Upgraded Kitchen and Bath Affect Taxes in NJ

When it comes to home renovations, one of the biggest questions homeowners have is how it will affect their taxes. In New Jersey, where property taxes are notoriously high, this is an important consideration. If you are planning to upgrade your kitchen and bath, you may be wondering, will it affect my taxes? The short answer is yes, but how much will depend on several factors.

Do Upgraded Kitchen and Bath Affect Taxes in NJ

The simple act of renovating your kitchen and bath will not automatically increase your taxes. However, the upgrades may increase the overall value of your home, which in turn can impact your taxes. This is because property taxes are based on the assessed value of your home. If the value of your home increases, your taxes may also increase.

How Upgraded Kitchen and Bath Affect Taxes in NJ

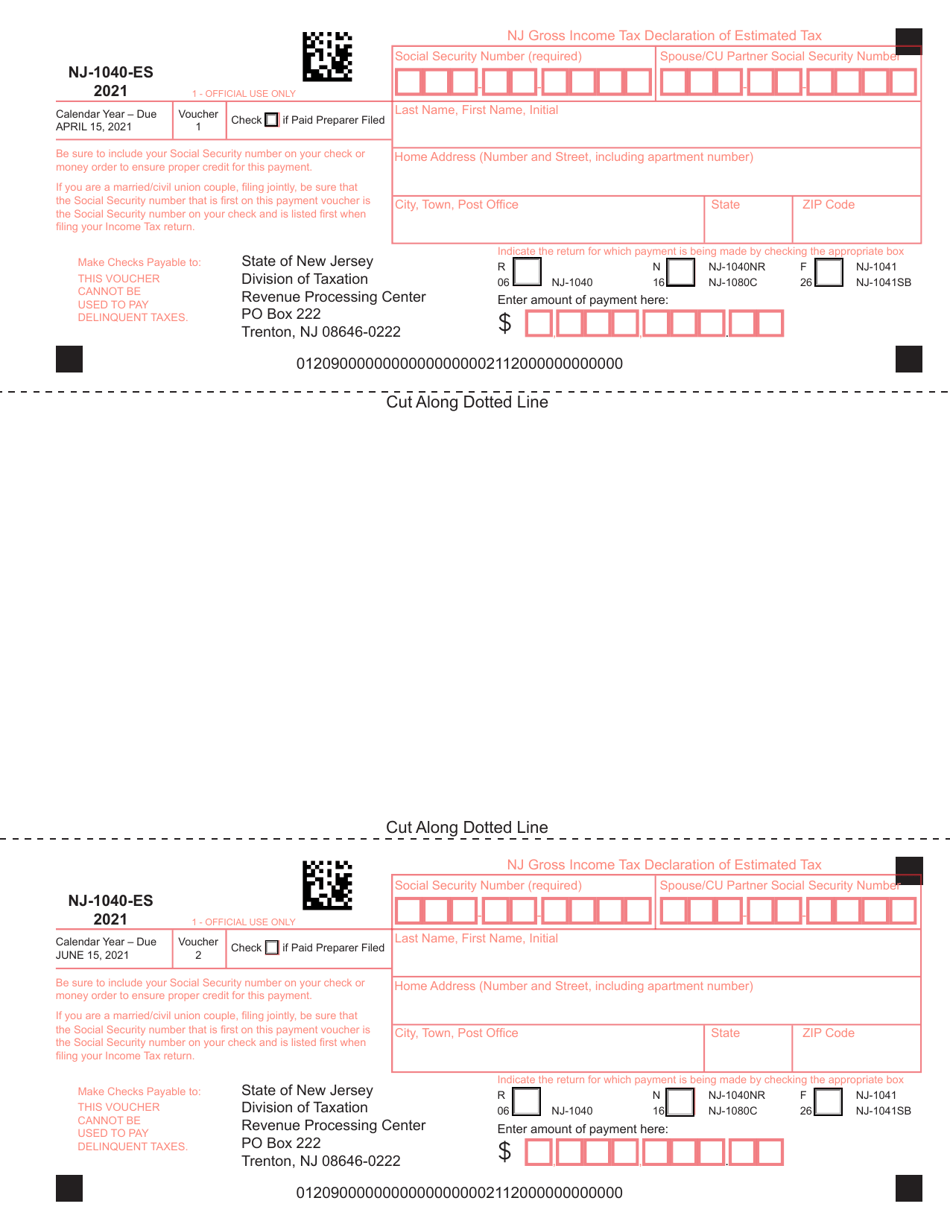

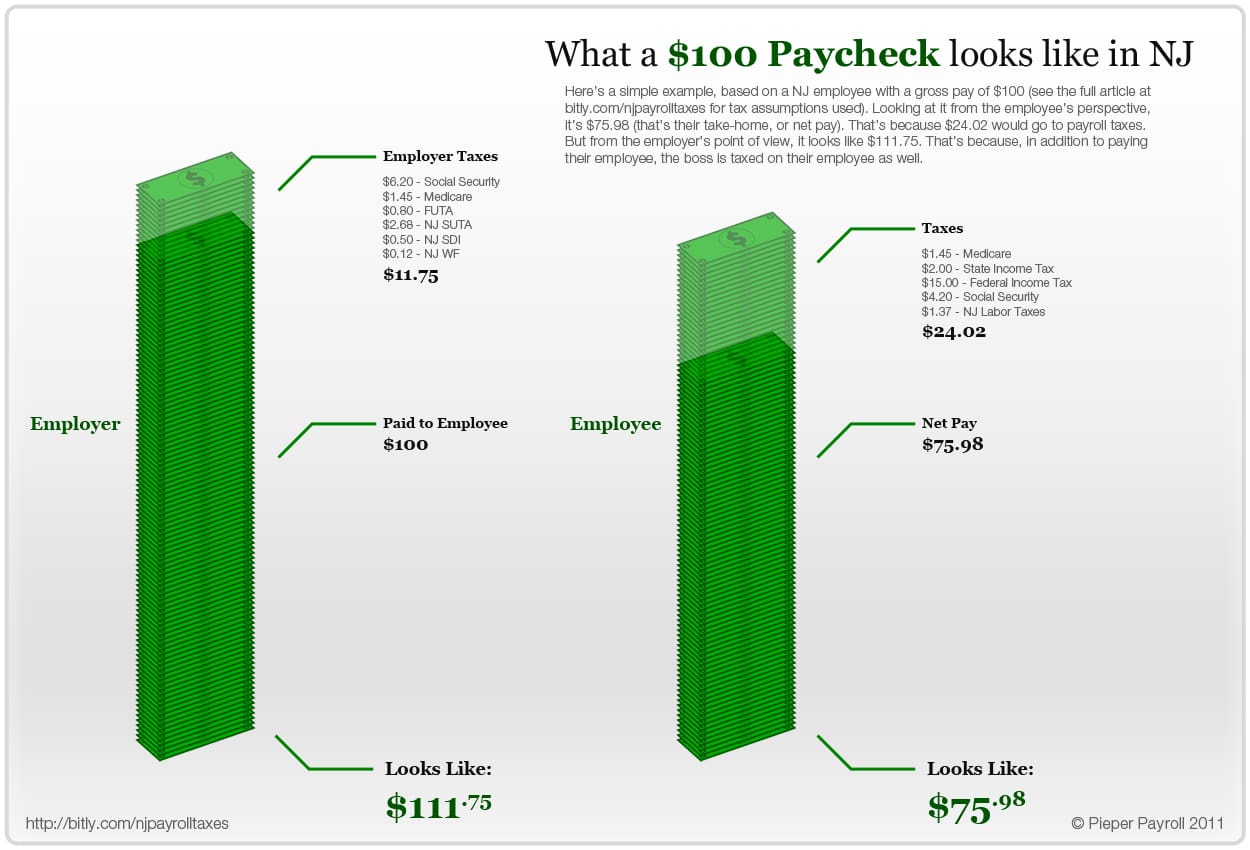

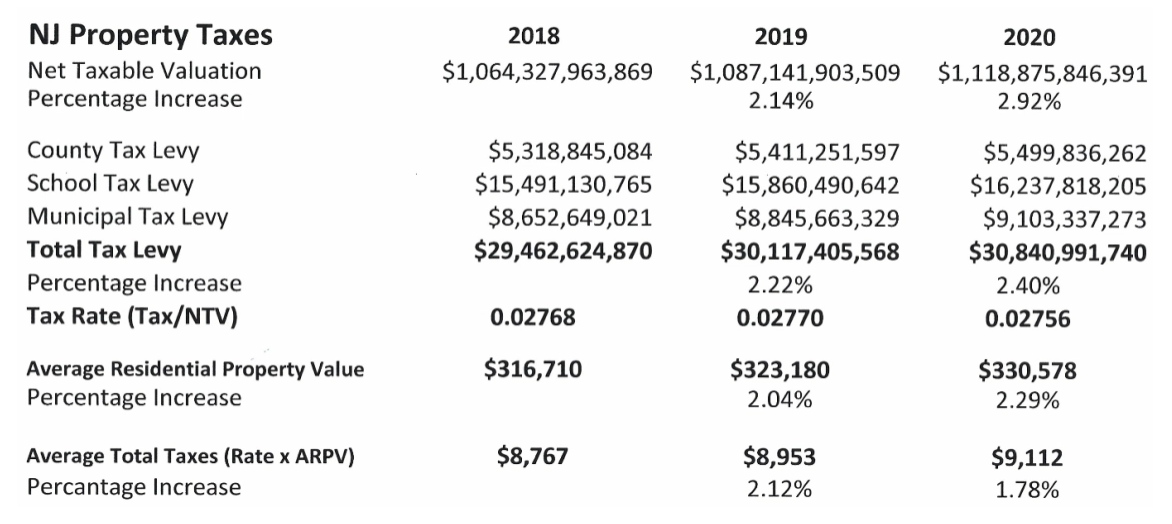

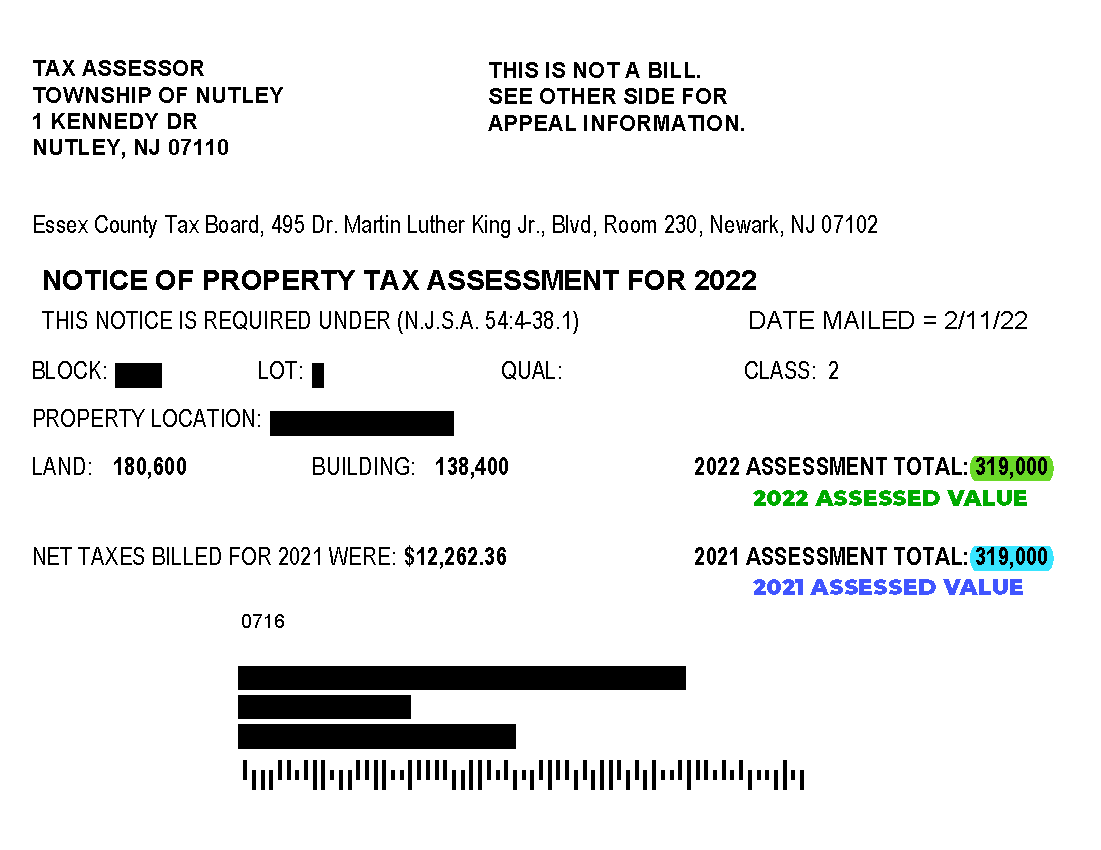

In New Jersey, property taxes are calculated based on the assessed value of your home and the tax rate in your municipality. The assessed value is determined by your local tax assessor and is typically based on the market value of your home. This means that any upgrades that increase the market value of your home can also increase its assessed value and, consequently, your property taxes.

Upgraded Kitchen and Bath Impact on Taxes in NJ

The impact of upgraded kitchen and bath on your taxes will vary depending on the extent of the renovations and the current market value of your home. For example, if you only upgrade your cabinets and countertops, the increase in value may be minimal and may not have a significant impact on your taxes. However, if you do a full remodel that increases the overall square footage of your home, the impact on your taxes may be more substantial.

