If you're in the market for a new mattress, you may have noticed that the price you see is not always the price you pay. That's because most states charge a sales tax on retail purchases, including mattresses. If you're unsure how to calculate sales tax on a mattress, don't worry, we've got you covered. Here's a step by step guide on how to determine the sales tax on your next mattress purchase.How to Calculate Sales Tax on a Mattress

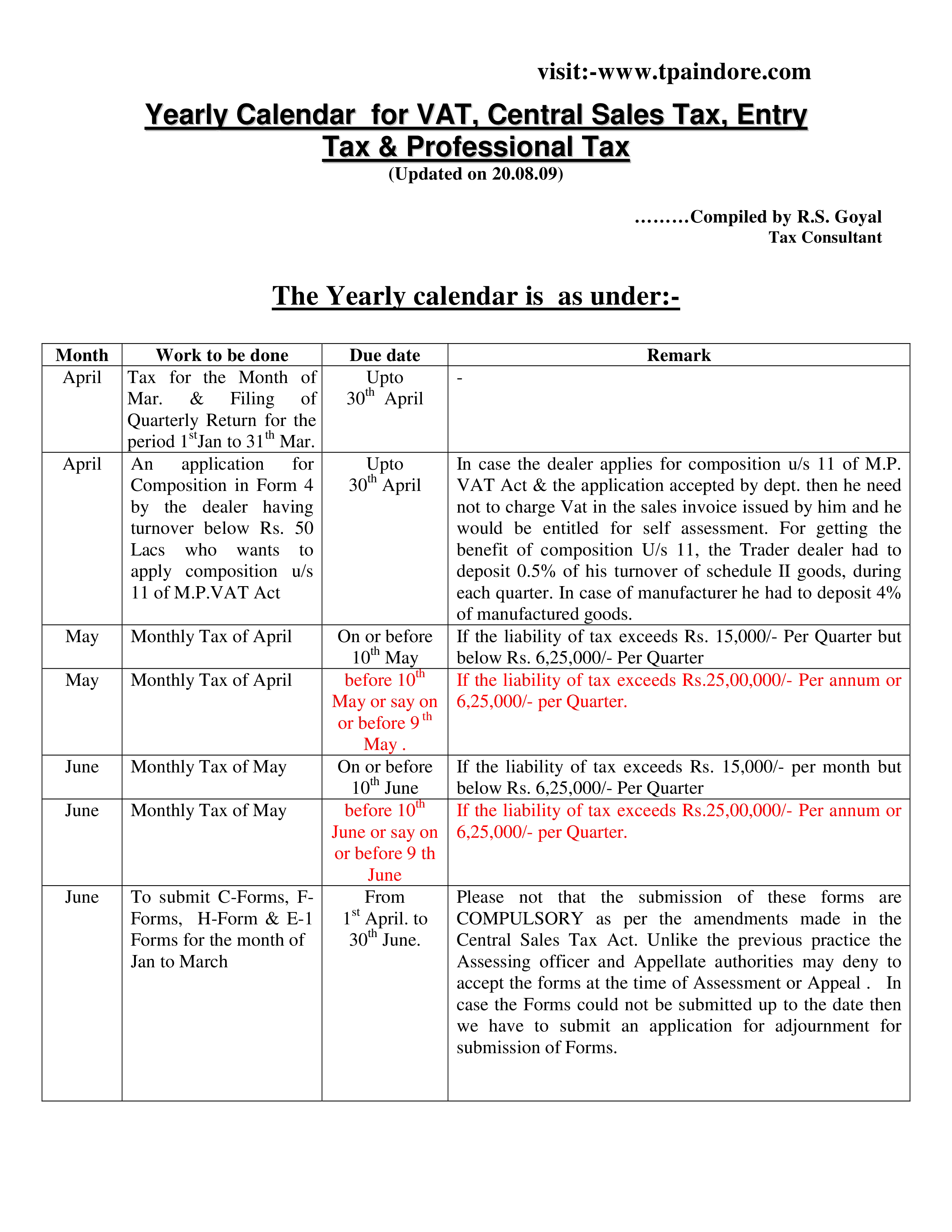

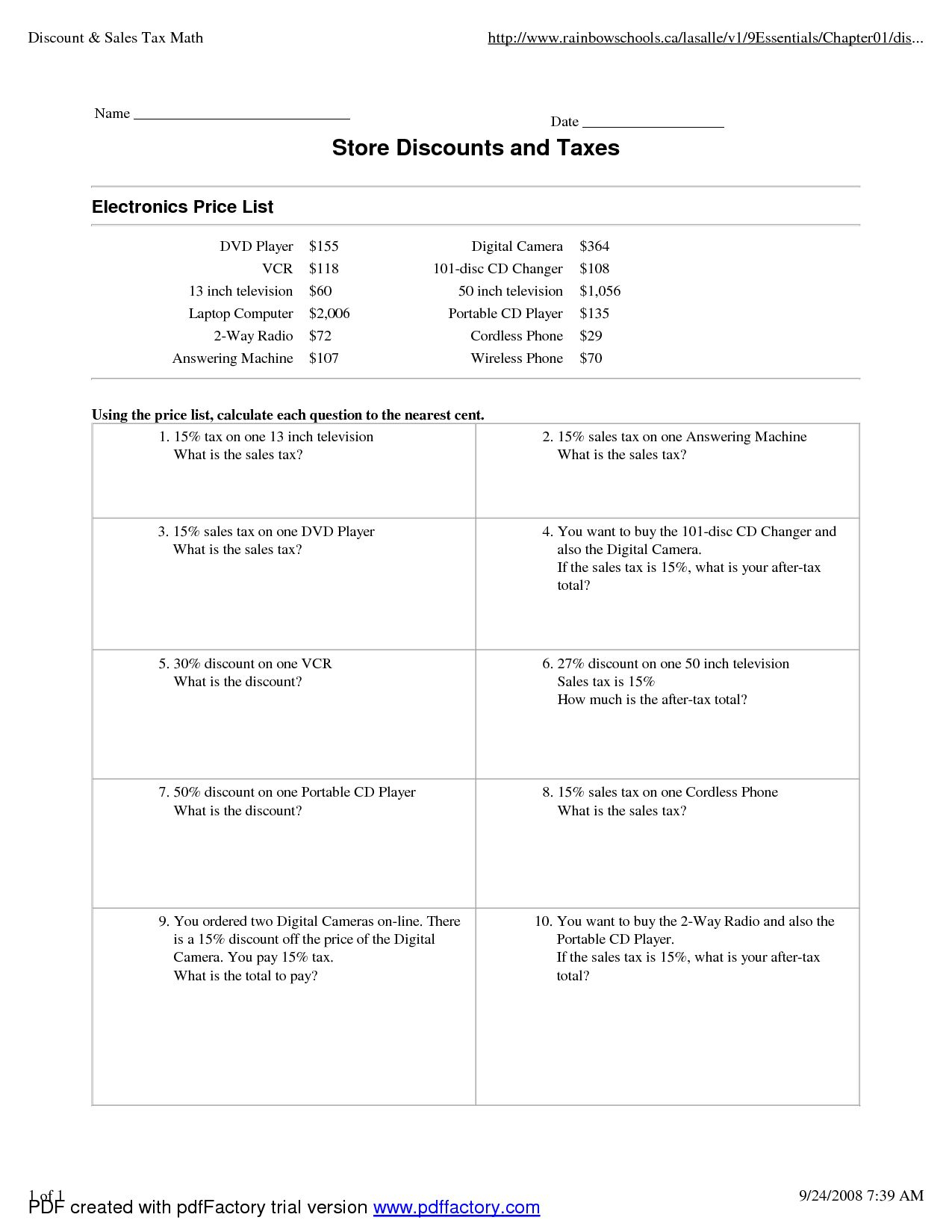

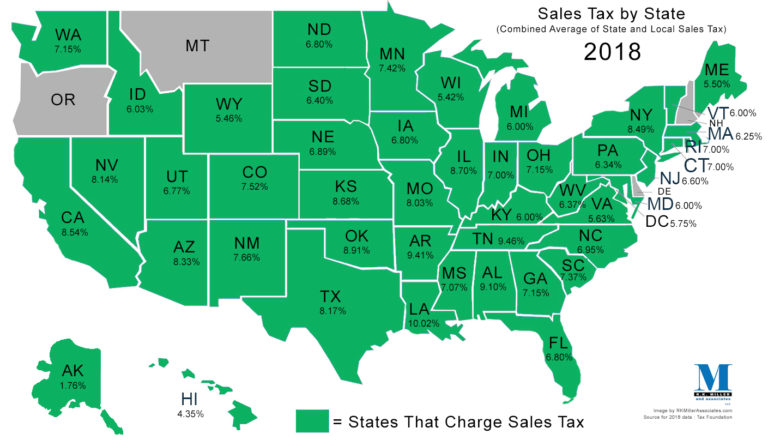

The first step in determining the sales tax on your mattress purchase is to know the sales tax rate in your state. Sales tax rates can vary greatly from state to state, so it's important to do your research beforehand. You can typically find this information on your state's Department of Revenue website or by contacting your local tax office.How to Determine Sales Tax on a Mattress Purchase

Now that you know the sales tax rate in your state, it's important to understand how it applies to mattress stores. In most states, retailers are required to collect sales tax on all taxable items sold, including mattresses. This means that when you make a purchase at a mattress store, you can expect to pay the listed price plus sales tax.Understanding Sales Tax for Mattress Stores

