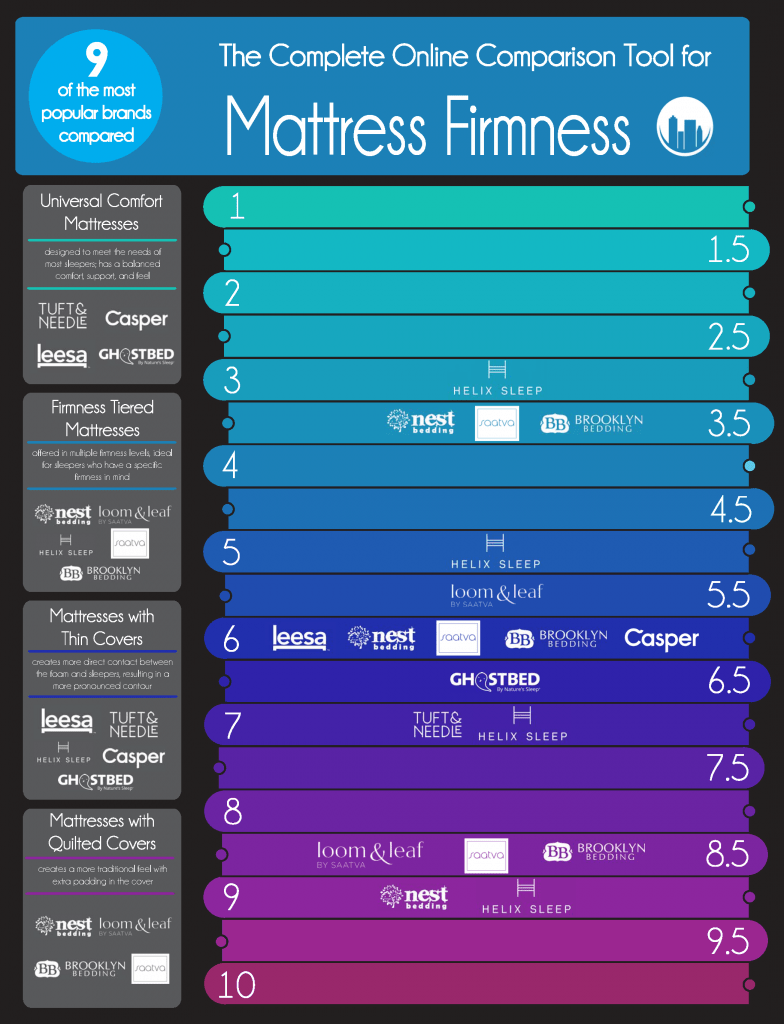

When it comes to buying a mattress, you may be wondering if your credit score will affect your ability to make a purchase. The truth is, your credit score can have an impact on your options for mattress financing. Here's what you need to know about credit scores and buying a mattress.What Credit Score Do You Need to Buy a Mattress?

If you have a bad credit score, you may be worried about your ability to finance a mattress. However, there are options available for those with less than perfect credit. One option is to look for a mattress firm that offers financing specifically for customers with bad credit. Another option is to consider a rent-to-own mattress option, where you make regular payments until you own the mattress outright.How to Finance a Mattress with Bad Credit

Many mattress firms offer financing options for customers looking to purchase a new mattress. This can be a great way to spread out the cost of a new mattress over time, rather than paying for it all at once. However, these financing options often require a credit check and may have specific credit score requirements.Mattress Firm Financing Options