Do Upgraded Kitchen and Bath Impact Taxes in NJ

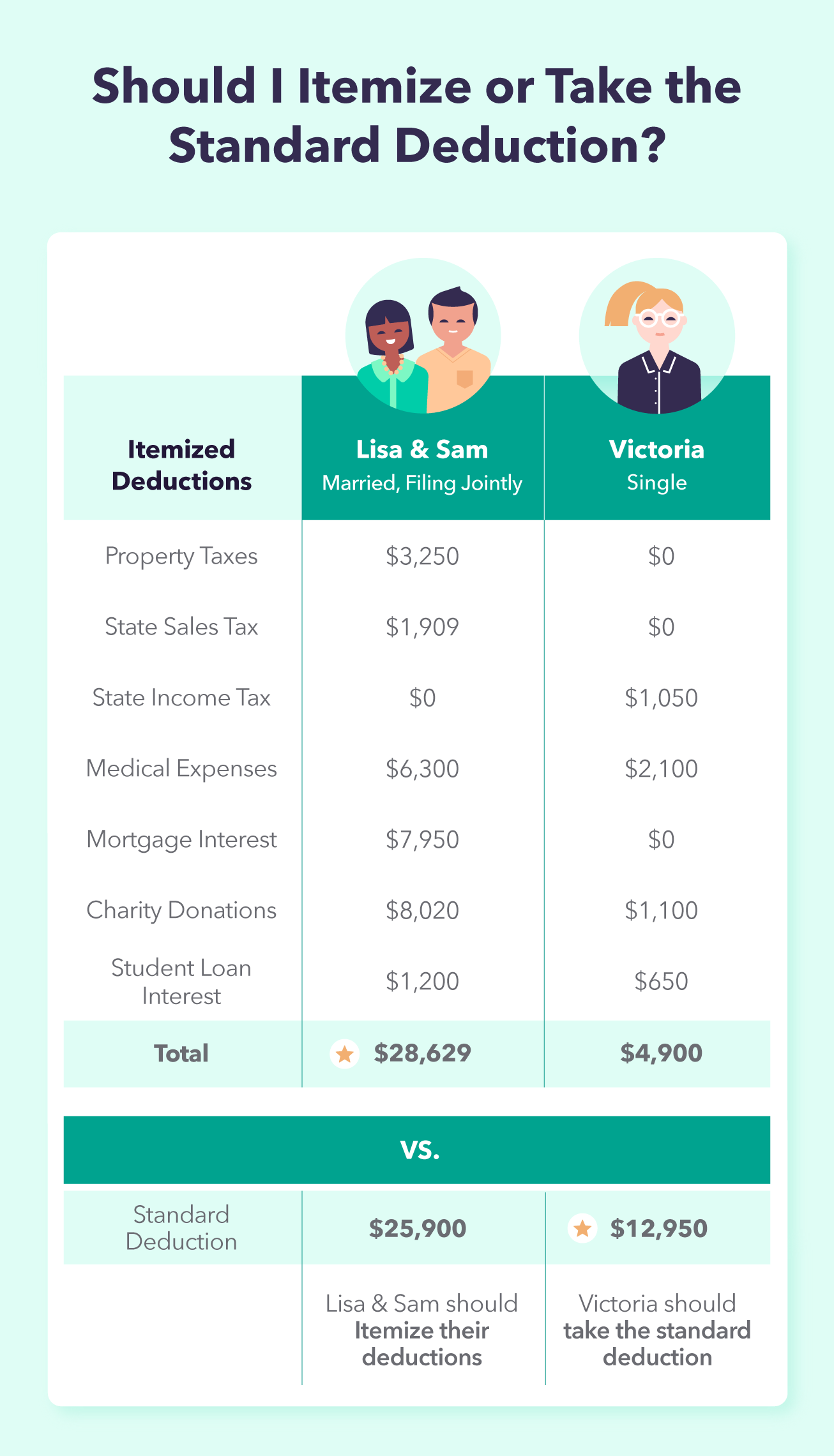

It's important to note that not all home improvements will increase your property taxes. Some upgrades, such as energy-efficient features or accessibility modifications, may actually qualify for tax credits or deductions. It's best to check with your local tax assessor or a tax professional to see if your specific renovations will have any tax implications.

How Upgraded Kitchen and Bath Impact Taxes in NJ

In addition to potentially increasing your property taxes, upgrading your kitchen and bath can also have an indirect impact on your taxes. An upgraded kitchen and bath can make your home more desirable and may increase its overall market value. This means that when you decide to sell your home, you may be subject to capital gains taxes on the increased value. Again, it's best to consult with a tax professional to understand how this may affect you.

Upgraded Kitchen and Bath and NJ Taxes

It's important to keep in mind that property taxes in New Jersey are not solely based on the value of your home. The tax rate in each municipality is also a factor. So, while your renovations may increase the value of your home, the tax rate may decrease, resulting in little to no change in your overall taxes.

Upgraded Kitchen and Bath and Property Taxes in NJ

Another factor to consider is the tax assessment process in New Jersey. Property taxes are reassessed every few years, which means any upgrades you make to your home may not immediately affect your taxes. The reassessment process takes into account the value of other homes in your area and the market conditions at the time.

Upgraded Kitchen and Bath and Real Estate Taxes in NJ

Real estate taxes are another important consideration when it comes to home upgrades. In New Jersey, homeowners pay both property taxes and real estate taxes. Real estate taxes are typically paid to your local municipality and are used to fund services such as schools, roads, and public safety. Any increase in your property taxes may also result in an increase in your real estate taxes.

Upgraded Kitchen and Bath and Tax Assessment in NJ

When planning your kitchen and bath renovations, it's important to keep in mind the potential impact on your taxes. While upgrades can increase the value and desirability of your home, they may also result in a higher tax bill. It's always a good idea to consult with a tax professional to understand how your specific renovations may affect your taxes. With careful planning and consideration, you can upgrade your kitchen and bath without experiencing a significant increase in your taxes.

The Impact of Upgraded Kitchen and Bath on Property Taxes in New Jersey

Introduction

When it comes to upgrading your home, the kitchen and bathroom are two of the most common areas that homeowners focus on. Not only do these renovations improve the overall look and functionality of your home, but they can also potentially increase its value. However, when living in New Jersey, it's important to consider the potential impact on property taxes before diving into these upgrades. In this article, we will delve into the relationship between upgraded kitchen and bath and property taxes in New Jersey.