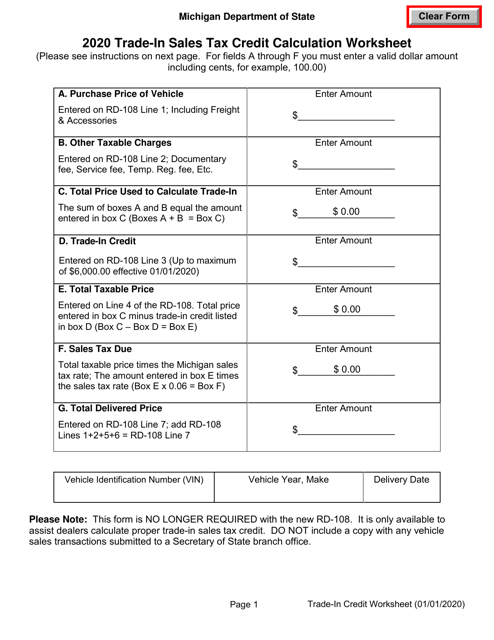

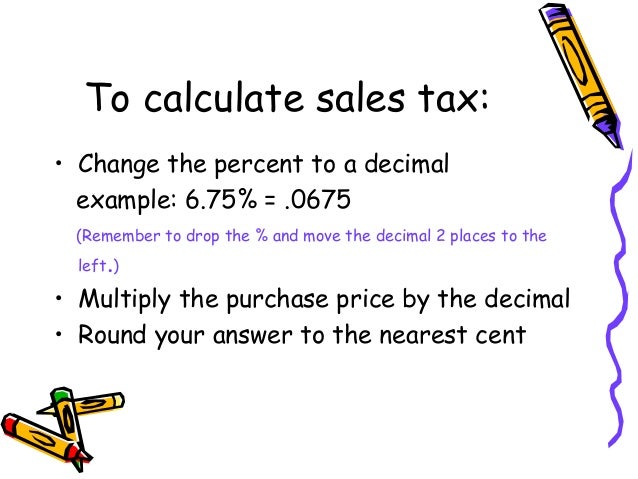

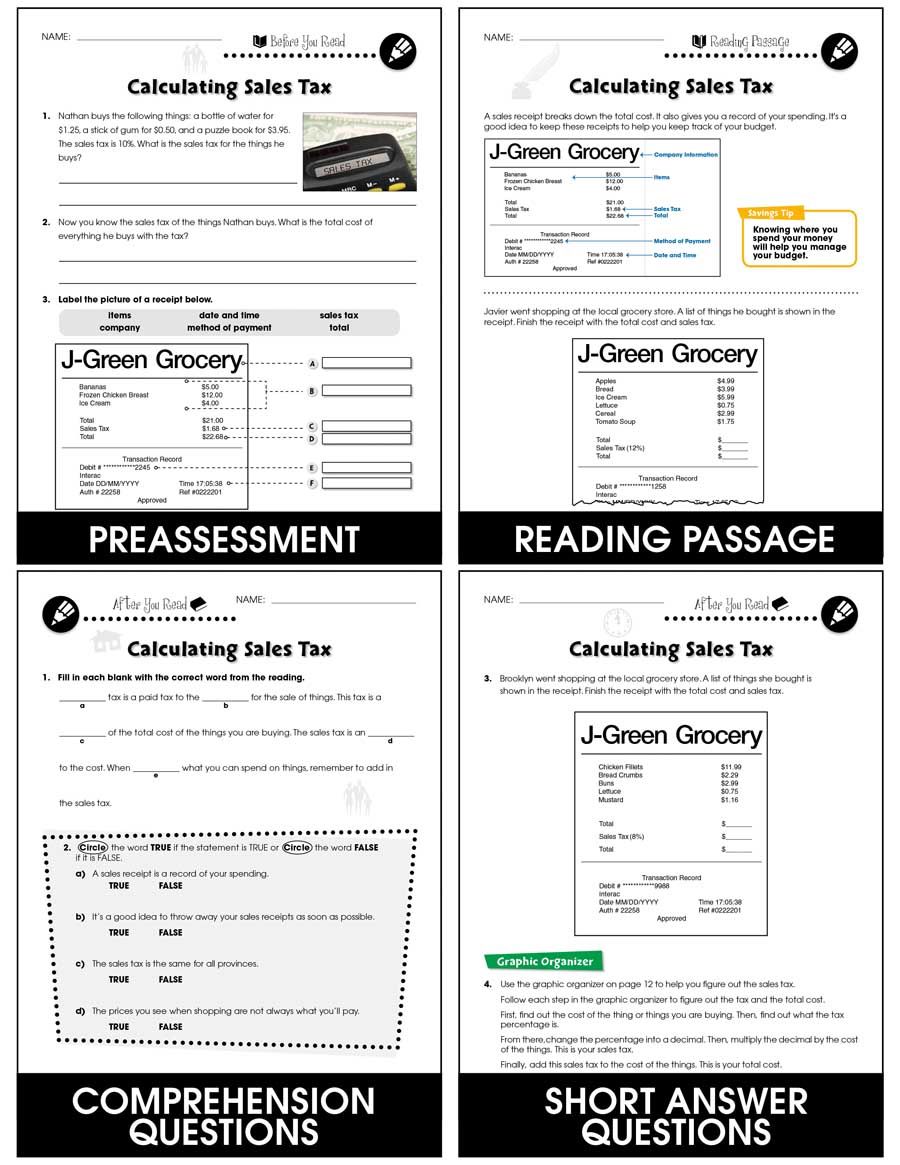

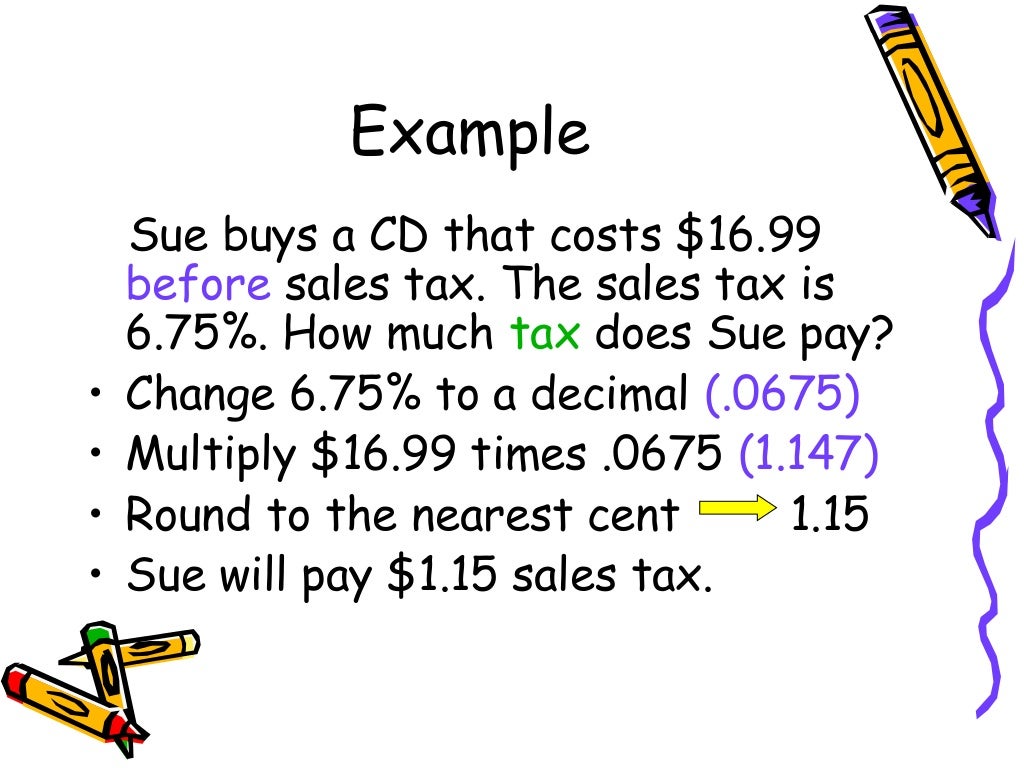

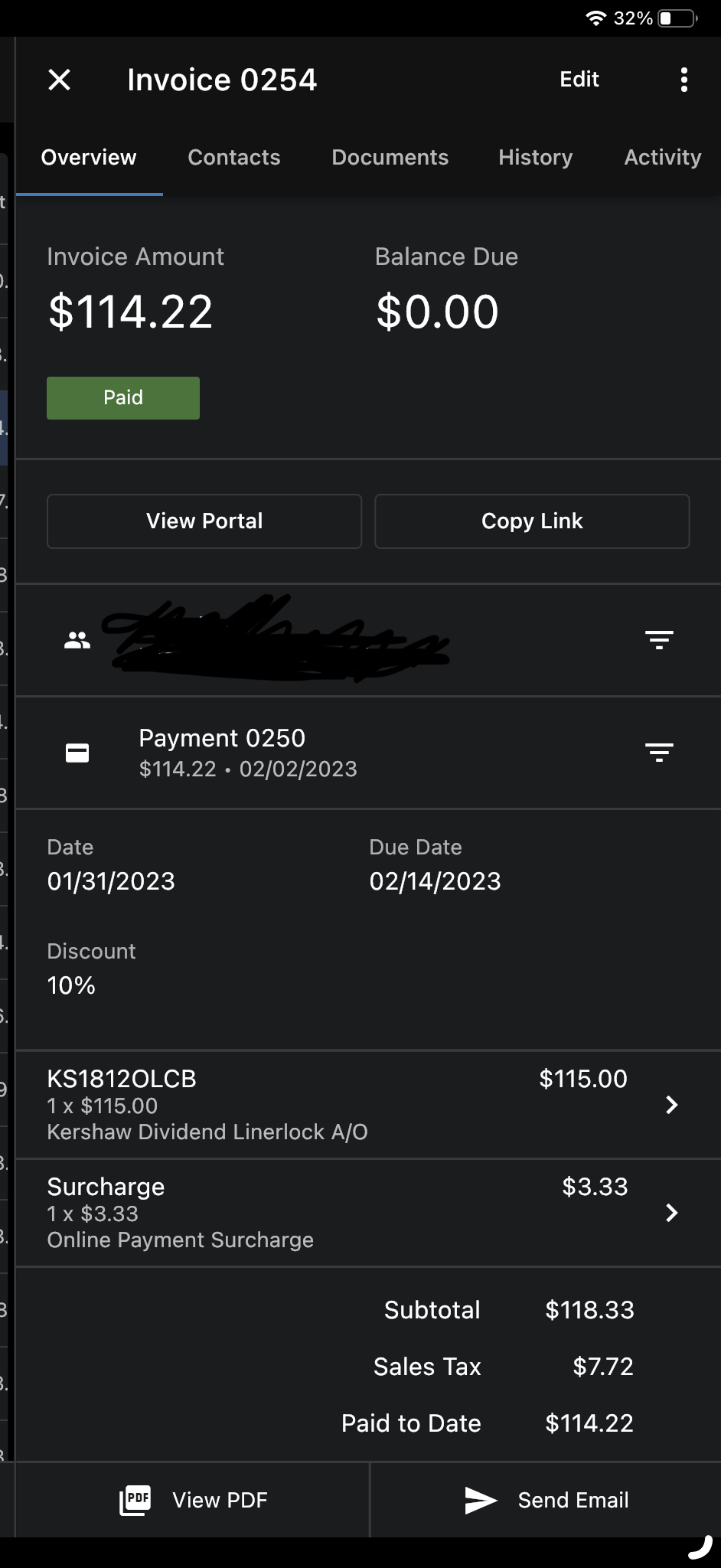

Calculating sales tax for mattress sales is a simple process. You will need to multiply the cost of the mattress by the sales tax rate in your state. For example, if your mattress costs $1000 and the sales tax rate is 7%, you will need to multiply $1000 