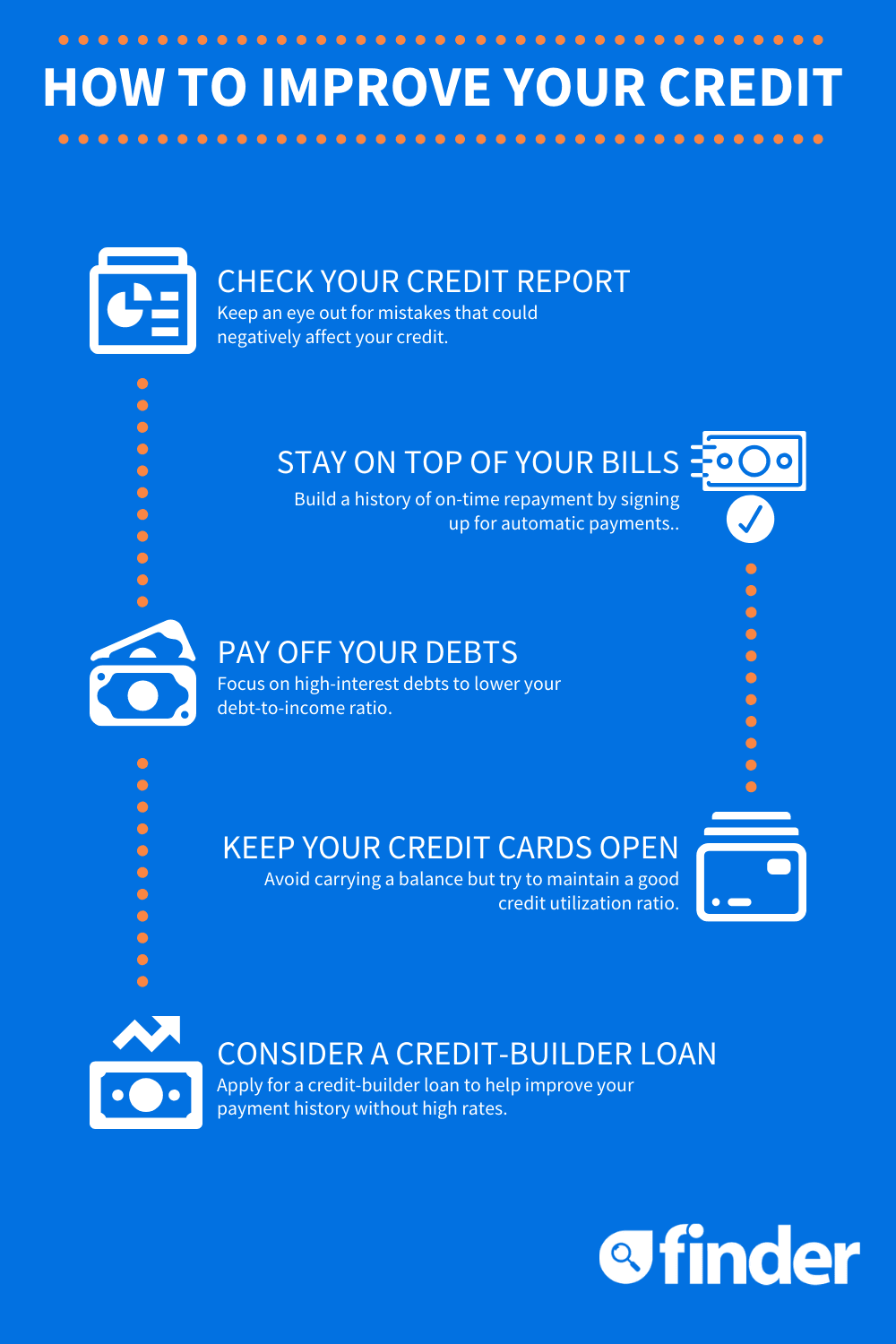

If you're concerned about your credit score affecting your ability to finance a mattress, there are steps you can take to improve your score. This includes paying bills on time, keeping your credit card balances low, and regularly checking your credit report for any errors or discrepancies. By taking these steps, you can improve your credit score and increase your chances of getting approved for mattress financing.How to Improve Your Credit Score for Mattress Financing

If you have bad credit, you may be limited in your options for mattress financing. However, there are still plenty of mattresses available that offer comfort and support without breaking the bank. Look for mattresses that come with payment plans or that offer financing options specifically for customers with bad credit. You may also want to consider a lower-priced mattress to start with, and upgrade to a higher-end one in the future when your credit score has improved.Best Mattresses for Bad Credit

For those with no credit or a limited credit history, getting approved for mattress financing can be challenging. However, there are no credit check mattress financing options available. These typically involve a higher down payment or interest rate, but can be a great way to get the mattress you need without having to worry about your credit score.No Credit Check Mattress Financing

If you have no credit history, it can be difficult to get approved for mattress financing. However, there are still options available. Some mattress companies offer financing for customers with no credit, or you may be able to find a co-signer to help you secure financing. You can also consider saving up for a mattress and paying for it in full to avoid any credit checks or financing requirements.How to Get a Mattress with No Credit

Having a low credit score doesn't necessarily mean you won't be able to finance a mattress. Many mattress firms offer financing options for customers with low credit scores, with varying interest rates and down payment requirements. Be sure to shop around and compare options to find the best deal for your situation.Mattress Financing for Low Credit Scores

If you're looking to improve your credit score, making a mattress purchase can actually help. By financing a mattress and making regular, on-time payments, you can build your credit and improve your score over time. Just be sure to choose a financing option that reports to the credit bureaus so your payments are reflected on your credit report.How to Build Credit with a Mattress Purchase

Another option for financing a mattress is to apply for a mattress firm credit card. These cards often come with special financing offers and can be a great way to spread out the cost of a new mattress. However, be sure to read the terms and conditions carefully and make sure you can afford the monthly payments before applying for a credit card.Mattress Firm Credit Card Options

Understanding the Importance of Credit Score for Purchasing a Mattress from Mattress Firm

When it comes to buying a new mattress, many people may not realize that their credit score can play a significant role in the purchasing process. Mattresses, like any other big-ticket item, require a certain level of financial responsibility and stability. This is where your credit score comes into play. Mattress Firm , one of the leading mattress retailers in the market, understands the significance of credit score and its impact on their customers' buying power.