When it comes to upgrading your home, the kitchen and bathroom are two of the most common areas that homeowners focus on. Not only do these renovations improve the overall look and functionality of your home, but they can also potentially increase its value. However, when living in New Jersey, it's important to consider the potential impact on property taxes before diving into these upgrades. In this article, we will delve into the relationship between upgraded kitchen and bath and property taxes in New Jersey.

Understanding Property Taxes in New Jersey

Before we can discuss the impact of upgraded kitchen and bath on property taxes, it's important to have a basic understanding of how property taxes are calculated in New Jersey. Property taxes are determined by multiplying the assessed value of your property by the local tax rate. The assessed value is determined by the municipality and is based on the market value of your home, including any improvements such as additions or renovations.

Featured Keywords: property taxes, New Jersey

Before we can discuss the impact of upgraded kitchen and bath on property taxes, it's important to have a basic understanding of how property taxes are calculated in New Jersey. Property taxes are determined by multiplying the assessed value of your property by the local tax rate. The assessed value is determined by the municipality and is based on the market value of your home, including any improvements such as additions or renovations.

Featured Keywords: property taxes, New Jersey

The Effect of Upgraded Kitchen and Bath on Property Taxes

Now that we have a better understanding of how property taxes are calculated, let's address the main question: do upgraded kitchen and bath affect taxes in New Jersey? The short answer is yes, they can. Upgrading your kitchen and bathroom can increase the assessed value of your home, which in turn can lead to a higher property tax bill. However, the extent of the impact will depend on the scope of the renovations and the current tax rate in your municipality.

Featured Keywords: upgraded kitchen and bath, taxes, New Jersey

Now that we have a better understanding of how property taxes are calculated, let's address the main question: do upgraded kitchen and bath affect taxes in New Jersey? The short answer is yes, they can. Upgrading your kitchen and bathroom can increase the assessed value of your home, which in turn can lead to a higher property tax bill. However, the extent of the impact will depend on the scope of the renovations and the current tax rate in your municipality.

Featured Keywords: upgraded kitchen and bath, taxes, New Jersey

Factors to Consider

While upgrading your kitchen and bathroom may increase your property taxes, there are a few factors to consider that can help mitigate the impact. First, the tax assessment process in New Jersey is not an exact science and can vary between municipalities. This means that the increase in assessed value may not always directly correlate with the cost of the renovations. Additionally, certain upgrades, such as energy-efficient appliances or fixtures, may qualify for tax credits or exemptions in New Jersey.

Featured Keywords: property taxes, New Jersey, tax assessment process, energy-efficient

While upgrading your kitchen and bathroom may increase your property taxes, there are a few factors to consider that can help mitigate the impact. First, the tax assessment process in New Jersey is not an exact science and can vary between municipalities. This means that the increase in assessed value may not always directly correlate with the cost of the renovations. Additionally, certain upgrades, such as energy-efficient appliances or fixtures, may qualify for tax credits or exemptions in New Jersey.

Featured Keywords: property taxes, New Jersey, tax assessment process, energy-efficient

Conclusion

In conclusion, while upgraded kitchen and bath can potentially increase your property taxes in New Jersey, there are factors that can help offset the impact. It's important to research and understand the potential impact on your taxes before starting any renovations. Consult with your local tax assessor's office and consider speaking with a tax professional for personalized advice. With careful planning and consideration, you can enjoy a beautiful and functional home without breaking the bank on property taxes.

Featured Keywords: property taxes, New Jersey, upgraded kitchen and bath, tax assessor, tax professional

In conclusion, while upgraded kitchen and bath can potentially increase your property taxes in New Jersey, there are factors that can help offset the impact. It's important to research and understand the potential impact on your taxes before starting any renovations. Consult with your local tax assessor's office and consider speaking with a tax professional for personalized advice. With careful planning and consideration, you can enjoy a beautiful and functional home without breaking the bank on property taxes.

Featured Keywords: property taxes, New Jersey, upgraded kitchen and bath, tax assessor, tax professional