by 0.07 to get the sales tax amount of $70. This means that the total cost of your mattress will be $1070.Calculating Sales Tax for Mattress Sales

The sales tax rate for mattress stores can vary depending on the state and even the city or county. In some states, the sales tax rate is a flat rate for the entire state, while in others, it can vary by location. It's important to check with your state's tax office to determine the exact sales tax rate for your purchase.What is the Sales Tax Rate for Mattress Stores?

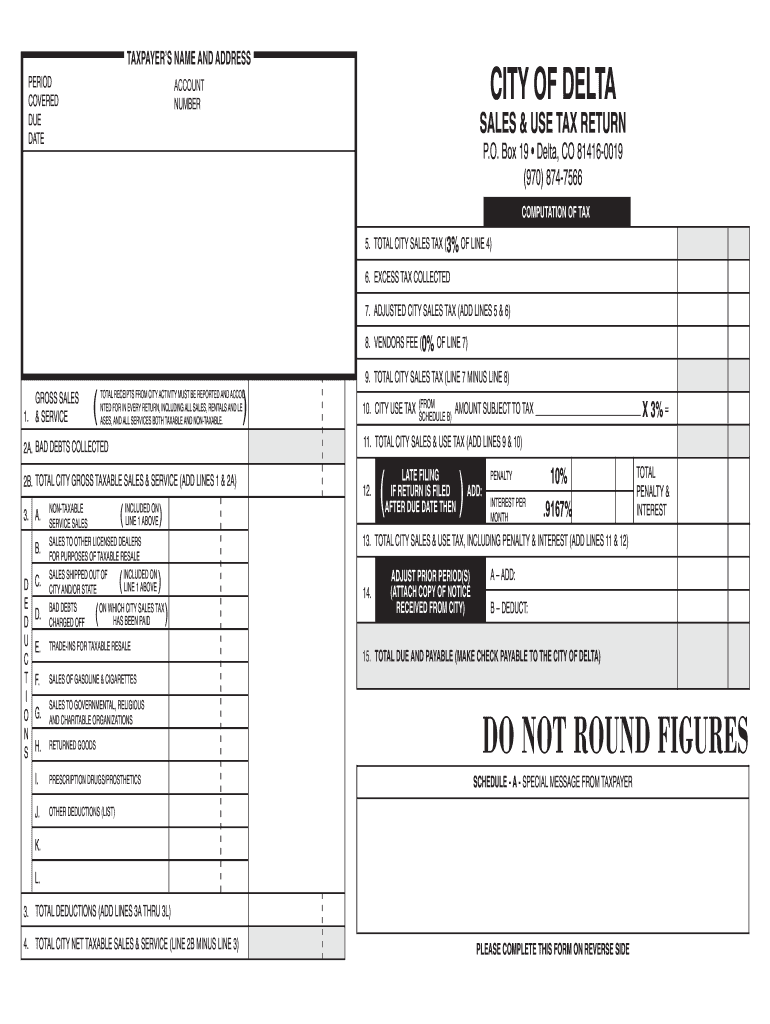

As mentioned earlier, retailers are required to collect sales tax on all taxable items sold, including mattresses. This is because they are considered the end seller of the product. In addition, retailers are also responsible for remitting the collected sales tax to the state. Failure to do so can result in penalties and fines.Sales Tax Laws for Mattress Retailers