What is a Credit Score?

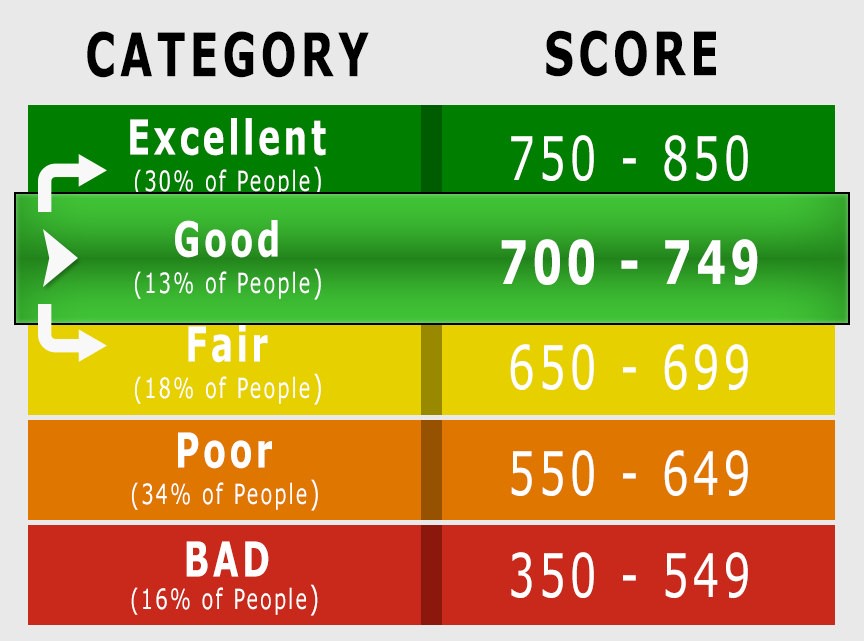

Simply put, a credit score is a numerical representation of an individual's creditworthiness. It is used by lenders, such as banks, credit card companies, and retailers, to determine the risk involved in lending money to a consumer. Credit scores can range from 300 to 850, with a higher score reflecting a better credit history and a lower risk for the lender.

Why is Credit Score Important for Mattress Purchases?

When you walk into a Mattress Firm store, you may be overwhelmed by the variety of mattresses on display. But before you start envisioning yourself sleeping on the most comfortable bed, it is essential to understand that buying a mattress is not just about picking the right one. Your credit score also plays a crucial role in determining whether you can afford the mattress you have your eyes on.

Many mattress retailers, including Mattress Firm , offer financing options to their customers. This means that you can purchase a mattress and pay for it in installments over a set period. However, this financing option is only available to those with a good credit score. A low credit score can lead to higher interest rates, making your mattress purchase more expensive in the long run.

How Can You Improve Your Credit Score?

If you are planning to purchase a mattress from Mattress Firm in the near future, it is essential to start working on improving your credit score. Here are a few tips to help you boost your credit score:

- Pay your bills on time: Late payments can significantly impact your credit score, so make sure to pay your bills on time.

- Keep your credit card balances low: High credit card balances can negatively affect your credit score. Try to keep your balances below 30% of your credit limit.

- Check your credit report regularly: Make sure to review your credit report for any errors and report them immediately.

By understanding the importance of credit score for purchasing a mattress from Mattress Firm , you can take the necessary steps to improve your credit and make your dream mattress a reality. Remember to keep your credit score in check and shop within your means to avoid any financial strain in the future. Happy mattress shopping!

Understanding the Importance of Credit Score for Purchasing a Mattress from Mattress Firm

When it comes to buying a new mattress, many people may not realize that their credit score can play a significant role in the purchasing process. Mattresses, like any other big-ticket item, require a certain level of financial responsibility and stability. This is where your credit score comes into play. Mattress Firm , one of the leading mattress retailers in the market, understands the significance of credit score and its impact on their customers' buying power.

What is a Credit Score ?

Simply put, a credit score is a numerical representation of an individual's creditworthiness. It is used by lenders, such as banks, credit card companies, and retailers, to determine the risk involved in lending money to a consumer. Credit scores can range from 300 to 850, with a higher score reflecting a better credit history and a lower risk for the lender.

Why is Credit Score Important for Mattress Purchases?

When you walk into a Mattress Firm store, you may be overwhelmed by the variety of mattresses on display. But before you start envisioning yourself sleeping on the most comfortable bed, it is essential to understand that buying a mattress is not just about picking the right one. Your

:max_bytes(150000):strip_icc()/Helix-Assets-Photography-Product-Mattress-Standard-Midnight-Lifestyle-20190312-5c9124aa46e0fb0001555923.jpg)

:max_bytes(150000):strip_icc()/_hero_4109254-feathertop-5c7d415346e0fb0001a5f085.jpg)