest rate and shorter repayment period than a home equity loan.

Some contractors may also offer their own financing plans with low or no interest rates, making it easier to afford your remodel

. It's important to do your research and compare different financing options to find the best fit for your specific project and financial situation.

Investing in Your Home

A kitchen and bath remodel not only enhances the appearance and functionality of your home, but it also adds value. By

investing in your home through a remodel, you can increase its overall worth and potentially see a return on your investment

when it comes time to sell.

In conclusion,

kitchen and bath remodeling financing

is an excellent option for homeowners looking to transform their house into a dream home. With the right financing plan, you can achieve the design you've always wanted without breaking the bank. Take the time to research and compare different financing options to find the best fit for your project and budget. With proper planning and financing, you can turn your outdated kitchen and bathroom into beautiful, functional spaces that you can enjoy for years to come.

A kitchen and bath remodel not only enhances the appearance and functionality of your home, but it also adds value. By

investing in your home through a remodel, you can increase its overall worth and potentially see a return on your investment

when it comes time to sell.

In conclusion,

kitchen and bath remodeling financing

is an excellent option for homeowners looking to transform their house into a dream home. With the right financing plan, you can achieve the design you've always wanted without breaking the bank. Take the time to research and compare different financing options to find the best fit for your project and budget. With proper planning and financing, you can turn your outdated kitchen and bathroom into beautiful, functional spaces that you can enjoy for years to come.

:max_bytes(150000):strip_icc()/FHA203kloans-425c04160ace4051a9a31b731fe3e2ee.png)