Adding sales tax to a mattress purchase is a simple process. Most retailers will automatically add the sales tax to the listed price of the mattress. However, if you are purchasing a mattress online or from a retailer that does not include sales tax, you will need to calculate and add the sales tax yourself as explained above.How to Add Sales Tax to a Mattress Purchase

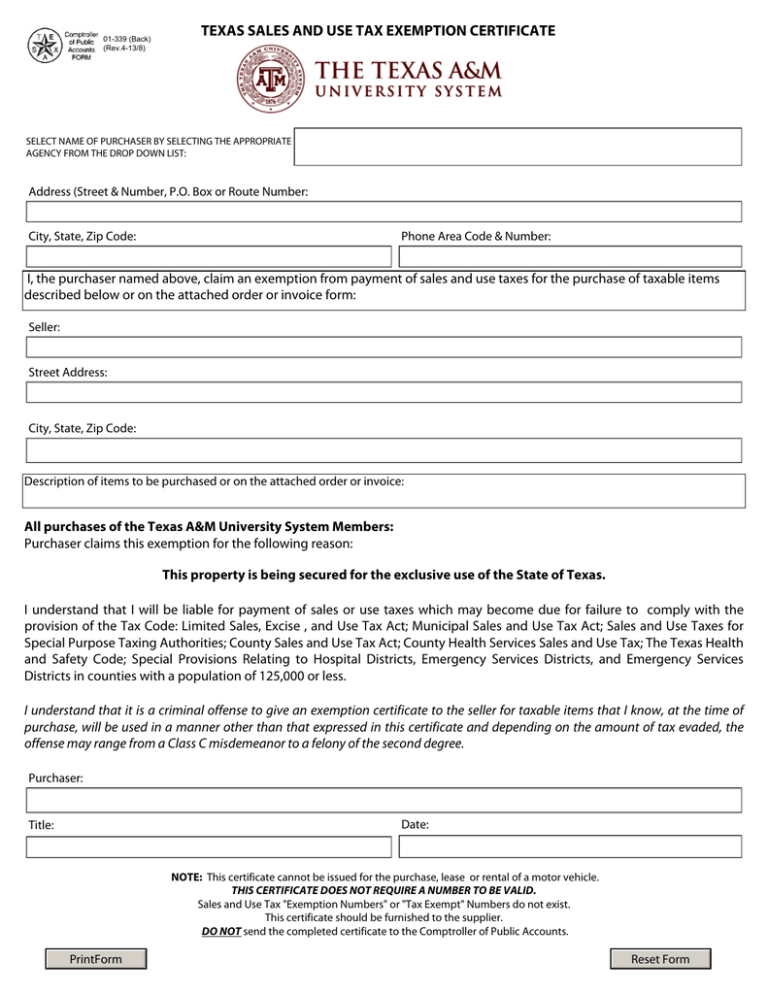

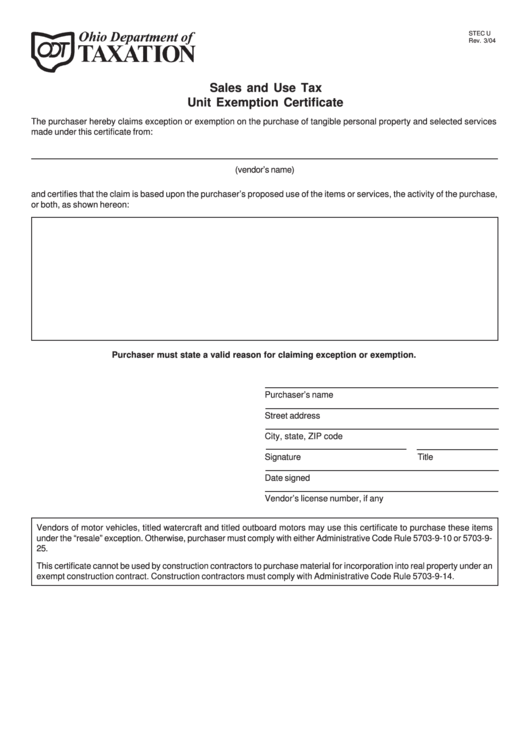

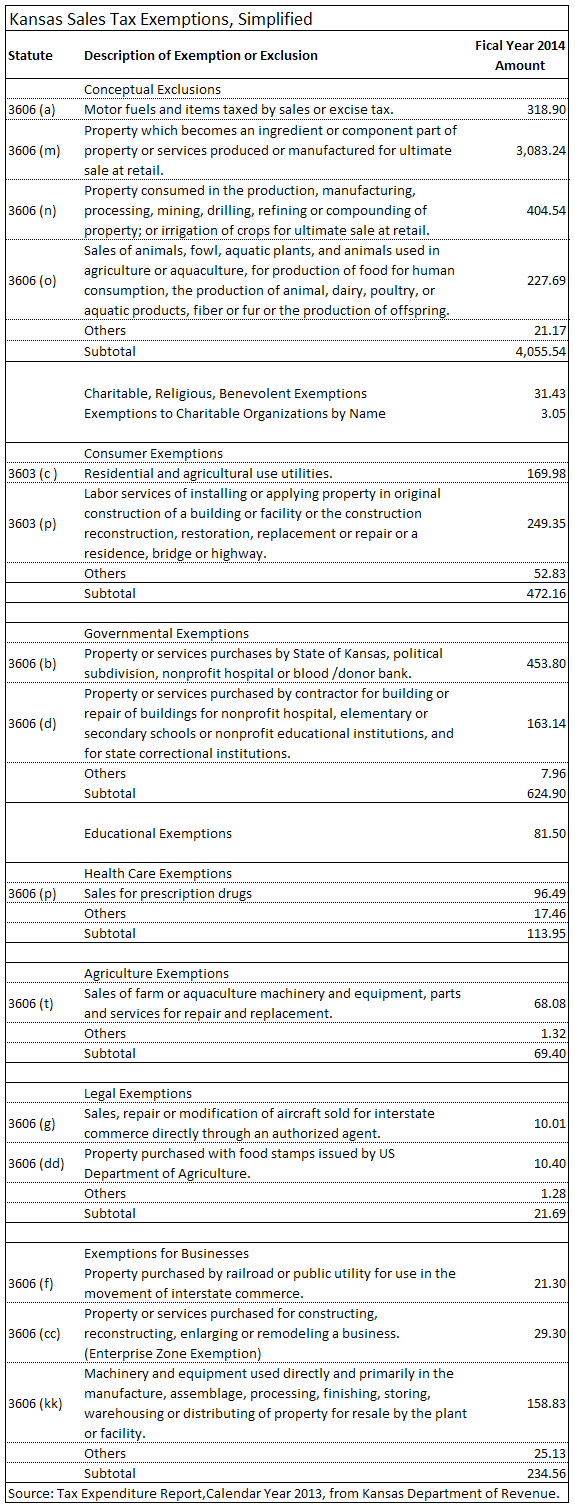

There are certain exemptions to sales tax for mattress stores, such as when the mattress is being sold for resale or if the purchaser has a valid tax exemption certificate. Additionally, some states may have exemptions for items such as medical or therapeutic mattresses. It's important to check with your state's tax office to determine if any exemptions apply to your mattress purchase.Sales Tax Exemptions for Mattress Stores

State sales tax for mattress sales can be a bit confusing, as each state has its own sales tax laws and rates. It's important to do your research and understand the sales tax laws in your state before making a purchase. This will ensure that you are not surprised by any additional costs when you go to make your purchase.Understanding State Sales Tax for Mattress Sales

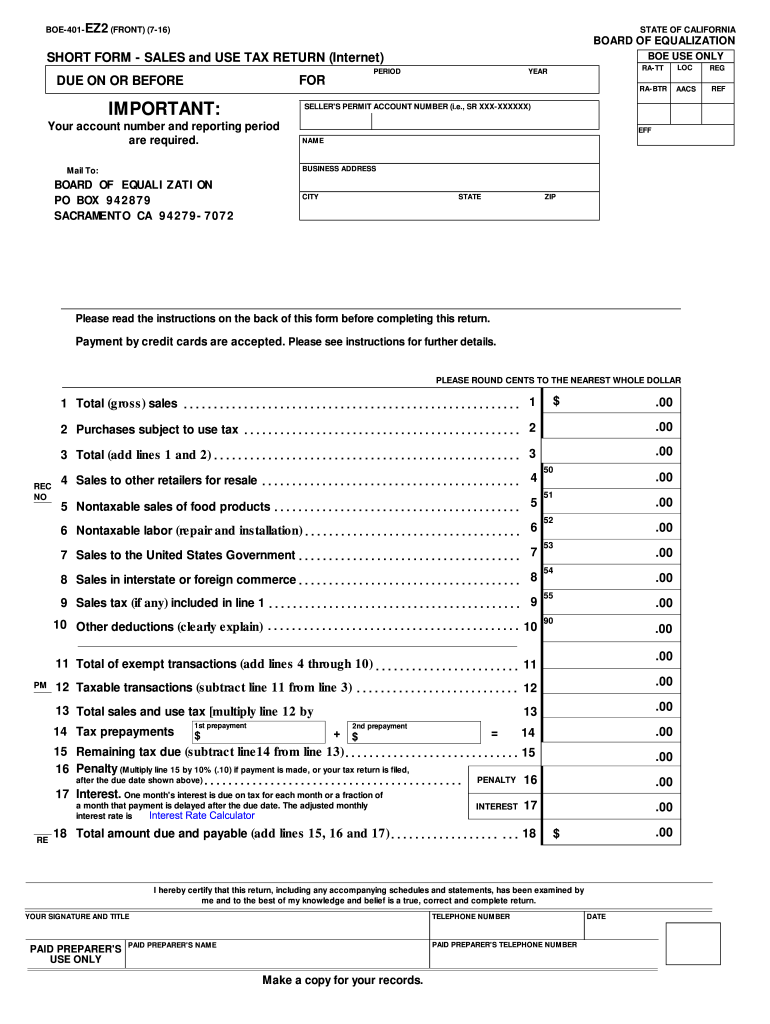

If you are a mattress store owner, it is your responsibility to collect and remit sales tax to the state. This can be done by registering for a sales tax permit with your state's tax office. You will then need to collect sales tax on all taxable items sold and remit the collected tax to the state on a regular basis, usually monthly or quarterly. In conclusion, understanding and calculating sales tax on a mattress purchase is an important aspect of the buying process. By following these steps and doing your research, you can ensure that you are prepared and not caught off guard by any additional costs. Remember, it's always better to know and understand the sales tax laws in your state than to be surprised at the checkout counter.How to Collect and Remit Sales Tax for Mattress Stores

How a Mattress Store Charges Sales Tax Can Affect Your Budget

When shopping for a new mattress, most people tend to focus on factors such as comfort, support, and price. However, one crucial aspect that often gets overlooked is sales tax. The amount of sales tax a mattress store charges can have a significant impact on your budget and the final cost of your purchase. In this article, we will discuss the importance of understanding sales tax and how it can affect your mattress buying experience.

The Basics of Sales Tax

Sales tax is a form of consumption tax that is imposed on the sale of goods and services. It is a percentage of the purchase price that is added to the total cost of an item. The percentage of sales tax varies depending on the state and local tax rates. Some states have a flat rate, while others have a range of tax rates based on the type of item being purchased. For example, food and clothing may be taxed at a lower rate than luxury items.

Why Sales Tax Matters When Buying a Mattress

When it comes to purchasing a mattress, sales tax can significantly impact the final price you pay. While the actual cost of the mattress may be within your budget, the added sales tax can push it over your limit. For example, if you are purchasing a $1,000 mattress and the sales tax rate is 7%, that adds an additional $70 to your purchase. This may not seem like a significant amount, but when you factor in other expenses such as delivery and accessories, the total cost can add up quickly.

Furthermore, some states have different tax rates for in-store purchases versus online purchases. This means that if you decide to buy your mattress online to avoid sales tax, you may still end up paying it in the form of a “use tax” when you file your state income taxes.

How to Save on Sales Tax

One way to save on sales tax when buying a mattress is to shop during tax-free weekends. Many states offer a designated weekend each year where certain items, including mattresses, are exempt from sales tax. Doing some research and timing your purchase accordingly can help you save a significant amount of money.

Another option is to look for sales and promotions that offer a percentage or dollar amount off your purchase. This can help offset the cost of sales tax, making it more manageable for your budget.

Conclusion

In conclusion, understanding how a mattress store charges sales tax is an essential aspect of your mattress buying experience. It can greatly impact the final cost of your purchase and should not be overlooked. By being aware of sales tax rates and taking advantage of money-saving opportunities, you can ensure that you stay within your budget and get the best deal on your new mattress.

Convert this content to HTML code:How a Mattress Store Charges Sales Tax Can Affect Your Budget

When shopping for a new mattress, most people tend to focus on factors such as comfort, support, and price. However, one crucial aspect that often gets overlooked is sales tax. The amount of sales tax a mattress store charges can have a significant impact on your budget and the final cost of your purchase. In this article, we will discuss the importance of understanding sales tax and how it can affect your mattress buying experience.

The Basics of Sales Tax

Sales tax is a form of consumption tax that is imposed on the sale of goods and services. It is a percentage of the purchase price that is added to the total cost of an item. The percentage of sales tax varies depending on the state and local tax rates. Some states have a flat rate, while others have a range of tax rates based on the type of item being purchased. For example, food and clothing may be taxed at a lower rate than luxury items.

Why Sales Tax Matters When Buying a Mattress

When it comes to purchasing a mattress, sales tax can significantly impact the final price you pay. While the actual cost of the mattress may be within your budget, the added sales tax can push it over your limit. For example, if you are purchasing a $1,000 mattress and the sales tax rate is 7% , that adds an additional $70 to your purchase. This may not seem like a significant amount, but when you factor in other expenses such as delivery and accessories, the total cost can add up quickly.

Furthermore, some states have different tax rates for in-store purchases versus online purchases. This means that if you decide to buy your mattress online to avoid sales tax, you may still end up paying it